The data indicates that the market for cryptocurrency derivative contracts has experienced a significant number of forced closures (liquidations) over the past 24 hours, due to a steep decline in the value of Bitcoin and related assets.

Bitcoin, Ethereum Saw Notable Plunges During Past Day

Over the past day, there’s been a downward trend in the digital asset market, with many assets experiencing a dip greater than 5%. Notably, Bitcoin has fallen below the $95,000 mark, continuing its price decline.

Just a few short days ago, the value of the asset surged past the $102,000 threshold, indicating a significant recovery. However, the subsequent sharp decline implies that investors were uncertain about the sustainability of this rally, leading them to cash out their earnings before the trend reversed.

Speaking in simpler terms, the value of Ethereum, the second most valuable digital currency following Bitcoin, took a significant hit, falling to around $3,350 after experiencing a nearly 8% decline over the past 24 hours.

In simple terms, Ethereum’s recent drop has essentially wiped out the bullish energy that characterized its start in the year 2025. While Bitcoin still holds onto some of its gains, if the current trend persists, it won’t be too far before it experiences a similar setback as well.

Given the turmoil experienced by the digital asset industry, it’s logical to anticipate that the derivatives market associated with it might also have faced some disruption or instability.

Crypto Longs Have Just Taken A Massive Beating

Based on information from CoinGlass, there has been a significant buildup of forced closures on derivatives trading platforms over the past day. This term “liquidation” signifies the compulsory settlement of any open contract when its losses reach a certain threshold (which can vary among different platforms).

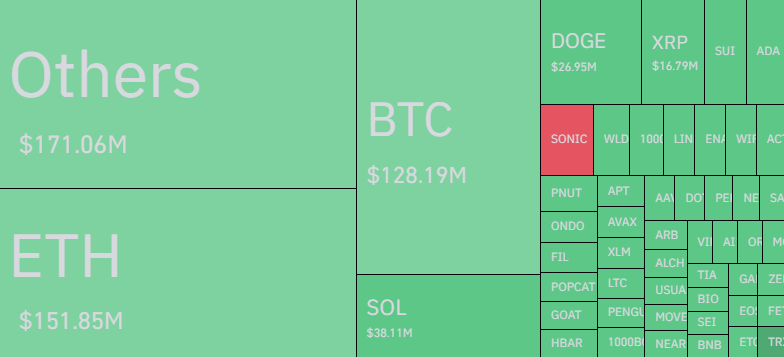

The following table provides a summary of key figures regarding recent cryptocurrency sell-offs.

The revised version aims to simplify the language and make it more accessible to readers who may not be familiar with terms like “liquidations.

In the past day, a grand total of $689 million worth of contracts have been closed. More than 88% of these closures, representing approximately $609 million, were long positions. This implies that a massive 88% of the liquidations impacted traders who had bet on a positive or bullish market trend.

Due to the recent turbulence in the cryptocurrency market, it’s no wonder that we’re observing such a difference between closed long positions (buying) and open short positions (selling).

Since the cryptocurrency market has been experiencing a downturn, it’s not unexpected to see more people closing their buy positions than opening sell positions.

Regarding the impact of each symbol on the market squeeze, it’s worth noting that Bitcoin hasn’t led the pack this time. Contrarily, Ethereum has been dominating, registering nearly $152 million in liquidations.

It’s worth considering that Ethereum’s larger price drop compared to Bitcoin could be a factor, but there might be more to the tale. It’s plausible that the current trend suggests heightened speculative enthusiasm for Ethereum in recent times.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2025-01-09 15:04