As an experienced analyst, I’ve witnessed numerous market cycles and have learned to pay close attention to on-chain data in addition to price action. Bitcoin’s current price stagnation has many investors concerned about its future direction, but a deeper look at the whale activity suggests a different narrative.

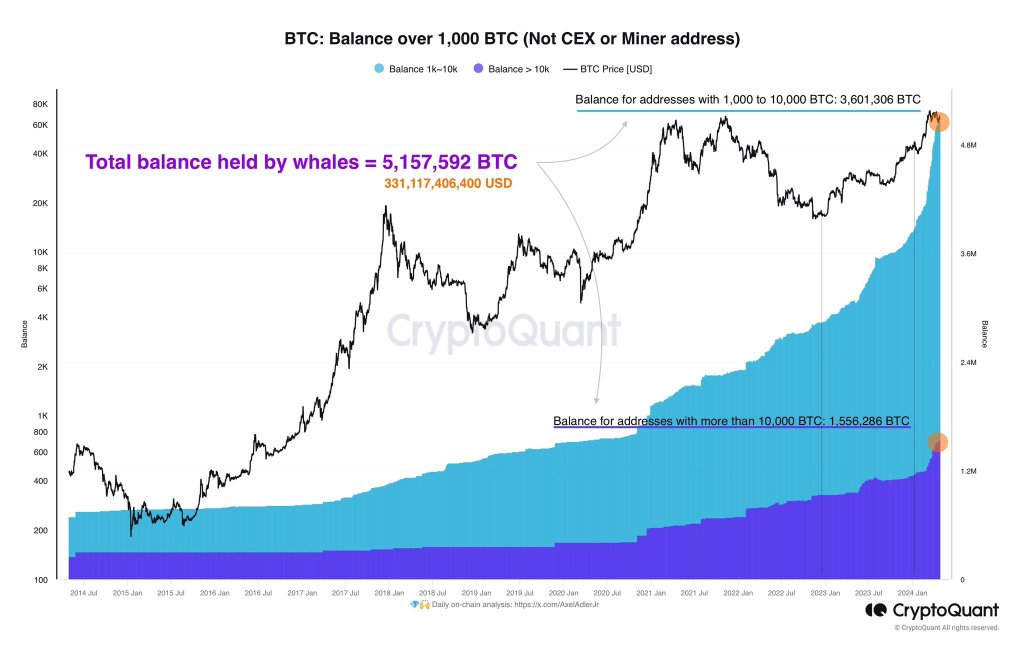

Although Bitcoin‘s price remains stagnant within a limited scope, data from the blockchain reveals contrasting information. One observer pointed out on X that substantial crypto investors, referred to as whales due to their large holdings, are currently amassing Bitcoin.

Bitcoin Whales Accumulating Despite Weakness

As a crypto investor, I’ve noticed that by the time this information was disclosed, Bitcoin whales had amassed over 5.1 million BTC, equivalent to an astonishing $331 billion in value. It’s quite surprising that despite the narrow price range and recent market instability, there seems to be persistent demand that challenges skeptics who have been betting on further price drops.

At present, Bitcoin is trapped between two price levels, with a ceiling at $73,800 and a floor at $60,000. Despite a generally optimistic market outlook, the cryptocurrency has yet to surge past $70,000, even following the Halving event on April 20. Although prices remain stable, the lack of significant price increase after April 21 and 22 suggests potential vulnerability.

As a market analyst, I’ve been closely monitoring the Bitcoin (BTC) price chart against the US Dollar (USDT). A notable development has emerged: if BTC manages to surpass the middle Bollinger Band (BB), we could be in for an explosive move. This potential uptrend would be significantly amplified by any positive fundamental news or developments, potentially propelling Bitcoin to new all-time highs.

From a different perspective, Bitcoin could experience further declines if selling pressure resurfaces. The strong resistance to bullish advances on April 24 is a bearish sign. Consequently, this situation may trigger a series of new lows, potentially pushing the coin beneath its April 2023 lowest points.

Traders Panicked Sold, Register Huge Losses

As a researcher studying the cryptocurrency market, I’ve noticed some concerning trends on Binance and OKX, two of the largest crypto exchanges by trading volumes. Over the past two weeks, panic sellers have collectively disposed of approximately 5,137 Bitcoin at a loss. The market data indicates that prices have been declining during this period, with bulls struggling to regain control. This struggle has been particularly evident following two consecutive daily losses on April 12 and 13.

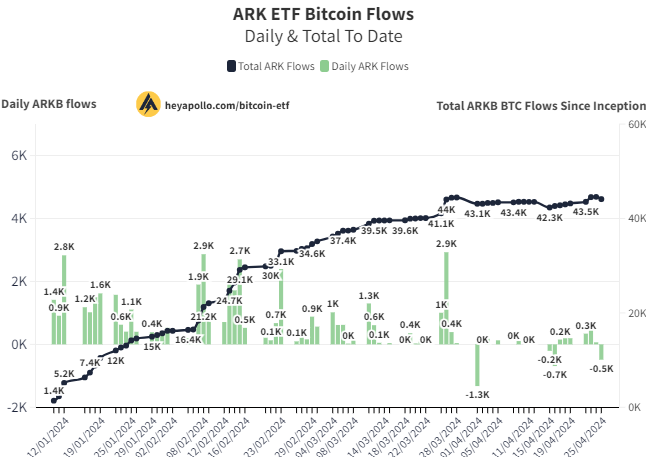

Recently, a significant amount of Bitcoin has been withdrawn from the ARK Investment Management LLC’s Bitcoin ETF (ARKB), totaling approximately 490 Bitcoins, or around $31 million, on April 25th. This is the third-largest one-day withdrawal on record for this specific ETF.

As an analyst, I’ve noticed a correlation between the recent price pressure on Bitcoin (BTC) and a significant decrease in spot Bitcoin Exchange-Traded Fund (ETF) inflows during the second half of April. Specifically, data from Lookonchain revealed that on April 25, Grayscale Bitcoin Trust (GBTC) and all nine other spot Bitcoin ETF issuers collectively withdrew approximately 2,100 Bitcoins, which is equivalent to around $135 million.

Read More

- CORE PREDICTION. CORE cryptocurrency

- Top gainers and losers

- SYS PREDICTION. SYS cryptocurrency

- KUNCI PREDICTION. KUNCI cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CFG PREDICTION. CFG cryptocurrency

- Best coins for today

- DOGE PREDICTION. DOGE cryptocurrency

- THOR PREDICTION. THOR cryptocurrency

- STFX PREDICTION. STFX cryptocurrency

2024-04-27 00:04