As a seasoned researcher with over a decade of experience tracking the cryptocurrency market, I’ve seen my fair share of wild price swings and euphoric rallies. But this current Bitcoin bull run is unlike anything I’ve ever witnessed before. The sheer magnitude of the gains, the record-breaking Open Interest, and the widespread optimism among traders are truly breathtaking.

As an analyst, I’m thrilled to report that Bitcoin has once again broken through previous records, peaking at an astounding $97,903 only moments ago. The cryptocurrency market is buzzing with excitement as Bitcoin takes the lead, driving phenomenal growth that’s ignited a wave of optimism among investors and traders alike. Speculation is rife that this rally could have further legs, with Bitcoin seemingly poised to breach the significant $100,000 milestone.

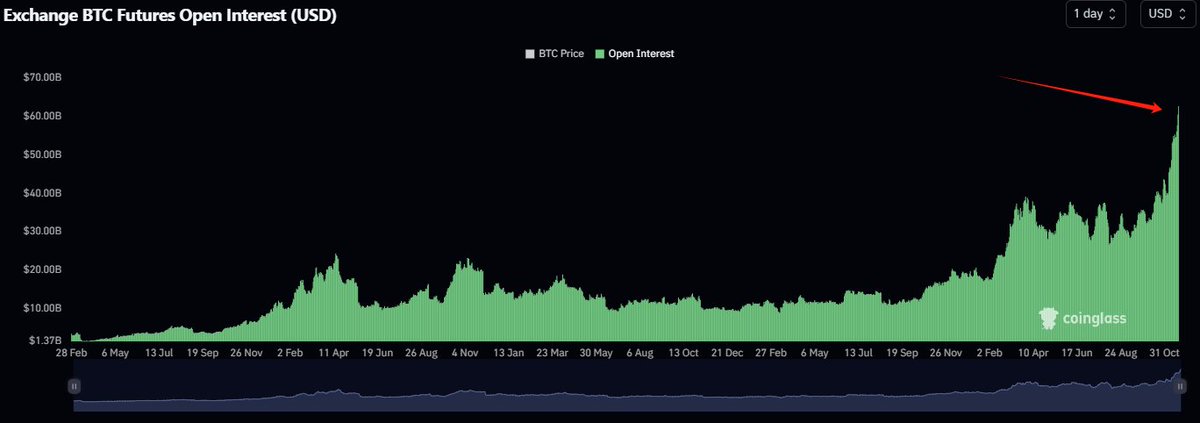

According to Coinglass, Bitcoin’s Open Interest has hit a record level, suggesting a large influx of capital into the market. This increase in Open Interest suggests increased trading activity and confidence among investors. These statistics underscore the excitement within the market, where optimism prevails and the energy remains high as the market continues to gain momentum.

As Bitcoin’s price surge continues at an unprecedented speed and market indicators reach new highs, there is a strong expectation that Bitcoin will surpass the significant $100,000 milestone. The question now is whether Bitcoin can maintain its momentum or if a short-term dip might happen before another upward spike. Regardless, all eyes are on Bitcoin as it solidifies its position as the dominant player during this intense bull market.

Bitcoin Greed Enters The Market

The Bitcoin market is being dominated by excessive optimism among investors, with the Fear and Greed Index reaching 76%. This high level of greed suggests that people are buying Bitcoin enthusiastically, believing its price will keep rising without major obstacles ahead. Such confidence frequently fuels speculative trading as individuals aim to profit from the ongoing surge in prices.

According to data from Coinglass, the Bitcoin Open Interest, which denotes the combined worth of all ongoing derivative contracts, has hit a record peak of $62.69 billion, bolstering this storyline.

This unusually high number underscores the speculative character of the present market, with traders employing leveraged tools such as futures contracts to intensify their possible profits. Although this boosts optimism, it also introduces volatility, making the market vulnerable to sudden shifts in either bullish or bearish trends.

As a crypto investor, it’s fascinating to observe the stark difference between Bitcoin’s thriving environment and the broader crypto market where many altcoins are still trying to regain their yearly peaks. While Bitcoin is breaking records with its impressive performance, most altcoins seem to be lagging behind, highlighting Bitcoin’s dominance during this particular phase of the market cycle.

In my role as a researcher, I am closely watching the surge in Bitcoin’s price, driven by speculative activity and investor optimism. The question on everyone’s mind is whether this rally has further momentum or if a correction may be imminent. At present, Bitcoin stands as the center of attention during this exuberant bull run.

BTC Enters Price Discovery Again

Currently, Bitcoin is trading at an astounding $97,500, setting a new record high, and fueling its remarkable surge. The dominating force in the market has reached a stage known as price discovery – a period typically marked by rapid increases, such as the one propelling BTC upward right now. Excitement among investors is palpable, with the $100,000 milestone just 2.5% away.

Reaching this psychological barrier might create strong resistance, possibly keeping Bitcoin low for a while. A pause in price action at this level could be advantageous for the overall market, giving altcoins a chance to gain ground and ensuring the uptrend remains steady.

In other words, it’s difficult to accurately predict price movements for Bitcoin. If Bitcoin doesn’t reach $100,000 in the near future, there could be a decrease in price due to a lessening of bullish enthusiasm. A drop to lower demand areas, like the $88,500 region, would give the market a chance to regroup before resuming its upward trend.

Regardless of any temporary fluctuations, Bitcoin’s price performance continues to be robust. Its commanding position within the cryptocurrency market and the prevailing optimistic atmosphere indicate that bullish forces are still significantly influential. As traders and investors keep a close eye on price trends, whether Bitcoin can surpass significant psychological thresholds will shape the upcoming stages of this unprecedented market surge.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-11-21 22:36