As a researcher with a background in finance and experience following the cryptocurrency market, I find Chamath Palihapitiya’s prediction of Bitcoin reaching $500,000 intriguing. His analysis of historical halving cycles and their impact on Bitcoin’s price trend is compelling.

Chamath Palihapitiya, a venture capitalist and billionaire investor, has made a bold prediction that the price of Bitcoin could reach an unprecedented high of $500,000. This forecast is based on the possibility of a bull market emerging after Bitcoin experiences its fourth halving cycle, which is expected to occur on April 20, 2024.

Bitcoin To Surge To $500,000

Billionaire investor Palihapitiya has joined a significant debate on how past Bitcoin halving cycles have influenced the cryptocurrency’s value. He presented an intriguing price analysis showcasing Bitcoin’s historical trends and performance following each halving event.

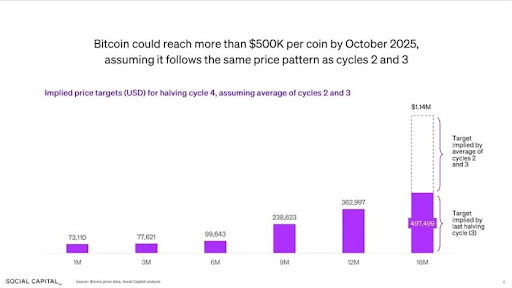

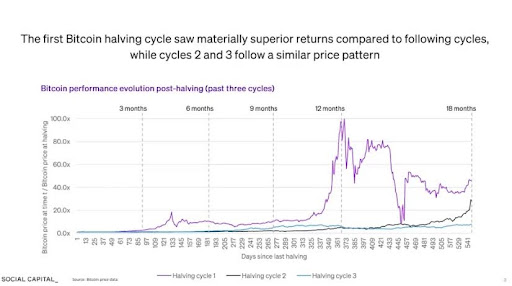

Based on Palihapitiya’s analysis, historically, Bitcoin has hit new peak prices following each halving event. He drew attention to the relationship between Bitcoin’s halving occurrences from 2012 to 2024, explaining Bitcoin’s price trends one month, three months, six months, nine months, twelve months and eighteen months afterwards.

During the initial three-month period following a Bitcoin halving, investors typically engage in careful analysis of the event and its potential implications for the cryptocurrency market. Yet, from six to eighteen months post-halving, Bitcoin has historically experienced significant price growth, propelling it to unprecedented peak values.

“According to Palihapitiya’s observation, the value of Bitcoin significantly rises after each halving. The greatest gains typically occur within the timeframe of 12 to 18 months following the halving.”

Eighteen months following Bitcoin’s initial halving event, its price experienced a remarkable increase of approximately 45 times the original value. After undergoing its second halving cycle, Bitcoin saw a near 28-fold rise in price. Subsequently, the cryptocurrency surged nearly 8 times higher after the third halving occurred.

As a crypto investor, I’ve been closely following the bitcoin halving patterns and based on my analysis, I believe that by October 2025, the price of bitcoin could potentially reach $500,000. This projection is derived from the fact that in the past, bitcoin has followed a similar trend after its previous halving cycles.

BTC Could Replace Gold

During his talk, Palihapitiya shared insights gained from studying past Bitcoin halving cycles. He proposed a possibility that Bitcoin’s price could soar up to an astounding $1.4 million based on these trends. He further emphasized that if Bitcoin ever reached such heights, it could potentially replace gold as a valuable asset due to its unique potential as a digital currency with practical applications for tangible goods and services.

Based on the historical trends of Bitcoin’s price after its halving events, the billionaire investor anticipates that the cryptocurrency’s value will increase. Specifically, six months following the April halving event, Bitcoin is projected to reach approximately $99,643. In the next nine months, its price is expected to climb to around $238,623. Within a year from the halving event, Bitcoin’s value may reach nearly $362,997. And in the 18 months following the halving, the investor predicts that Bitcoin could potentially hit close to $500,000.

As a crypto investor, I’m always on the lookout for potential price drivers for Bitcoin. One factor Chamath Palihapitiya mentioned that could significantly influence Bitcoin’s value by 2024 is the growing demand for Spot Bitcoin ETFs. These exchange-traded funds allow investors to buy Bitcoin shares rather than dealing with the complexities of owning the actual cryptocurrency directly. With increasing interest in these investment vehicles, there’s a strong possibility that more institutional and retail investors will enter the market, leading to higher demand for Bitcoin and potentially pushing its price towards $500,000.

The SEC’s approval of Spot Bitcoin ETFs at the start of the year significantly boosted Bitcoin’s price, which surpassed $73,000 for the first time in 2021 following their launch. This increase suggests that the prediction made earlier carries substantial validity.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-06-04 17:47