Several investors have voiced concerns over the recent downturn in the crypto market, including Bitcoin‘s price decrease. This slide has caused altcoins to follow suit, leading to increased pessimism within certain circles of the cryptocurrency world.

Investors can be reassured by analysts and traders that market ups and downs are typical occurrences in the investment process. Some advise the community to focus on the long-term perspective, as many altcoins currently trade at prices higher than they have been in years.

Famous cryptocurrency expert Altcoin Sherpa shared his insights on this topic, highlighting the factors and distinctions that set this current bull market apart from those experienced in the 2010s.

Time For An Altcoins Cool-Off?

In a recent post on X, Altcoin Sherpa expressed the belief that altcoins may see a pause in their growth for the next 1-4 months. The analyst thinks that the current market situation calls for a period of relaxation and consolidation following the significant price increases.

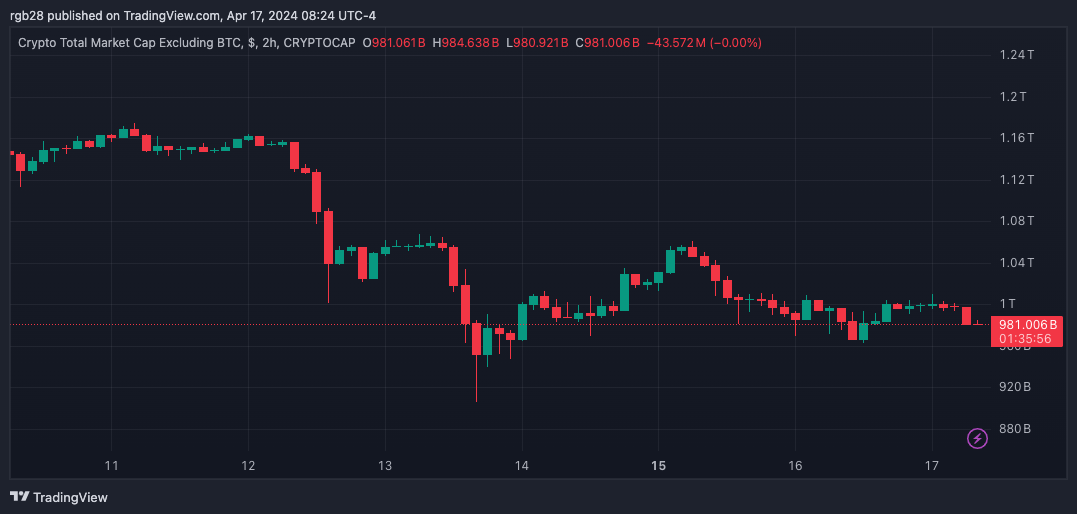

Although their market value has dipped under $1 trillion collectively lately, altcoins have shown impressive gains over the past few months. Data from TradingView indicates that the total value of all cryptocurrencies except Bitcoin grew by approximately 22.79% in 2024.

The value of altcoins in the market has significantly increased in the long term, rising by 91.31% in the previous six months and 52.46% over the past year. This substantial growth, referred to as a “big run” by Sherpa, brings the cryptocurrency market close to levels last seen in 2022.

Despite the positive trend for cryptocurrencies as a whole, some analysts are concerned that many alternative coins (alts) haven’t shown significant growth in recent months. For instance, Chainlink’s token, LINK, is an example of this stagnation.

Even after over 500 days of investment, LINK investors have only seen returns of around 3-4 times their initial investment, depending on when they entered the market. Now, the price of the token is experiencing a substantial decline. The anticipation surrounding altcoins during this particular market cycle appears to be influencing current investor sentiment significantly.

According to one X user’s prediction, LINK was supposed to perform exceptionally well in this cycle. However, Sherpa expressed some surprise with a casual response, “I thought there would be more to it than that.” The user made a lighthearted observation, implying that new and trendy coins might yield better returns than dinosaur coins like LINK.

How Did The Market Change?

The last remark brings out an apparent distinction between this current bull market and those in the 2020s. Picking which investments to hold, or your “bag,” has grown increasingly challenging due to the substantial market growth.

Now, according to Sherpa, it’s crucial to select the altcoins that are likely to perform exceptionally well, given the current market conditions. In the year 2020, there was an impressive surge in the altcoin market, causing prices to rise successively.

In 2024, the money flow is more dispersed with only a few industries thriving. The AI and meme sectors have been particularly buzzing, while L1 tokens such as SEI have shown impressive gains. However, other areas are not doing so well according to Sherpa’s assessment.

A large volume of tokens, including new and existing ones, are having a harder time gaining people’s focus or interest.

For retail investors, it’s no wonder they prefer memecoins over delving into complex topics like DeFi rewards, Oracles, Layer 1 solutions, modular systems, and the like.

The analyst advised investors to shift their focus towards coins with inherent worth, such as Ethereum and Solana. He also believes that major token debuts, backed by substantial financial resources, possess genuine value. According to his post, these coins hold the potential for impressive gains once Bitcoin finds stability.

In simpler terms, Sherpa’s assessment of the market ends with a pessimistic viewpoint for the upcoming months. The increasing challenge of retaining user interest and transforming them into dedicated users or active community members for numerous projects has significantly altered the market landscape.

In the end, the analyst stressed the importance of periodically adjusting your portfolio and expressed his conviction that this market rally still has room to continue.

Read More

- CORE PREDICTION. CORE cryptocurrency

- Top gainers and losers

- SYS PREDICTION. SYS cryptocurrency

- KUNCI PREDICTION. KUNCI cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CFG PREDICTION. CFG cryptocurrency

- Best coins for today

- DOGE PREDICTION. DOGE cryptocurrency

- THOR PREDICTION. THOR cryptocurrency

- STFX PREDICTION. STFX cryptocurrency

2024-04-18 00:05