As a seasoned crypto investor with over a decade of experience in this wild and volatile market, I have seen my fair share of patterns, trends, and predictions. The recent statement by veteran trader Peter Brandt that Bitcoin has formed a ‘Three Blind Mice’ pattern has certainly piqued my interest.

Experienced cryptocurrency trader Peter Brandt has noted that Bitcoin (BTC) appears to be exhibiting a ‘three-headed mouse’ formation, without clarifying whether this indicates a bullish or bearish trend for the leading digital currency. This observation has sparked curiosity among crypto enthusiasts, who are seeking insights into what potential implications this pattern could have for BTC.

Veteran Crypto Trader Says Bitcoin Has Formed ‘Three Blind Mice Pattern’

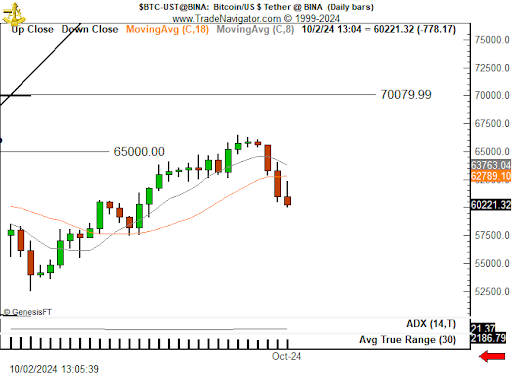

In a recent post, experienced trader Peter Brandt pointed out that Bitcoin seemed to have formed the well-known “Three Blind Mice and a Piece of Cheese” trading pattern. Unfortunately, he didn’t elaborate further on what this pattern entails. However, the chart accompanying his statement suggests a potential bearish trend for BTC, as the most recent candlesticks suggest a downtrend.

In simpler terms, if the ‘Three Blind Mice’ pattern emerges following a rise in the market, it usually signals a shift towards bearish trends, suggesting that the bears are now dominating the market. This could mean that Bitcoin might face increased downward pressure. Given Bitcoin’s recent decline since it surpassed $65,000 last week, this seems to be the current trend in its price action.

In September, Bitcoin surpassed $65,000 and was on track for its strongest monthly close since 2013. However, starting in October, a substantial drop in price has occurred, indicating that it may be entering another bear phase. Notably, Bitcoin has not breached the crucial support level of $60,000 as of yet, which offers some optimism to Bitcoin investors.

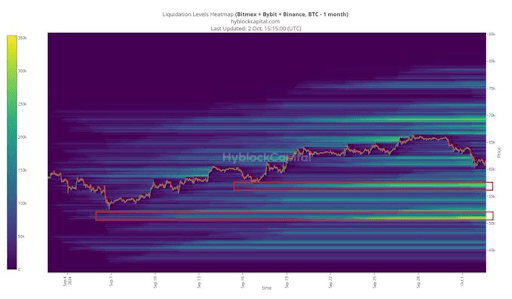

The drop in Bitcoin’s value can largely be attributed to the increasing conflicts in the Middle East, particularly the intensifying dispute between Israel and Iran. After Iran launched a missile attack on Israel, Bitcoin was tested against the $60,000 support level.

In simpler terms, Peter Brandt’s previous post indicates that he is currently pessimistic about Bitcoin’s future price movement. He pointed out that the recent surge in BTC prices hasn’t broken a seven-month pattern of lower peaks and lower valleys. According to him, it would take Bitcoin closing above $71,000 and setting a new all-time high for us to believe that the trend from November 22 low is still intact.

Bitcoin Could Drop To As Low As $52,000

As a researcher delving into cryptocurrency analysis, I’ve come across predictions suggesting potential drops in Bitcoin’s price. For instance, Crypto analyst Ali Martinez foresees a possible decline to around $52,000, based on the governing pattern of a descending parallel channel influencing recent price action. Similarly, Justin Bennett has offered a bearish perspective for BTC, indicating that there could be a compelling argument for Bitcoin dropping down to approximately $51,000.

He mentioned that he’s not completely sure about Bitcoin dropping to $51,000 at this moment. What he is more confident about, though, is a potential drop to $57,000, as he’s achieved his initial goal of reaching $60,000. He also cautioned investors about the possibility of a relief rally in Bitcoin, but noted that the failure at $64,700 has exposed sell-side liquidity.

currently, Bitcoin is being exchanged for approximately $61,000, showing a decrease over the past 24 hours based on information from CoinMarketCap.

Read More

- Odin Valhalla Rising Codes (April 2025)

- King God Castle Unit Tier List (November 2024)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- POPCAT PREDICTION. POPCAT cryptocurrency

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Cape Fear Cast: Patrick Wilson Eyed to Star in Apple TV+ Show

- Vesper’s Host guide – Destiny 2

- Rare Porsche 911 Carrera RS 2.7 Lightweight Heads to Auction

- Incarnon weapon tier list – Warframe

- Thunderbolts* Post-Credits Scene Sets an MCU Record

2024-10-03 17:10