As a seasoned researcher with over two decades of experience in financial markets and a keen interest in cryptocurrencies, I find the current Dogecoin (DOGE) situation intriguing. The combination of technical indicators and market sentiment data points to a potential bullish reversal for this popular memecoin.

It seems that the price of Dogecoin (DOGE) is showing signs of a substantial bullish turnaround, backed up by technical analysis and market opinion. Although there have been some negative influences, various aspects hint at a possible rise in the well-known meme currency.

#1 Dogecoin Bounces Off Key Support Level (1D Chart)

crypto expert CRG (@MacroCRG) emphasized the durability of Dogecoin and PEPE, a well-known meme coin, remarking, “Dogecoin and PEPE are both rebounding from crucial points. I believe the notion that meme coins are dying off is greatly overstated. The next surge will likely catch many off guard.

CRG’s technical assessment shows that Dogecoin (DOGE) has kept closing daily at a significant support price of $0.385 for nine straight days, even amidst intense selling activity. In a similar fashion, PEPE has upheld its vital support level, hinting that the “meme coin trend” could be on the verge of re-emerging soon.

For Dogecoin, the short-term resistance zone at $0.42 remains a pivotal level. CRG suggests that a break above this threshold could signal the onset of a new bull run, potentially catching many investors off guard.

#2 Bullish Market Structure (4-Hour Chart)

Additional technical analysis is offered by the crypto expert Gonzo (@GonzoXBT). He delved into Dogecoin’s price dynamics and shared his insights. According to Gonzo, the 4-hour Exponential Moving Average (EMA) 100 serves as resistance, while the 4-hour EMA 200 functions as support. Until the 4-hour EMA 100 flips, we can anticipate choppy price movements without wanting to see Dogecoin fall below the 4-hour EMA 200.

In my research, I’ve found that the 4-hour Exponential Moving Averages (EMAs) play a crucial role in predicting short-term price fluctuations. At the moment, the 4-hour EMA100 acts as a resistance level, while the 4-hour EMA200 provides support. If we see a consistent break above the 4-hour EMA100, it could lead to an upward trend, potentially signaling an upward breakout. Conversely, if we fail to sustain above the 4-hour EMA200, it might lead to further consolidation or even a decline.

