As an experienced analyst, I believe the recent accumulation of Bitcoin by whales and institutional investors is a strong bullish sign for the flagship crypto. The significant purchases made by these large-scale investors suggest that they have confidence in Bitcoin’s long-term growth potential, despite the volatility in its price.

Bitcoin‘s major investors, referred to as “whales,” have remained unfazed and demonstrated robust optimism towards cryptocurrency’s flagship token. Over the past week, these investors have amassed a substantial quantity of Bitcoin despite Bitcoin’s price experiencing increased volatility.

Bitcoin Whales Accumulate $1.4 Worth Of BTC

According to market intelligence data from IntoTheBlock, investors holding between 1,000 and 10,000 Bitcoins have collectively added approximately 20,000 Bitcoins (equivalent to around $1.4 billion) to their holdings over the past week. This accumulation has taken place concurrently with Bitcoin’s price rise surpassing $70,000.

As a researcher studying cryptocurrency markets, I’ve observed an intriguing trend: recent large-scale purchases by whale investors indicate that Bitcoin’s trading volume is increasing noticeably. This uptick in activity could potentially set off new price surges for the flagship crypto. Additionally, according to Glassnode’s latest market analysis, selling pressure on Bitcoin has been decreasing. With substantial buys such as those made by these whales, it seems that Bitcoin’s price is poised for a significant upward trend sooner rather than later.

As a researcher studying the crypto market, I’ve noticed an uptick in institutional investment in Bitcoin. This trend is becoming more apparent with the significant inflows into Spot Bitcoin ETFs over the past two weeks. According to Farside Investors, these funds have seen nearly $800 million in investments just this week.

In his latest market analysis, cryptocurrency expert James Check, also recognized as Checkmatey, pointed out that these Spot Bitcoin ETFs could spearhead the upcoming surge in demand, potentially pushing Bitcoin’s price to a never-before-seen peak (ATH). Throughout this year, these Exchange-Traded Funds (ETFs) have significantly contributed to Bitcoin’s expansion, enabling it to reach its current ATH of $73,750, which was attained in March earlier.

Similar to Check and crypto expert Gustavo Faria’s recent assessment in his blog post, there are indications of an impending surge in demand for cryptocurrencies. This could potentially bring about the next market uptrend sooner than anticipated. Crypto analysts such as BitQuant have offered their perspectives on Bitcoin’s potential growth trajectory during its subsequent rise, estimating that the digital token may surpass $95,000 in value.

No Need To Worry About Price Dips

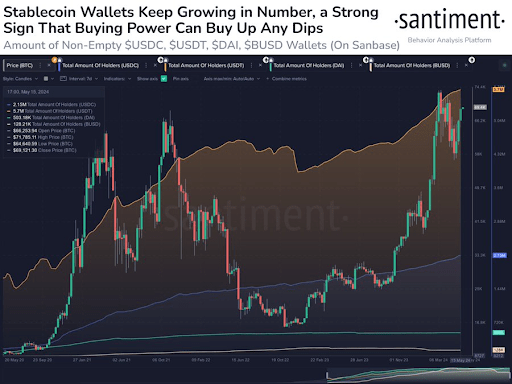

According to Santiment’s analysis, investors need not be concerned about Bitcoin price corrections since the buying power of bulls is sufficient to absorb any dips. The platform identified an increase in the number of non-empty stablecoin wallets as evidence that more significant investors, or “whales,” are preparing to invest in the crypto market by stockpiling stablecoins.

The number of USDC wallets with a balance, and those of Tether, has expanded by more than 13% and 15%, respectively. This trend is predicted to continue as the market rally persists deeper into the year.

Currently, Bitcoin is priced approximately at $67,200 during this point in time, representing a decrease of more than 3% within the past 24 hours based on information from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-25 01:16