As an analyst with years of experience navigating the tumultuous waters of the cryptocurrency market, I find myself cautiously optimistic about the current state of Bitcoin and Ethereum. The impending expiration of significant Bitcoin options contracts suggests that we could be in for some short-term volatility, but the overall sentiment remains bullish.

As we approach the weekly close, the price of Bitcoin (BTC) has surged to a fresh record high of $99,502, with a total market capitalization of $1.95 trillion. Today marks the expiration of approximately $2.86 billion in Bitcoin options, suggesting potential volatility in the cryptocurrency market.

As an analyst, I foresee that a significant expiration event might instigate temporary fluctuations in Bitcoin’s price. This is largely due to the heightened anticipation among markets for Bitcoin to surpass the $100,000 mark, which could potentially amplify these short-term price swings.

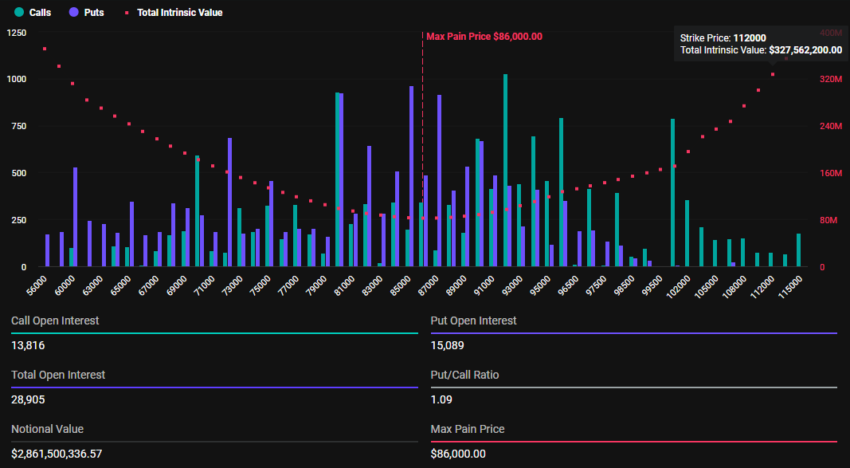

A Look into the Bitcoin Options Expiry Data

On Friday, data from Deribit indicates there will be 28,905 Bitcoin option contracts expiring, with a put-to-call ratio slightly favoring puts at 1.09. The highest potential loss or “maximum pain point” in this scenario is estimated to be around $86,000.

The put-to-call ratio, which measures market sentiment, currently stands above 1, signaling bearish sentiment despite recent growth fueled by Bitcoin whales and long-term holders.

