As a seasoned researcher with over two decades of trading experience under my belt, I find myself closely observing the recent developments in the Bitcoin market. After carefully analyzing the insights from veteran traders like Peter Brandt, Jesse Colombo, Roman, and others, it seems that the current rally hasn’t been enough to flip the long-term bearish trend for Bitcoin just yet.

As a researcher examining the cryptocurrency market, I find myself aligning with the views of veteran trader Peter Brandt. Despite Bitcoin‘s recent rally, I too am not convinced that it has been sufficient to overturn the long-term bearish trend. While we have witnessed a brief surge in BTC, I share his skepticism as I believe the necessary levels for confirming a bullish reversal have yet to be reached.

According to Brandt, Bitcoin must initially surpass $71,000 before it can be considered confirmed. Meanwhile, other financial experts like Jesse Colombo and Roman suggest that global conflicts and market trends could potentially drive Bitcoin’s value lower.

QCP Capital expresses a measured sense of hope, observing that the recent market dip seems minimal, hinting at the possibility of a swift recovery. As prominent traders ponder their next moves, Michal van de Poppe anticipates this downturn to be temporary and is eager for another test of the $60,000 support level before Bitcoin experiences a significant rebound.

Bitcoin has been moving downwards for over seven months, with each high and low point lower than the last, creating a bearish trend. Moments of brief optimism have emerged, but these haven’t significantly changed the overall pattern, as suggested by Brandt’s analysis. For a bullish shift to occur, Bitcoin needs to overcome the existing resistance levels first.

Resistance Levels Holding Bitcoin Back

As per Brandt’s analysis, Bitcoin finds itself sandwiched between two significant barriers of resistance. The first barrier lies at around $70,600, while the second and record high for Bitcoin sits at approximately $73,800. These levels have consistently halted its upward trend, making them crucial for Bitcoin’s next major shift. Given that it seems improbable for Bitcoin to convincingly surpass $71,000, Brandt predicts that the asset will likely continue in its current holding pattern.

In simple terms, the recent surge in Bitcoin hasn’t broken the ongoing pattern of successive highs and lows over the past seven months. For us to confirm that the trend originating from the November 2022 low is still active, we need to see a close above 71,000 and a new all-time high (ATH).

— Peter Brandt (@PeterLBrandt) October 2, 2024

Roman is also well-known among crypto traders for sharing a similar viewpoint. He’s observed that when volume rises alongside price decreases, it often signals a powerful downward trend. Roman predicts that Bitcoin will encounter resistance within the $55,000 to $57,000 range before any potential reversal. This prediction underscores the difficulty of breaking through these levels.

Moving Averages And Market Uncertainty

Over the past 8 weeks, Bitcoin’s average price (SMA) has hovered near $60,526 and has acted as a barrier for its price increase on charts. The Bitcoin price has been fluctuating around this level without showing clear signs of buyers or sellers dominance. It hasn’t dropped significantly below it to gather enough momentum to rise.

In simpler terms, the average daily price range fluctuation (Average True Range) for Bitcoin is currently around 5,756. This indicates a relatively low level of market volatility at present. However, it’s important to note that even with this moderate volatility, significant price swings are still possible. What traders are closely monitoring are these indicators, as they may suggest when Bitcoin will make its next major move. These signals could provide insights into future market direction.

