As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset landscape, I find myself bracing for potential turbulence as September, historically a challenging month for Bitcoin, unfolds. While I’ve seen my fair share of market upheavals and recoveries, the recent research by Ali Martinez has caught my attention. His insights into the Short-Term Holder Realized Price and its prolonged bearish movement are concerning, especially given the resistance it presents during downtrends.

Beginning with September, often perceived as a challenging month for Bitcoin, a crypto analyst has highlighted potential prolonged selling pressure on the digital asset due to recent market instability and uncertainties. Current trends indicate an increase in negative sentiment, as some investors might choose to offload their Bitcoins amidst the tumultuous market scenario.

Will Bitcoin Undergo An Extended Selling Pressure?

According to a gloomy study conducted by market analyst and trader, Ali Martinez, there’s a persistent tendency for Bitcoin, the leading cryptocurrency, to experience selling pressure.

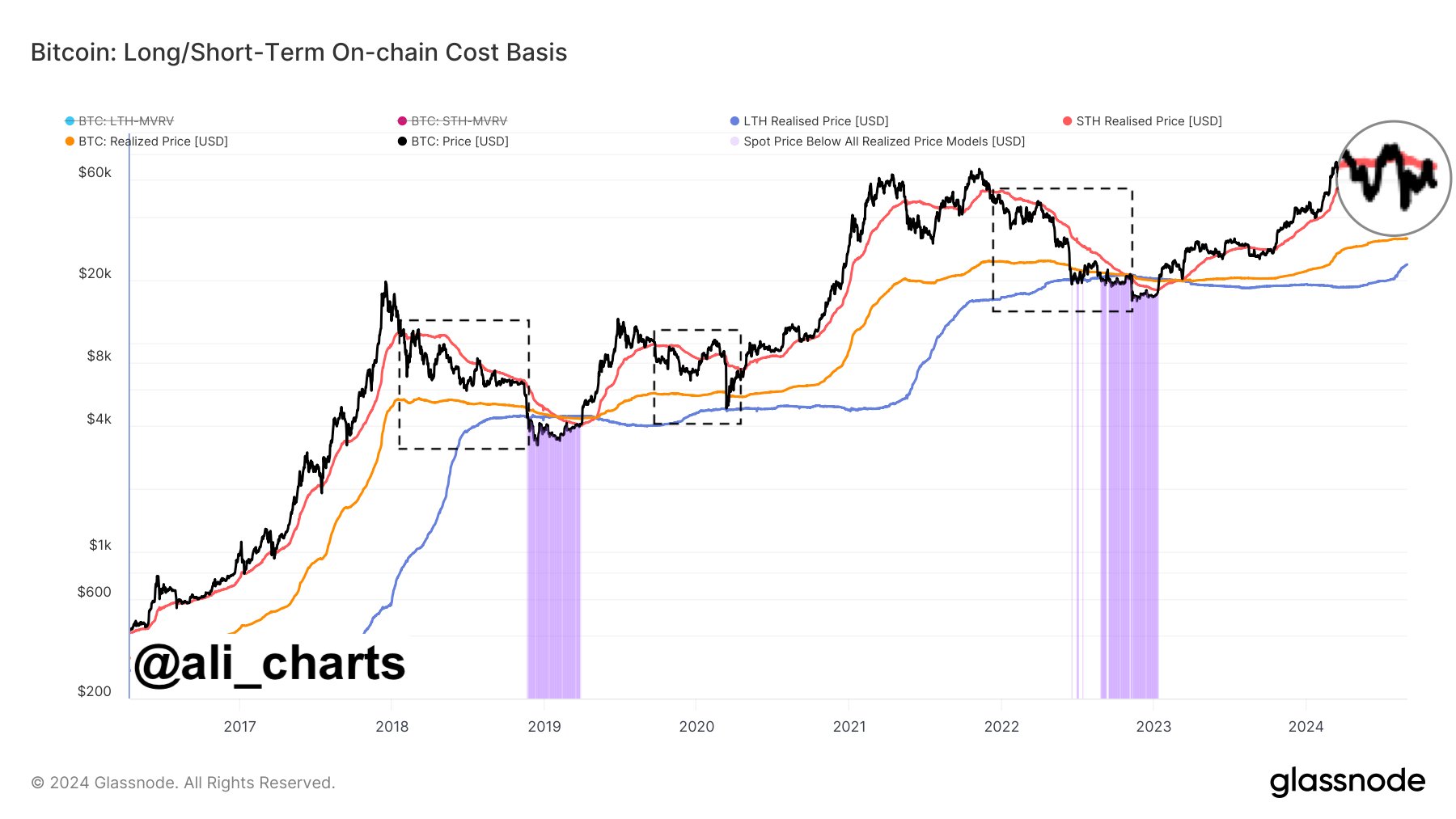

Martinez constructs his predictions using the Bitcoin Short-Term Holder Realized Price as a foundation. He observes a persistent downtrend associated with this indicator, especially noticeable over the past two months. This trend has sparked discussions among cryptocurrency enthusiasts regarding Bitcoin’s potential performance in the near future.

It is worth noting that the behavior of recent Bitcoin purchases can be estimated using the Short-Term Holder Realized Price. Given their increased propensity to sell should the price drop below their entry point, the metric serves as resistance during downtrends.

Based on expert analysis, Bitcoin has been finding it tough to surpass the $63,250 price point since 2022. If this level doesn’t become a strong support zone again soon, Martinez anticipates that selling pressure might continue, potentially indicating a bearish trend for Bitcoin in the immediate future.

In simpler terms, if significant support levels for Bitcoin are breached, it could lead to additional price decreases because of increased selling. This means that market experts advise investors to stay alert during such periods, as there’s a potential for further market declines.

If September 2022 indicates a downward trend for Bitcoin (BTC), this pessimistic forecast might trigger increased selling activity because historically, digital assets have tended to decline during September over the past decade.

BTC’s Warm Supply Realized Price Level At $60,000

While the short-term holder realized price is demonstrating a pessimistic trend, Martinez, considering the Warm Supply Realized Price for BTC, highlighted a potential start of an extended bear market in another post on the X (formerly Twitter) platform.

When Bitcoin exceeds its average selling price (based on current supply), it typically signals a favorable trend for growth. Conversely, if it drops below this point, it often foreshadows an extended period of bear market conditions.

As an analyst, I’m currently observing that the Bitcoin level stands at approximately $66,000. If Bitcoin fails to surpass this level, I would advise a strategic approach for potential buyers, suggesting a possible broader bearish trend may be developing.

As a crypto investor, I’m closely watching how the market reacts to selling pressure, since its ability to absorb such activity without significant price drops could be a key indicator of Bitcoin’s short-term trend. In other words, I’m keeping an eye on whether the market can handle selloffs without causing major price declines, as this could signal the direction Bitcoin might take in the near future.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-09-02 15:40