As an experienced analyst, I believe the recent Ethereum whale transaction causing panic among community members might not be as bearish as it seems at first glance. The data from IntoTheBlock indicates that there is a strong demand for Ethereum among large holders, with a significant increase in the netflow to exchange netflow ratio and a decrease in inflow volume into exchanges. This suggests that investors are accumulating more ETH, which could lead to a price rebound.

A large-scale Ethereum investor, referred to as a “whale,” has triggered concern among the community after executing a significant transaction, possibly indicating their intention to sell off their Ethereum holdings. This development unfolds at a time when Matrixport, a research firm, forecasts that Ethereum’s price may experience a substantial surge from its present value.

Ethereum Whales Transfers 11,215 ETH

According to on-chain records, a major Ethereum investor shifted 11,215 ETH, equivalent to approximately $34.3 million, to the cryptocurrency exchange Coinbase. This transaction suggests that the investor may be looking to sell these tokens. Given the volume of Ethereum being moved, such a sale could potentially influence ETH’s market price. However, information from market intelligence platform IntoTheBlock indicates that there might exist substantial demand for these tokens if, indeed, the whale intends to dispose of them.

As an analyst, I’ve noticed a significant surge of 132% in the ratio of large holders’ netflow to exchange netflow when it comes to Ethereum over the past week. This trend indicates that Ethereum whales have been actively accumulating more ETH. Furthermore, the inflow volume into exchanges has decreased by more than 11% during this period, suggesting a broader accumulation pattern among Ethereum holders.

During this time, the amount of Ethereum flowing out from these exchanges has risen by 3%. This indicates that Ethereum investors are choosing to keep their holdings and buy more ETH, thereby fueling a potential price increase for Ethereum. This trend is likely to boost Ethereum’s value significantly due to the accumulation of more ETH.

According to research company Matrixport’s prediction, Ethereum’s price is expected to bounce back from its present value due to the upcoming Spot Ethereum ETFs. These ETFs could potentially be launched as soon as this week.

Market analysts, such as James Seyffart from Bloomberg, believe it won’t be much longer before Spot Ethereum ETFs start trading, given that fund issuers have addressed most of the SEC’s concerns outlined in their S-1 filings.

ETH Is Primed For A Rally

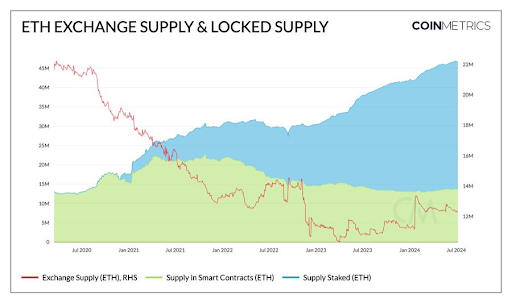

Expert: In a recent post on X (previously Twitter), cryptocurrency analyst Leon Waidmann expressed his belief that Ethereum is set for an uptrend. His conviction stems from the decreasing availability of Ethereum in circulation. Specifically, he pointed out that approximately 40% of Ethereum’s total supply is currently immobilized – with 28% being staked and the remaining 12% allocated to smart contracts and bridges.

Further, according to Waidmann’s prediction, the Ethereum supply on exchanges will likely decrease once Spot Ethereum ETFs become available for trading. Institutional investors are expected to be significant buyers, removing a substantial amount of Ethereum from the market. Consequently, if demand continues to exceed supply, Ethereum could experience price increases due to these dynamics.

As a researcher studying cryptocurrencies, I’ve noticed an intriguing observation made by analyst Follis. He points out that Ethereum’s price chart bears a striking resemblance to Bitcoin‘s preceding its massive 200% surge last year. This similarity, according to Follis, might hint towards potential upcoming growth for Ethereum. Another factor he mentioned that could potentially accelerate this trend is the upcoming approval and listing of Spot Ethereum Exchange-Traded Funds (ETFs).

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-07-10 23:10