As a seasoned crypto investor with a decade of market experience under my belt, I find myself at a crossroads following the recent geopolitical tensions in the Middle East and Bitcoin’s dip to $60,164. While it’s always challenging to predict the market’s every move, especially during election years, I can’t help but recall the old adage: “What goes up must come down, only to go back up again.

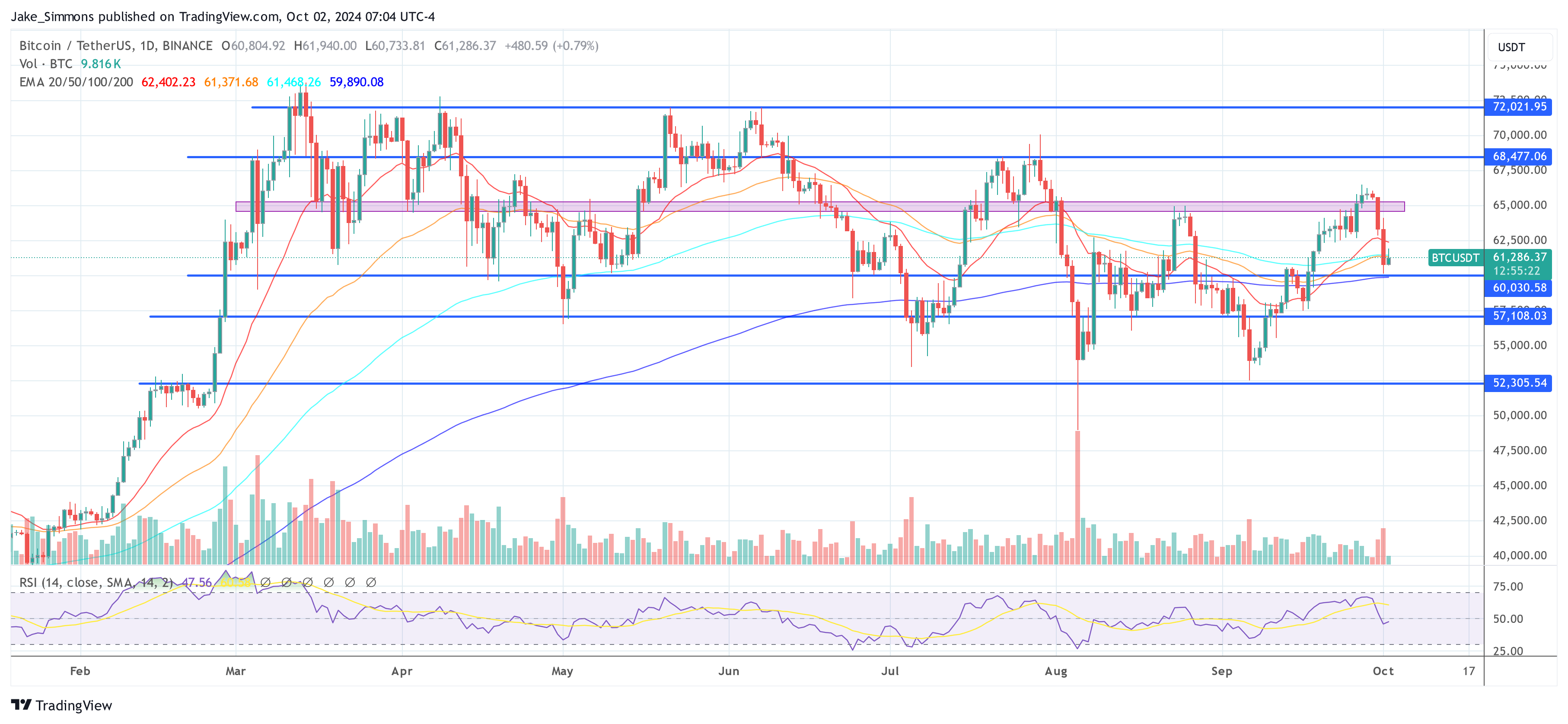

On Tuesday, the price of Bitcoin plunged to $60,164 due to increased geopolitical conflicts in the Middle East, particularly Iran’s missile strikes on Israel. This escalation caused jitters across global markets, affecting both conventional and digital assets alike. Notably, Bitcoin experienced a significant decrease of about 4%.

Investors who expected a robust upward trend in October, referred to as “Uptober,” had to reconsider their strategies due to a shift towards caution in the broader market mood. Yet, some analysts argue that the market’s response to geopolitical updates might be exaggerated.

Will Bitcoin Drop Further?

Macro analyst Alex Krüger (@krugermacro) advises about the swift change in market moods. Through source X, he expresses, “It’s quite surprising to see everyone transforming into complete optimists and forecasting ‘Uptober.’ In a flash, the outlook went from dire to cheerful […] Despite ongoing conflicts in the Middle East, this is an election year in the U.S., which brings a significant amount of uncertainty for the future.

Krüger points out that financial markets often exhibit increased volatility during U.S. election years, particularly in October. He explains that over time, equities have shown slightly negative returns during these months. Additionally, he notes that speculative markets are sensitive to uncertainties and, considering the upcoming elections and payroll data due out on Friday, further market turbulence is likely.

As a researcher, I’m expressing that if payroll figures show significant strength this upcoming Friday, it could lead to a surge in equities, given our current ‘good news is good news’ climate. However, the optimal moment to invest aggressively and maintain positions might be post-elections, potentially commencing on Election night itself, as per Krüger’s perspective.

According to well-known crypto analyst CRG (@MacroCRG), there’s a possibility that the Bitcoin price could rebound even amidst current market fluctuations. He suggests that this dip might be a quarterly low and mentions that markets often establish highs/lows at the start of a period. Moreover, he points out that geopolitical events tend to lose impact over time, but we may experience more volatility based on Israel’s reaction. However, the market seems to already be factoring in this situation, indicating a potential recovery.

Similar to Krüger, he suggests that a rise in market liquidity could potentially bolster Bitcoin. In simpler terms, he believes that an increase in liquidity will attract Bitcoin, and it might react to this situation quickly. To summarize, CRG continues to have a positive outlook for Bitcoin’s future direction, predicting that while there may be short-term doubts, the price of $100k BTC is anticipated to materialize.

QCP Capital, a finance company located in Singapore, shares its viewpoint on how the escalating Israeli-Iranian conflict is affecting the market. In their most recent report to investors, they explain that although Iran has fired more than 180 missiles, the traditional financial markets’ response has been relatively subdued. Specifically, the S&P 500 index decreased by only 1%, while West Texas Intermediate (WTI) crude oil experienced a 2% rise.

Despite a steeper drop, the crypto market experienced increased selling for Bitcoin, which ended 4% lower. The support held at approximately $60,000, and additional tension might drive Bitcoin down to around $55,000 according to QCP’s observations.

As a crypto investor, I find it reassuring that despite the temporary turbulence, QCP Capital’s report highlights a positive outlook for risk assets in the long run. In other words, while Middle Eastern politics may dominate headlines at present, the relatively light sell-off indicates that there’s still strong demand for risky investments. This short-term hiccup should not overshadow the broader, more optimistic perspective.

They additionally highlight global monetary policies as a crucial influence. “The influx of money from the People’s Bank of China and possible fiscal aid could boost asset values within China, possibly causing optimism to spread beyond and support risky assets like cryptocurrency. […] Asset prices are anticipated to continue receiving support until 2025, as both the most prominent (the Fed) and third-largest (PBoC) central banks have begun their rate reduction phases in earnest,” QCP suggests in conclusion.

At press time, BTC traded at $61,286.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-10-02 16:16