Courtesy: Deribit

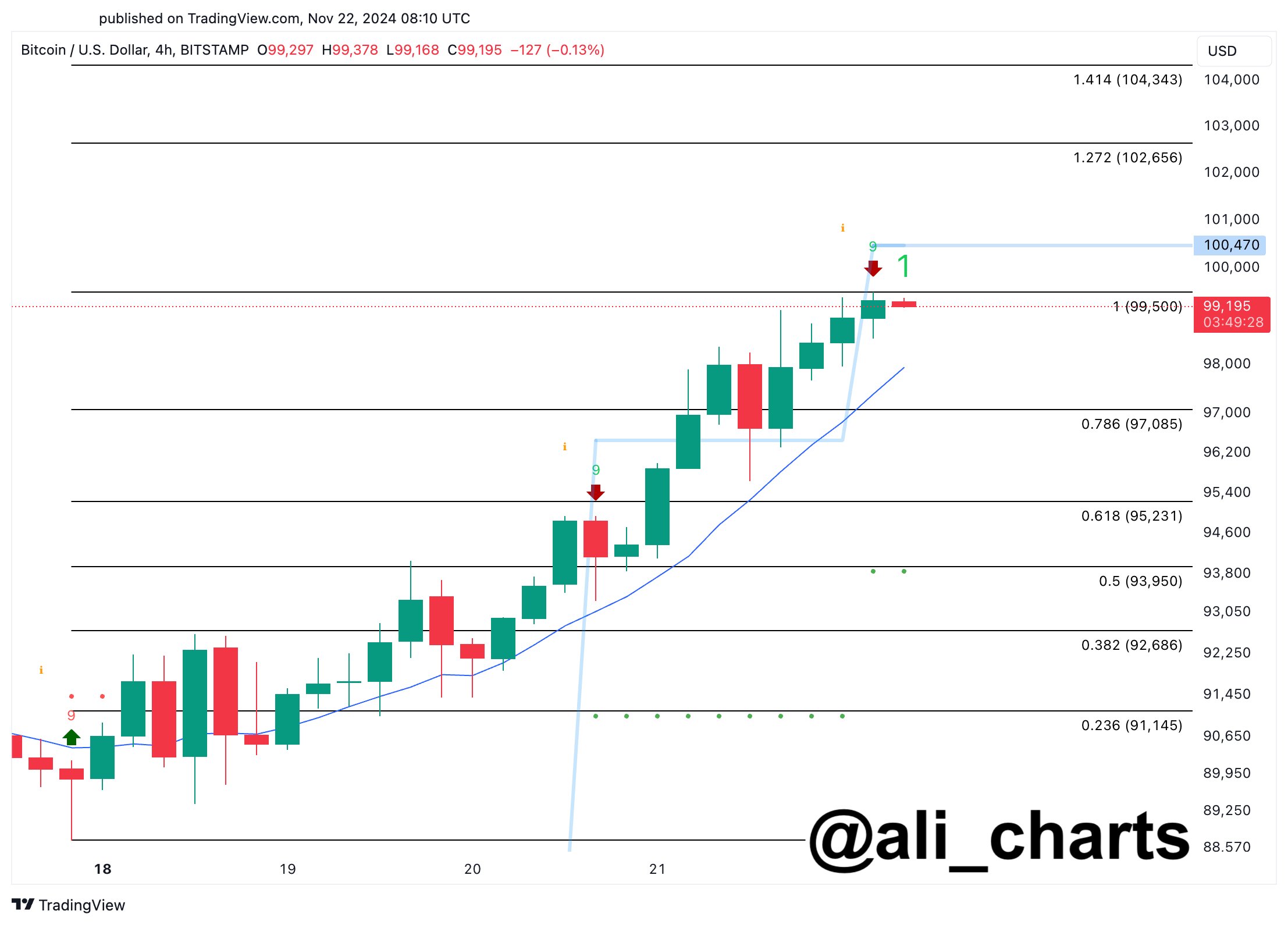

Anticipation runs high that Bitcoin will surge past $100K, but analyst Ali Martinez predicts a minor pullback might occur first. This is indicated by the TD Sequential indicator showing a sell signal on the 4-hour chart, which could lead to a possible drop toward $97,085.

Courtesy: Ali Charts

If Bitcoin can finish a candlestick above $100,470, it might disprove the bearish trend. In this case, BTC could potentially rise to targets of $102,656 or $104,343, as suggested by Martinez.

Ethereum Options Expiry and Analyst Predictions

As a researcher, I’ve found that approximately 164,687 Ethereum options contracts are due to expire today. The put-to-call ratio stands at 0.66, indicating a predominantly optimistic outlook in the Ethereum market, as a lower put-to-call ratio often signifies bullish sentiment. Additionally, the maximum potential loss or ‘maximum pain point’ for these contracts is set at $3,050.

Currently, Ethereum (ETH) is being traded at $3,389. According to analysts from Greeks.live, Ethereum might continue its upward trend in accordance with the bullish put-to-call ratio, while Bitcoin could be heading for a possible correction. They further stated:

Approaching this week, approximately 8% of positions are set to expire. The recent surge in Ethereum has noticeably boosted the Implied Volatility (IV) of its long-term options, whereas the IV of Bitcoin’s long-term options has remained fairly steady. At present, the market sentiment is markedly optimistic.

Experts point out that while Bitcoin might face a potential drop, the overall market surge could stop a major decline. This might be because of the large amounts of money flowing into ETFs, especially BlackRock’s recently introduced IBIT options. On the previous day alone, BlackRock’s IBIT saw trading volumes reach an impressive $5 billion.

Additionally, the combined investments into Bitcoin Spot ETFs exceeded $1 billion yesterday, with IBIT accounting for approximately $600 million of that amount.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-11-22 14:22