As a seasoned crypto investor with several years of experience under my belt, I’ve learned to pay close attention to on-chain data and market intelligence when assessing the health of Bitcoin’s price action. The recent revelation that Bitcoin has significant support between $66,900 and $68,900 based on IntoTheBlock’s data piqued my interest.

Bitcoins on-chain indicators suggest that the cryptocurrency might encounter strong backing in the price range of $66,900 to $68,900. This could potentially serve as a stable foundation for further gains towards increased values.

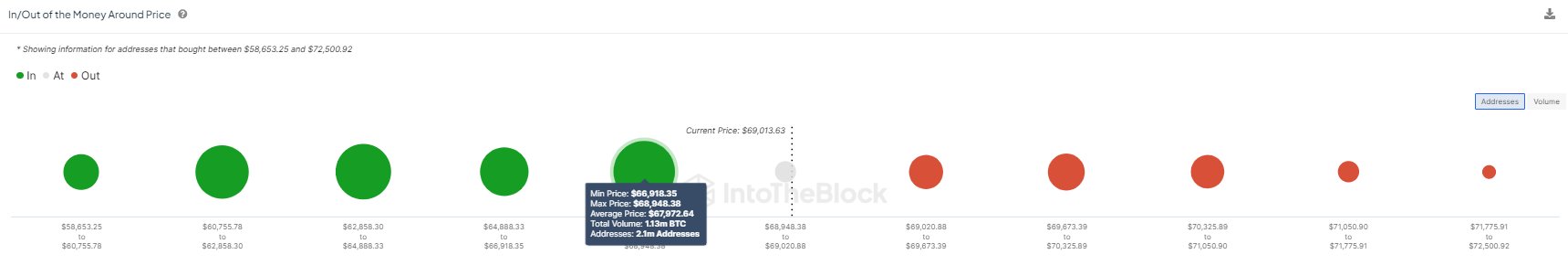

A Large Amount Of Investors Bought Their Bitcoin Between $66,900 & $68,900

As an analyst examining data from the market intelligence platform IntoTheBlock, I can report that Bitcoin (BTC) is presently hovering above a significant area of demand. The concept of demand zones in on-chain analysis hinges upon the amount of “interest” or “desire” to purchase that was evident at a given level.

As a researcher studying Bitcoin prices, I’ve compiled the following chart displaying different price ranges in proximity to the current market value. This comparison is based on the total quantity of Bitcoin each investment represents.

In this representation, the dot’s size signifies the quantity of tokens bought recently within each price range. It seems that among these brackets, the prices between $66,900 and $68,900 contain the largest number of Bitcoin cost bases currently.

Approximately 2 million Bitcoin addresses hold around 1.1 million Bitcoins within that price range. Given the present Bitcoin market price surpasses these figures, any new buyers at these levels would realize modest gains.

As a crypto investor, I understand the significance of my cost basis when conducting on-chain analysis. The cost basis holds a unique psychological importance, and a possible revisit to this level could significantly shift the profit-loss dynamics for me as a holder.

During a price retest, investors might feel compelled to take certain actions. An investor holding losses prior to the retest, meaning the retest occurs at a lower price level, could be inclined to sell out of fear that the price will continue to decline.

An investor who bought green, or at a profit, prior to a price retest might be optimistic about further price increases and choose to purchase additional holdings accordingly.

As a crypto investor, when I notice heavy investor presence at specific price ranges being tested once again, I understand that one of several potential reactions may unfold, which could significantly impact the broader market. Consequently, significant demand zones situated beneath these levels can function as supportive pillars, while price levels above serve as formidable resistance barriers.

Currently, Bitcoin boasts a robust support level between $66,900 and $68,900. This range may act as a buffer if the cryptocurrency’s value were to decline.

As a researcher examining the chart, I’ve observed that the Bitcoin price ranges exhibit thin holding areas concurrently. In theory, this situation might set the stage for a significant rally toward elevated levels due to reduced resistance for upward price movement.

BTC Price

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin reached a new milestone by breaking through the $70,000 mark early today. However, it has subsequently experienced a pullback and is now trading around $69,100.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-06-04 02:10