Geopolitics Tensions And Market Sentiment

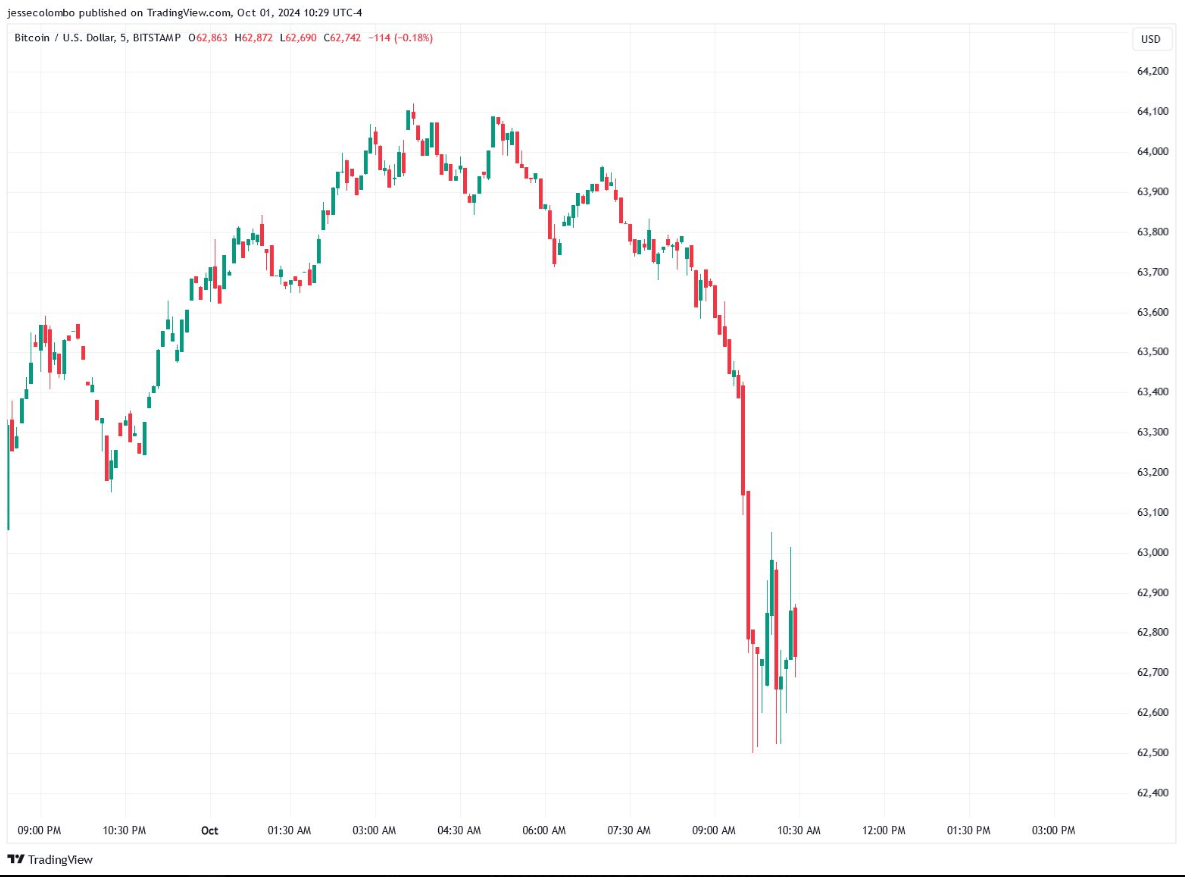

The ongoing tension in the Middle East is adding another layer of uncertainty to the world of cryptocurrency. Notably, Bitcoin’s price fluctuations are mirroring increasing global instability worries. In the past 24 hours, Bitcoin’s price dropped by 3%, settling at around $61,380. This decline is part of a broader downward trend across cryptocurrencies, causing the total market capitalization to decrease by 7.6% over a two-day period.

Bitcoin and crypto always tank when there are geopolitical fears, unlike precious metals.

That confirms my long-held belief that crypto is not a safe-haven.

It’s yet another risk asset just like high-flying tech stocks. $BTC $GLD

— Jesse Colombo (@TheBubbleBubble) October 1, 2024

Based on Jesse Colombo’s analysis as a recognized market expert, it’s common for Bitcoin and other cryptocurrencies to perform poorly during times of geopolitical tension. As he notes: “Bitcoin and crypto tend to drop when there are fears about geopolitics, unlike precious metals.” Historically, this pattern has been consistent with Bitcoin, especially when global conflicts escalate. At present, it seems the market is following this historical trend.

As a crypto investor, I’m maintaining an optimistic stance amidst the bearish chatter circulating around. This optimism stems from the belief that the recent sell-offs seem shallow and may not deter interest in riskier assets like Bitcoin for long. Notably, Michal van de Poppe anticipates a retest of the $60,000 support level, implying a potential market reversal if this level remains robust.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-03 14:11