As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and whale activities. The recent move by Justin Sun to unstake $209 million worth of Ethereum from Lido Finance is certainly noteworthy.

The significant withdrawal of $209 million worth of Ethereum (ETH) by Justin Sun from Lido Finance, a popular Ethereum staking platform, might cause some volatility in ETH’s price. While top cryptos like Bitcoin (BTC) and Dogecoin (DOGE) have shown remarkable growth, Ethereum has had a more subdued performance, reaching $4,000 before leveling off and struggling to climb further. If Sun chooses to sell more coins, the Ethereum price could potentially drop significantly due to increased selling pressure.

Justin Sun Dumps ETH

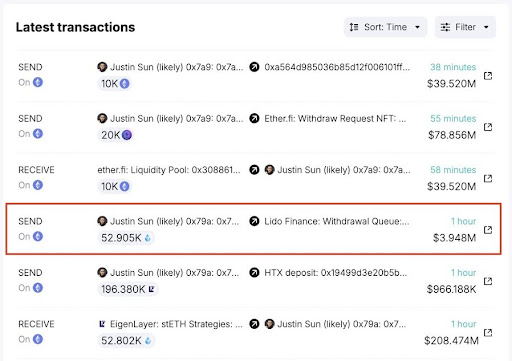

Recent findings from Spot On Chain, an AI-powered cryptocurrency platform, indicate that Sun has requested to withdraw approximately 52,905 Ether tokens, equivalent to around $209 million, from Lido Finance. The large-scale withdrawal appears to be a part of the Ether holdings that Sun is said to have amassed between February and August in the year 2024, according to on-chain data.

In simpler terms, it’s been disclosed that during this specific timeframe, the Spot On Chain platform reports the acquisition of 392,474 Ethereum Sun tokens, equating to approximately $1.19 billion in value. These tokens were bought using three different wallet addresses, with each purchase averaging around $3,027. Currently, the total profit made by the Tron founder from this investment is estimated at $349 million, marking a 29% rise compared to the initial buying price.

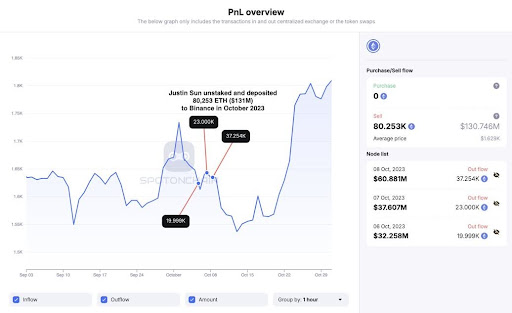

On October 24th, a significant amount – 80,251 ETH tokens worth approximately $131 million – was withdrawn from Lido Finance by an unidentified party, later known as Sun. Four days after this withdrawal, the entire sum was moved to Binance, the leading cryptocurrency exchange globally. This action occurred just before Ethereum’s price plummeted by 5% in mid-October, which could have resulted in a loss for Sun had he not made this move.

It’s no surprise that this isn’t a new occurrence; it was disclosed earlier this month by Spot On Chain that the creator of Tron has been selling off his Ethereum holdings as the market experienced a surge.

Over the course of the last month, I’ve been actively engaging in Ethereum transactions. Specifically, in November alone, I deposited approximately 19,000 ETH, equating to around $60.83 million, into HTX, a prominent crypto exchange. Furthermore, following a significant price surge over the past week that pushed the value of Ethereum beyond $4,000, I transferred an additional 29,920 ETH, worth roughly $119.7 million, to the same platform. These transactions are merely a few examples of my recent Ethereum dealings.

Considering the pattern of significant transactions made by the Sun in the past, additional sell-offs might exacerbate the existing instability in the Ethereum market. Yet, it’s uncertain if the creator of Tron will persist with his series of Ethereum sales.

Ethereum Price Crash Ahead?

Although Sun hasn’t yet spoken out about his substantial Ethereum withdrawals, the magnitude and timing of these transactions might create difficulties for Ethereum’s upcoming path. Precedent shows that significant Ethereum sell-offs, resulting from increased selling pressure, often lead to a price drop.

Currently, Ethereum’s price remains volatile as it attempts to build momentum for a significant upward trend. However, if large-scale sellers continue offloading ETH, market turbulence could intensify further. This is particularly concerning if other investors or major players decide to follow suit. At the moment, Ethereum appears to be performing positively, with a rise of over 7% in the last week and a 28% increase over the past month, as reported by CoinMarketCap.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-12-17 18:04