Ah, Bitcoin! The digital currency that dances like a drunken ballerina on a tightrope, teetering precariously over the abyss of despair. Just last week, it took a nosedive of 11.3%, now languishing in the low $80,000 range, as if it were a sad clown at a children’s party. 🎭

Defend the Fortress! 🏰

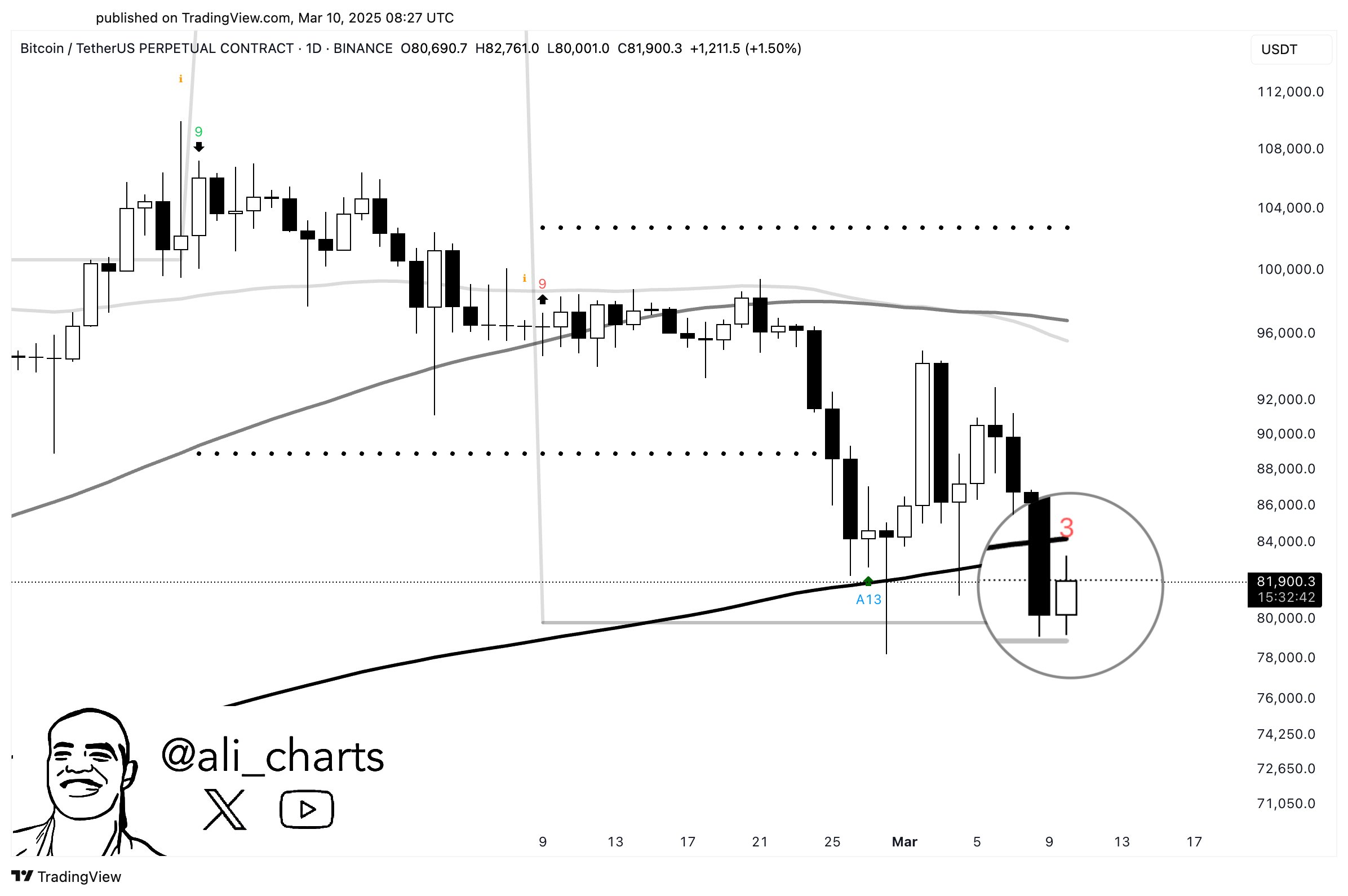

Our dear friend, the ever-astute crypto oracle Ali Martinez, has proclaimed that Bitcoin now finds itself beneath the illustrious 200-day moving average (MA). This is not just any price level; it’s the sacred ground where many a crypto warrior has fought valiantly to defend their fortunes. Alas, it seems our hero has stumbled!

For those who have yet to be initiated into the arcane mysteries of cryptocurrency, the 200-day MA is akin to a wise old sage, whispering secrets of the past 200 days to predict the future. When Bitcoin frolics above this line, it’s a party! 🎉 But when it dips below, well, let’s just say it’s time to check the emergency rations.

Martinez, with the gravitas of a seasoned general, insists that Bitcoin must cling to the TD Sequential indicator’s risk line at $79,280. Should it manage to do so, we might just witness a glorious resurgence, like a phoenix rising from the ashes of its own miscalculations.

And lo! Another sage, Ted, echoes this sentiment. He reminds us that Bitcoin has a penchant for dramatic corrections, often plummeting 25% to 30% before soaring to dizzying heights. In his own words, “In 2023, BTC went from $30K to $22K. In 2024, it plummeted from $74K to $50K. And now, it’s taken a dive from $109K to $79K. What a show!” 🎭

“We all know what happened after the last two major corrections,” he quips, as if he were narrating a tragicomedy.

If Bitcoin follows its own script, a 30% rebound could catapult it to around $104,000. But beware! The specter of macroeconomic forces looms large, with President Trump’s trade tariffs and the Federal Reserve’s monetary policies lurking like mischievous gremlins ready to wreak havoc.

First, the $84,000 Quest! 🏆

Martinez, ever the strategist, lays out the path to glory: Bitcoin must first reclaim the $84,000 mark as a support level. Only then can it dream of galloping toward the fabled land of $128,000.

Some indicators suggest that Bitcoin may have already hit a local bottom, like a weary traveler finding a cozy inn after a long journey. Rekt Capital, another sage of the crypto realm, posits that Bitcoin’s recent plunge to $78,258 could indeed mark the cycle low.

Moreover, the US Dollar Index (DXY) has just experienced one of its most dramatic weekly breakdowns since 2013, a sign that could herald bullish momentum for risk-loving assets like our beloved Bitcoin. As we speak, Bitcoin trades at $80,137, down a mere 3.5% in the past 24 hours, as if it were merely taking a breather before the next act in this grand performance.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-03-11 04:18