As a researcher with a background in blockchain analysis and a strong interest in Bitcoin’s market dynamics, I find the Thermo Cap Ratio an intriguing metric to evaluate the current state of Bitcoin’s price. The CryptoQuant CEO’s insights based on this ratio align with my own observations.

As a crypto investor, I’d interpret the CEO’s words as follows: According to the insights from the on-chain analytics firm, CryptoQuant, the current Bitcoin price doesn’t appear overvalued when considering its network fundamentals.

Bitcoin Price May Not Be Overvalued Yet Based On Thermo Cap Ratio

Ki Young Ju, the CEO and founder of CryptoQuant, has shared insights in a recent post about the recent behavior of Bitcoin’s Thermo Cap Ratio in an accessible way: In his latest update on X, Ki Young Ju explained how the Thermo CapRatio for Bitcoin has evolved lately. The Thermo Cap is a unique Bitcoin valuation method that assigns each token’s worth the same value as its spot price when it was mined on the network.

As a researcher studying blockchain technology, I would explain that this model computes the total worth of the mined coins accumulated since the inception of the blockchain. Contrastingly, the market capitalization determines the current value by multiplying the number of circulating coins with their prevailing market price.

The Thermo Cap can be seen as a reflection of the genuine funds flowing into the cryptocurrency network, since the coins mined by miners are the sole means to expand its supply.

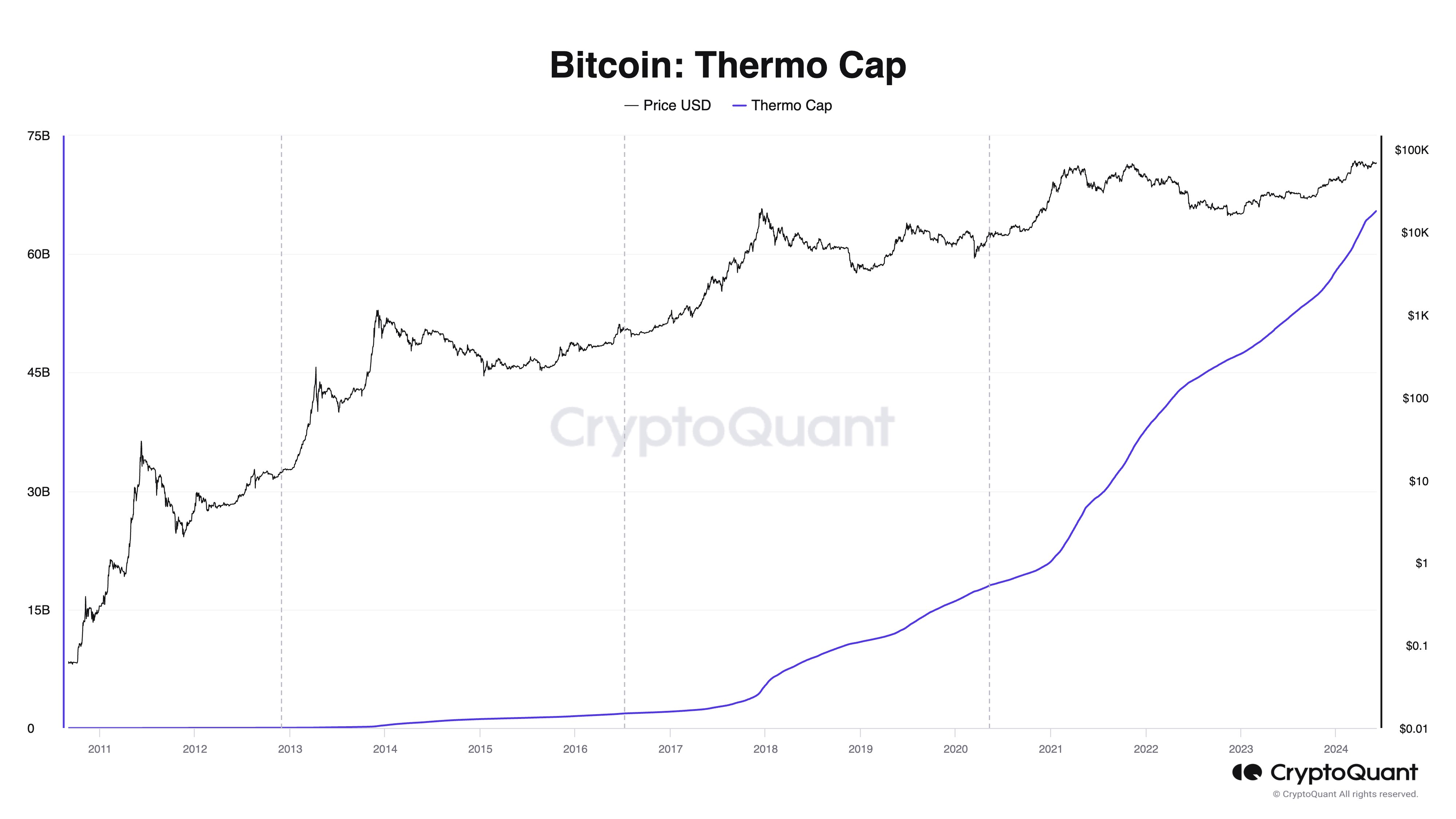

Here is a chart that displays how the Bitcoin Thermo Cap has changed over its history:

The Thermo Cap’s growth trajectory, as depicted in the graph, has been steadily climbing at a faster rate, indicative of the rising investment inflows into this asset class over the past few years.

