As a seasoned crypto investor with a keen interest in Ethereum’s market trends, I find the recent analysis by IntoTheBlock on Ethereum Foundation wallet netflows intriguing. Historically, large outflows from these wallets have coincided with Ethereum price peaks. The absence of such outflows during this cycle could be a potential bullish sign, indicating that a top isn’t imminent or that the foundation has changed its selling strategy.

Based on historical data recorded on Ethereum‘s blockchain, a particular signal that typically precedes peak prices has not emerged during the current market cycle.

Ethereum Foundation Wallets Haven’t Made Large Outflows This Cycle So Far

As a crypto investor, I’ve been keeping an eye on the latest analysis from IntoTheBlock, a reputable market intelligence platform. In their newest post, they’ve shed light on a recurring pattern Ethereum (ETH) has displayed during past market highs.

As a researcher studying the Ethereum network, I’ve noticed an intriguing pattern in the transactional data of wallets affiliated with the Ethereum Foundation. The Ethereum Foundation is a non-profit organization that plays a crucial role in backing the Ethereum cryptocurrency and its associated ecosystem.

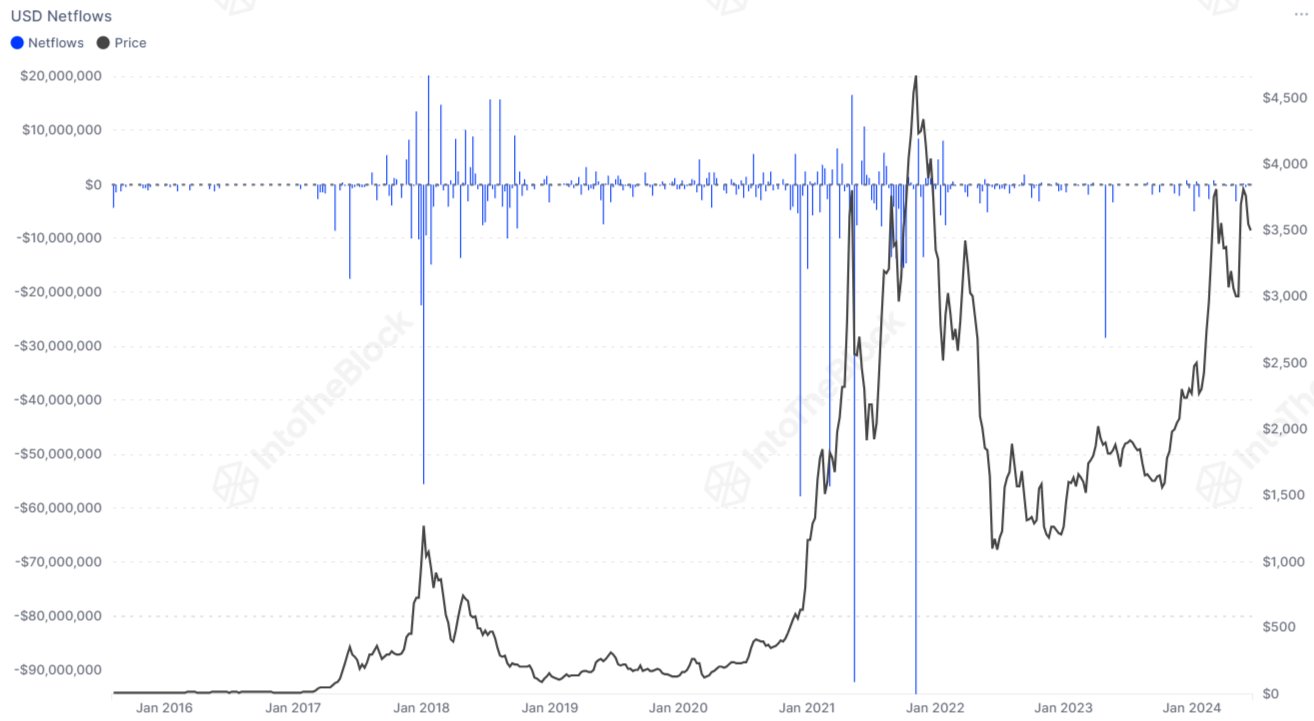

The following chart, provided by the analytics company, illustrates the fluctuation in the USD value of Ethereum (ETH) being transferred into or out of the linked wallets belonging to this organization.

In the given chart, it’s apparent that the Ethereum Foundation has experienced mostly outflows, as indicated by the negative netflows, during past market uptrends. This means that more Ether has been transferred out of the wallets associated with the organization than into them.

It’s worth noting that the indicator has shown notably large red peaks coinciding with the summit levels of cryptocurrencies, according to IntoTheBlock’s analysis.

Throughout history, the Foundation has consistently sold significant portions of its holdings during bull markets. These sales have frequently coincided with the peak of the markets.

As a crypto investor observing the charts, I’ve noticed that the indicator’s readings have remained relatively stable over the past few months, despite noticeable price growth in the asset.

During this bull market, the Ethereum Foundation hasn’t made significant sales of its cryptocurrency holdings. Based on past trends, this could indicate that the peak price for Ethereum has not yet been reached or that the Foundation does not believe it has.

As a researcher examining the data, an alternative interpretation could be that the non-profit organization has shifted its approach for this latest phase, implying that previous trends may carry less significance.

As a analyst, I’d rephrase that as follows: I’ve come across newsworthy information concerning the Ethereum Foundation. Specifically, their official email account was hacked, a fact disclosed by Tim Beiko, one of the Ethereum developers, in an X post.

The developer observed that the company was attempting to contact SendPulse, an email automation platform they utilize, in order to address the issue.

In a subsequent message, Beiko admitted that the Ethereum Foundation team had distributed a notification to their blog subscribers, cautioning them about a “staking platform” announcement earlier being a result of a security breach.

The developer expressed regret that we hadn’t secured all external entrances yet, but they were still in the process of verification.

ETH Price

Ethereum plunged under the $3,300 level yesterday, but the asset has since recovered above $3,400.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-06-26 03:40