As an analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. Watching Ethereum inch closer to its all-time highs has been quite an interesting journey this time around. The steady upward momentum, despite market uncertainty, is indeed impressive.

Ethereum is almost back to the $4,000 mark as it approaches record highs. This second-biggest cryptocurrency by market value has been met with doubt during this cycle, but some analysts thought it wouldn’t perform as well as its past bull runs. However, Ethereum has defied expectations, gradually rising in the last few weeks even amid market instability.

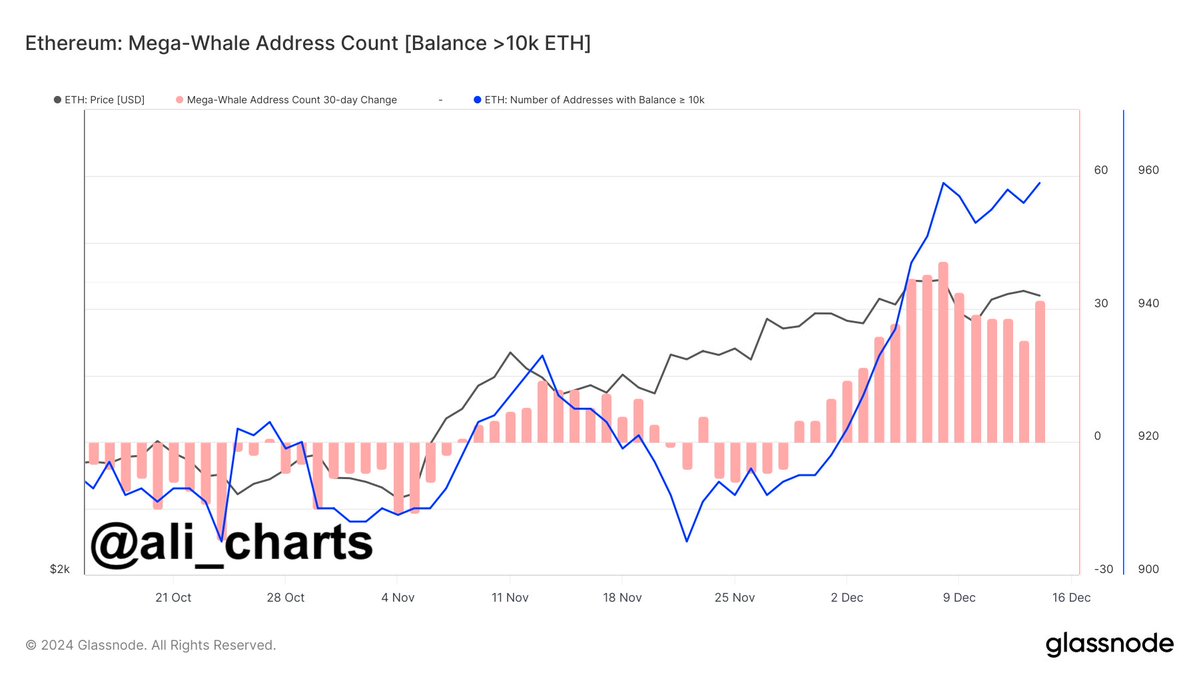

As a researcher delving into Ethereum’s on-chain data, I’ve noticed an intriguing pattern that could potentially drive further price growth: Since late November, Ethereum whales have been amassing their holdings at a rapid pace. This trend suggests growing optimism among significant investors, who are strategically positioning themselves for potential profit.

Regardless of the varying opinions about Ethereum’s future direction, whether it maintains momentum around $4,000 may significantly influence its performance over the coming weeks. Pushing past this key resistance level could pave the way for new record highs and strengthen Ethereum’s position as a dominant player during the current bull market.

Ethereum Mega-Whale Balances Grow

Since November 5th, Ethereum has been steadily climbing, albeit at a modest pace. However, it appears that the real explosive growth for ETH is still to come. As Bitcoin surges towards new pricing heights and various altcoins exceed their projected performance, investors in Ethereum are eagerly seeking strong indications of an upcoming bull run for this second-largest cryptocurrency. (First-person perspective: I’ve observed that since November 5th, Ethereum has been on a steady but moderate upward trend. However, it seems the true fireworks for ETH are yet to ignite. With Bitcoin reaching new price highs and several altcoins surpassing expectations, investors in Ethereum are actively looking for robust signs of an impending bull run for this second-largest cryptocurrency.)

Ali Martinez’s recent analysis on X offers intriguing perspectives about Ethereum’s current situation. Martinez points out that large Ethereum holders, or ‘whales,’ have been buying more ETH aggressively since the price surpassed $3,330.

The increasing pattern of accumulation indicates that savvy investors might be preparing for a significant price surge in the coming months. Traditionally, when ‘whales’ amass assets, it frequently signals robust price increases, as these big players typically foresee significant market changes prior to smaller retail investors.

Nevertheless, the storyline doesn’t present an entirely optimistic picture. Even though whale accumulation might indicate confidence, it also stirs apprehensions about a potential trap for bulls. These substantial investors could easily change their stance, selling their ETH in favor of other assets if market circumstances change or if Bitcoin’s dominance hinders altcoin expansion. This unexpected action could take smaller investors by surprise, resulting in sudden downturns.

Maintaining positions above significant thresholds such as $3,800 and breaching crucial resistance points might ignite the fire for Ethereum’s full-blown bull market. For now, Ethereum is an intriguing option to keep tabs on, offering a blend of promise and doubt.

Price Testing Crucial Resistance

Right now, Ethereum (ETH) is being traded at approximately $3,950. It’s been having a tough time pushing past the significant $4,000 barrier for multiple days. However, it’s holding strong, suggesting robust market backing. Overcoming this hurdle is vital to verify the persistence of the upward trend because $4,000 symbolizes both a psychological threshold and a substantial resistance area for this asset.

If Ethereum doesn’t manage to surpass $4,000, it might drop back towards regions with lower demand around $3,500. This level has been quite robust recently, acting as a safety net during times of heightened selling activity. A dip to this region could stimulate fresh buying interest, potentially paving the way for another push to break through higher levels.

Lately, the market trends indicate that Ethereum could experience a substantial price increase. The rise of Bitcoin in search of new pricing levels and growing enthusiasm for alternative cryptocurrencies have fostered a bullish atmosphere. Moreover, large investors (whales) are consistently buying more ETH, as indicated by on-chain data, leading market participants to feel optimistic about Ethereum potentially regaining and surpassing its record highs.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-12-17 07:18