In the present discussion, it’s important to note that the significance lies not in the Thermo Cap itself, but rather in the Thermo Cap Ratio. This particular measure calculates the relationship between the bitcoin market capitalization and the Thermo Cap.

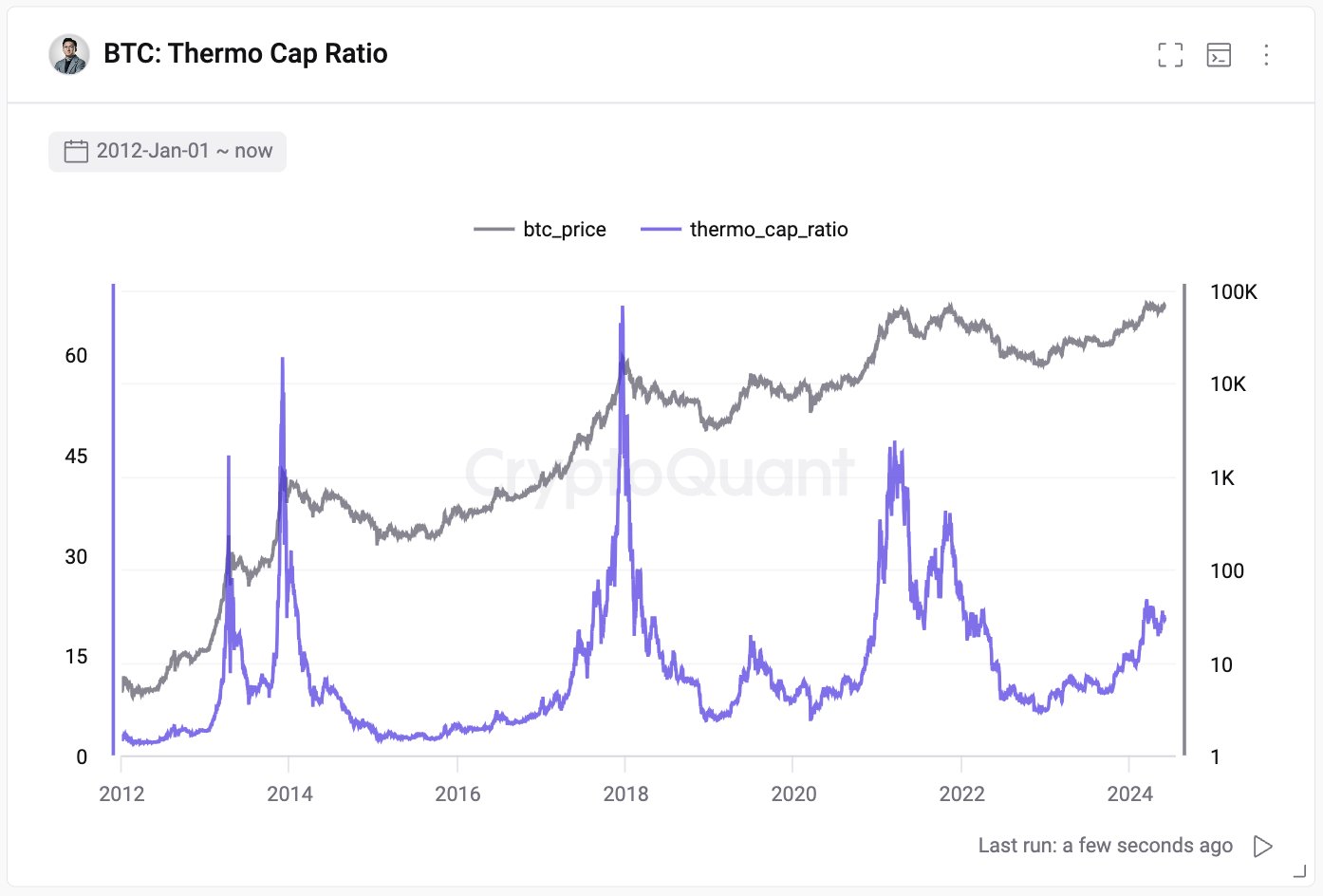

The chart below shows the trend in the Thermo Cap Ratio over the asset’s history.

A notable trend emerges from the chart. It seems that significant peaks in the Thermo Cap Ratio correlate with increased prices for the cryptocurrency.

When Bitcoin’s market capitalization is substantial, it dwarfs Thermo Cap’s size. Consequently, coins are being traded at significantly higher prices than their mining cost.

The ratio’s decrease signals potential bottoms in Bitcoin. While this indicator has been rising recently, its value hasn’t reached the high points seen during previous bull market peaks. According to the founder of CryptoQuant, Bitcoin’s current valuation doesn’t seem excessive based on its underlying network fundamentals.

BTC Price

Bitcoin’s price has been stuck within a particular range lately, reflecting its continuous sideways drift. Currently, the cryptocurrency is priced around $68,900.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-06-04 19:16