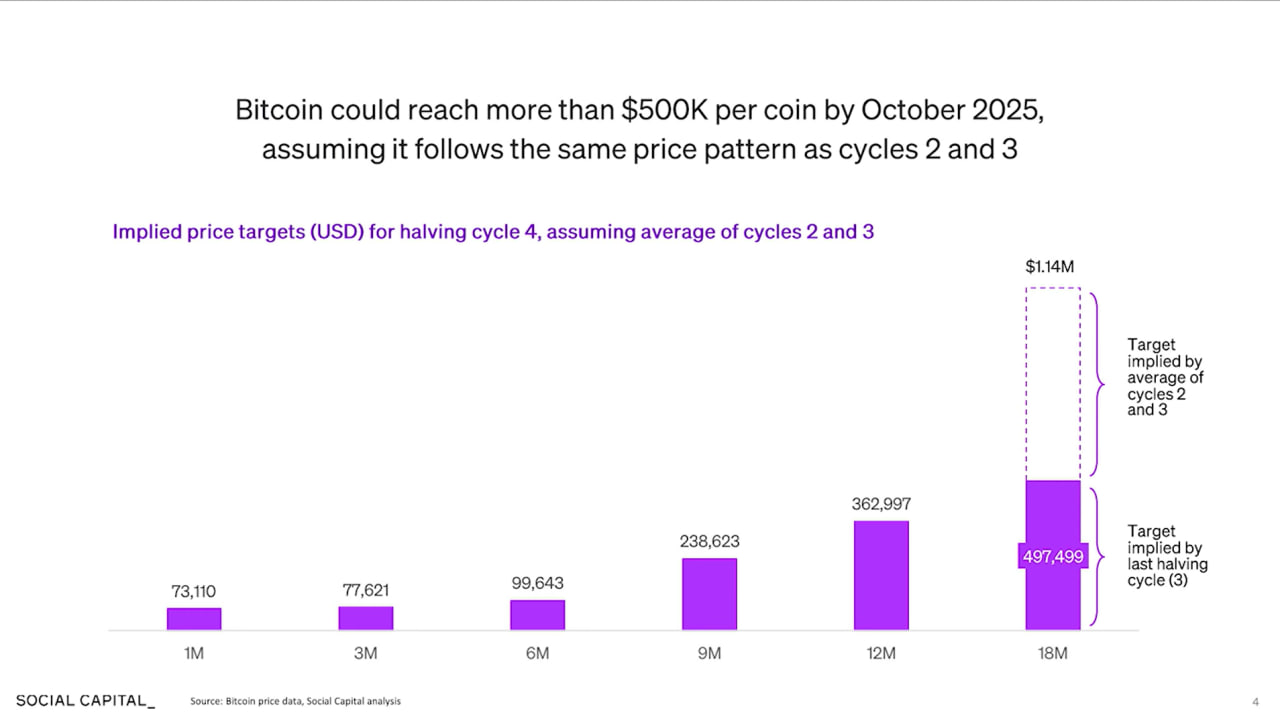

As a crypto investor with some experience under my belt, I find Chamath Palihapitiya’s analysis of Bitcoin’s price trends following the Halving events both intriguing and optimistic. The historical data he presents suggests that significant price appreciation tends to occur within six to 18 months after a Halving event. Based on this pattern, we could potentially see Bitcoin reaching around $500,000 by October 2025.

Bitcoin, the leading cryptocurrency, reached the notable price point of $70,000 recently, serving as a substantial barrier for its price stabilization over the past few months.

I’ve analyzed the Bitcoin (BTC) market trends and found some noteworthy insights. After hitting an unprecedented all-time high (ATH) of $73,700 in March, BTC underwent a 20% correction, plunging to around $56,500 at the beginning of May. However, this price dip didn’t deter the bullish momentum. Instead, it served as a catalyst for renewed growth, pushing the current BTC trading price up to approximately $69,300.

As an analyst, I’ve observed that Bitcoin’s price has gone through some fluctuations and hasn’t yet shown a clear upward trend. However, I’d like to share some positive perspectives from venture capitalist and market expert Chamath Palihapitiya regarding Bitcoin’s future prospects.

Bitcoin Price And Halving Analysis

As a researcher studying Bitcoin’s historical trends, I recently delved into the topic of the Halving event in an episode of the All In Podcast. This significant occurrence takes place roughly every four years and involves reducing the block reward bestowed upon miners. Palihapitiya’s analysis sheds light on its potential implications for the cryptocurrency market.

A venture capitalist observed that following a Halving, investors often take the initial three months to reevaluate prices and assess the broader market conditions. Nevertheless, notable price growth has tended to emerge between the sixth and eighteen-month periods.

As an analyst, I’d like to share that in bolstering his interpretation, Palihapitiya brought up past Bitcoin Halving occurrences for additional insight. Specifically, the initial Halving transpired on November 28, 2012, which resulted in a decrease in block rewards from 50 BTC to 25 BTC. At that moment in time, Bitcoin’s value was set at $13. Surprisingly enough, within the subsequent year, the price reached an astounding high of $1,152.

As a researcher, I’d put it this way: The second Bitcoin halving took place on July 16, 2016, resulting in a decrease in block rewards to 12.5 BTC. At the time of the halving, Bitcoin’s price was hovering around $664. Within the subsequent year, its value surged dramatically, reaching an all-time high of approximately $17,760.

The latest Bitcoin halving took place on May 11, 2020, resulting in a reduced block reward to 6.25 BTC. At the time of this event, Bitcoin was valued at approximately $9,734. Within a year following the halving, the price reached an unprecedented peak of around $69,000.

According to historical trends and taking into account past average growth rates during Halvings, Palihapitiya proposes that Bitcoin may experience a significant surge, potentially reaching approximately $500,000 by October 2025, as depicted in the graph provided.

As an expert analyst, I strongly believe that Bitcoin’s value surge could make it a viable alternative to gold and a useful tool for transacting with hard assets. This prospect, coupled with growing unease about the devaluation of fiat currencies, opens up fascinating possibilities for Bitcoin’s future development.

Increased Demand For BTC?

In the interview, Palihapitiya proposed that as more nations accept a two-currency system, designating Bitcoin as a valuable asset in addition to their native currencies, the desire for Bitcoin is expected to surge.

“This transition would take place once individuals understand the significance of Bitcoin for regular purchases of goods and services, as well as its role as a reliable long-term investment.”

As a crypto investor, I find Palihapitiya’s analysis of Bitcoin’s historical price trends following Halving events quite encouraging. Based on his insights, we can anticipate potential price growth in the aftermath of each Halving event.

As a financial analyst, I’m excited about the possibilities that lie ahead for Bitcoin. With the potential for Bitcoin to hit $500,000 by October 2025, this digital asset is becoming increasingly attractive to investors. Furthermore, its growing recognition as a dual-currency asset alongside fiat currencies opens up new opportunities for the broader cryptocurrency market. The future looks bright for those who are willing to embrace this technological innovation and diversify their portfolios accordingly.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-06-04 03:40