As a seasoned researcher with years of experience in the cryptocurrency market, I must say that the recent events surrounding Solana (SOL) have certainly caught my attention. While it’s always intriguing to see such dramatic price swings, what truly piques my interest is the behavior of investors and their predictions for the future.

Over the past few weeks, Solana (SOL) has been making headlines for various reasons. Following the announcement of Donald Trump’s presidency win, this well-known altcoin experienced a significant surge, climbing by an impressive 67.69% in just three weeks, peaking at a record high of $263 on November 5th.

Despite a recent increase in price by 15.13% over the past two weeks, current trends among investors indicate growing optimism towards the fifth-largest cryptocurrency, as suggested by recent market data.

Solana ‘New’ Investors Buoyant On Bullish Future

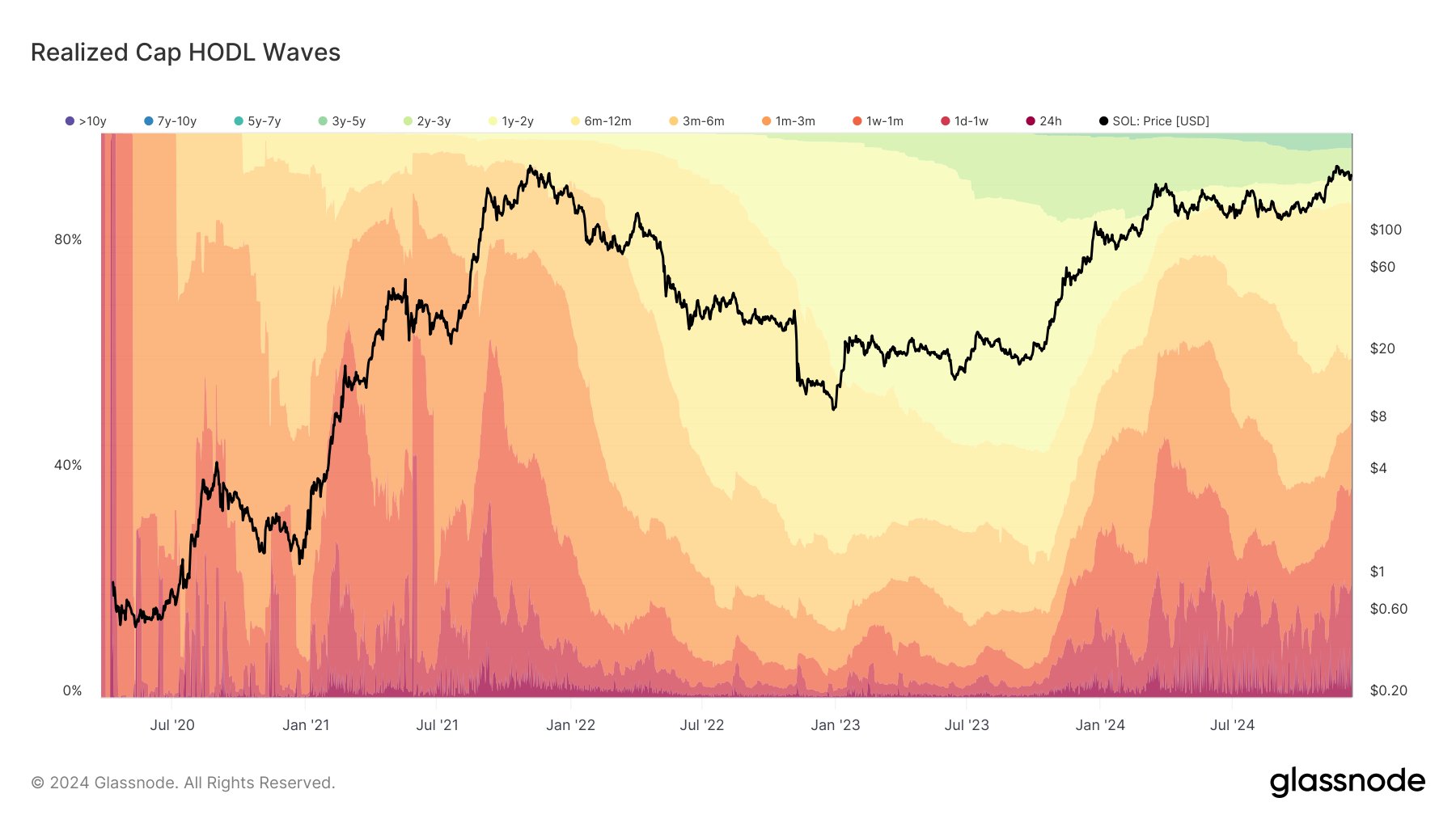

On December 13, a noteworthy report was posted by blockchain analysis firm Glassnode, revealing trends in Solana investor activity over the past few weeks. As per Glassnode’s findings, investors who jumped into Solana market 1-2 years ago have recently unloaded sizeable chunks of their holdings.

It appears that the analysts are suggesting that these investors probably purchased Solana when its value was increasing significantly in 2021 (during the bull run), and they later cashed out during the price surge in November. This action has led to a significant decrease in their ownership stake, which is currently less than 5%.

Sometimes, a decrease in long-term investments might indicate some skepticism about an asset’s future growth prospects. However, according to Glassnode, these recent transactions are merely transactional in nature, with many investors choosing to sell their holdings before the anticipated next surge in the market.

Essentially, a substantial portion of the selling pressure has been counteracted by newer Solana investors from the past 6 to 12 months. These newcomers have boosted their ownership in the market to approximately 24%, during Solana’s recent price rise. This heavy investment at escalating prices suggests that these new investors are optimistic about Solana’s long-term earnings potential, despite its temporary decline in value.

VanEck Predicts SOL To Reach $500 In Q1 2025

Meanwhile, VanEck’s prominent asset managers have expressed optimism about Solana, predicting it could thrive by 2025. In their recent analysis on digital assets, Matthew Sigel, Head of Digital Assets Research, and Patrick Bush, Senior Investment Analyst, suggest that the overall crypto market will likely continue its positive trajectory as we move into the new year.

In summary, digital assets are expected to reach their initial market high in Q1 2025, with Bitcoin predicted to hit $180,000. During this surge, it’s anticipated that Solana could trade at around $500, suggesting a possible increase of approximately 124.21% from its current value.

In contrast, analysts at VanEck predict that after this rise, Bitcoin might experience a dip of approximately 30%, whereas coins like Solana could decrease by roughly 60% as the crypto market settles down during the summer, entering a phase of consolidation instead.

Currently, as I type this, Solana is being traded at around $227, representing a 0.34% increase over the past 24 hours. Simultaneously, its trading volume has decreased by 14.28%, currently standing at approximately $4.12 billion.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-12-14 21:04