#3 Trading Against The Crowd

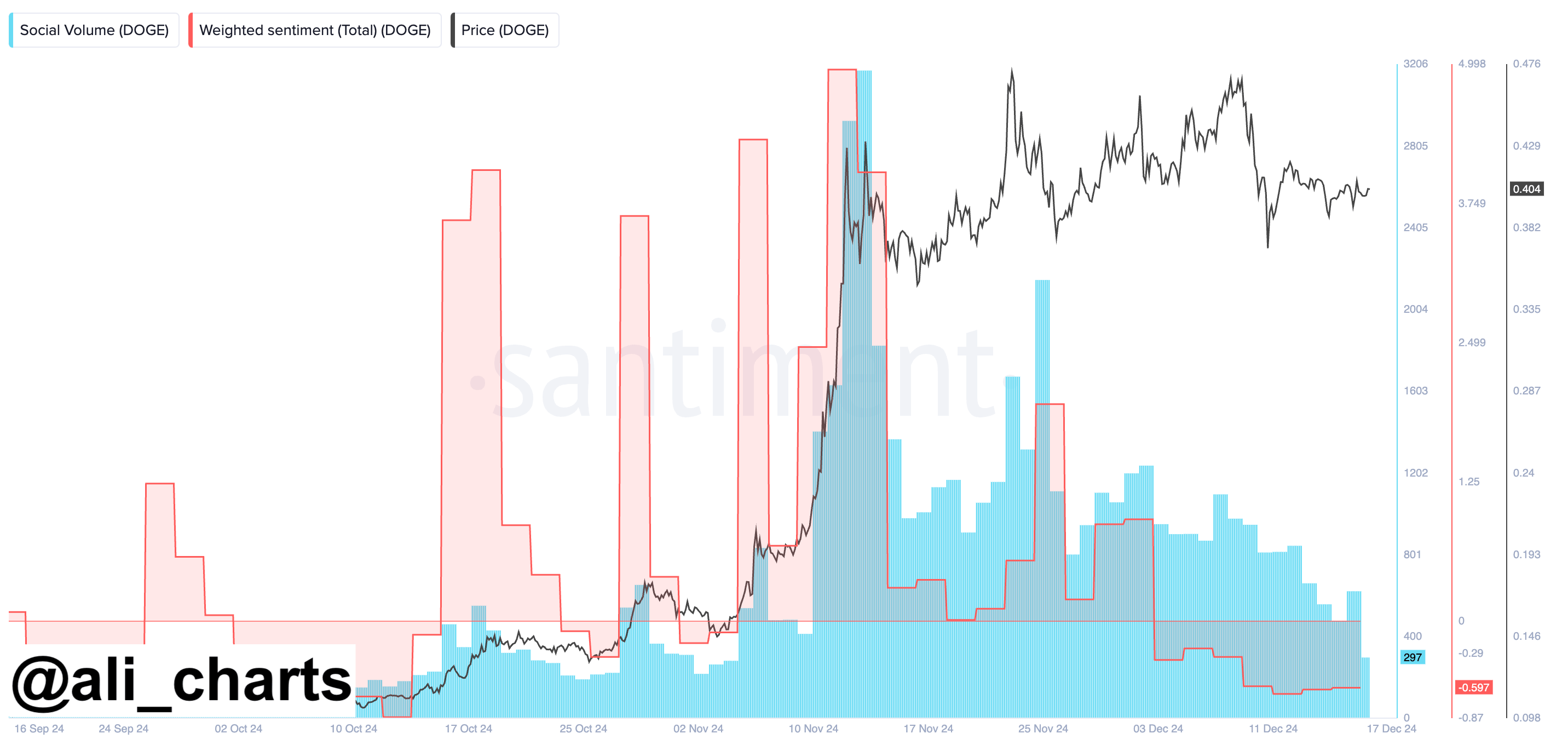

As a researcher, I’m sharing an insightful take from crypto analyst Ali Martinez (@ali_charts) regarding the near-term outlook of DOGE. He points out that the market sentiment towards Dogecoin has become negative and it appears that traders are growing restless amidst the ongoing price consolidation phase.

According to Martinez’s findings using Santiment data, there’s been a significant decrease in both search interest and overall sentiment. To be more precise, the overall sentiment has sunk to its nadir since mid-October, whereas the search volume has dipped down to figures not witnessed since early November.

Martinez mused about possible triggers that could swiftly revive optimistic energy for Dogecoin, pointing to the creation of the new US Department of Government Efficiency under Elon Musk’s leadership. He proposed, “Alternatively, you might be waiting for the initial action of the Department of Government Efficiency to occur.

Enhancing the positive argument further, crypto expert Carlos Garcia Tapia (@CAGThe3rd) provided some intriguing observations from the liquidation diagram over the last three days, stating, “Impulsive buyers who jumped in due to fear of missing out (FOMO) have been liquidated on the 3D chart. Dogecoin (DOGE).

Over the last two days, Coinglass’s heatmap shows a substantial sell-off of highly leveraged long positions, primarily concentrated between $0.393 and $0.385. However, it’s important to note a positive twist: since most long positions have been sold off, the remaining active sell-off points are centered around the $0.42 level.

The arrangement indicates that Dogecoin might form an uptrend candlestick, possibly instigating more sell-offs of negative positions and driving the cost higher. This is due to the fact that liquidation heatmaps are useful indicators in predicting price fluctuations since they illustrate the hidden market liquidity and leverage situations.

These heatmaps show areas where traders are likely to be compelled to sell due to forced liquidations, serving as both psychological and technical thresholds. As the price nears these points, significant market players can sway the direction of the price by setting off a chain reaction of liquidations, thereby intensifying the subsequent price shift.

At press time, DOGE traded at $0.3843.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-12-19 04:16