As a veteran crypto investor with over a decade of experience in this wild and unpredictable market, I’ve learned to take predictions about the future with a grain of salt. However, Quinn Thompson’s analysis resonates with me, given my own observations and experiences.

The poor performance of Ethereum (ETH) on price graphs may delay the anticipated rise of other cryptocurrencies, often referred to as the altcoin season. As per Quinn Thompson, founder of Lekker Capital, a crypto hedge fund, the potential risks for alternative coins could increase due to decreased investor enthusiasm towards ETH, particularly among US exchange-traded funds (ETF) buyers.

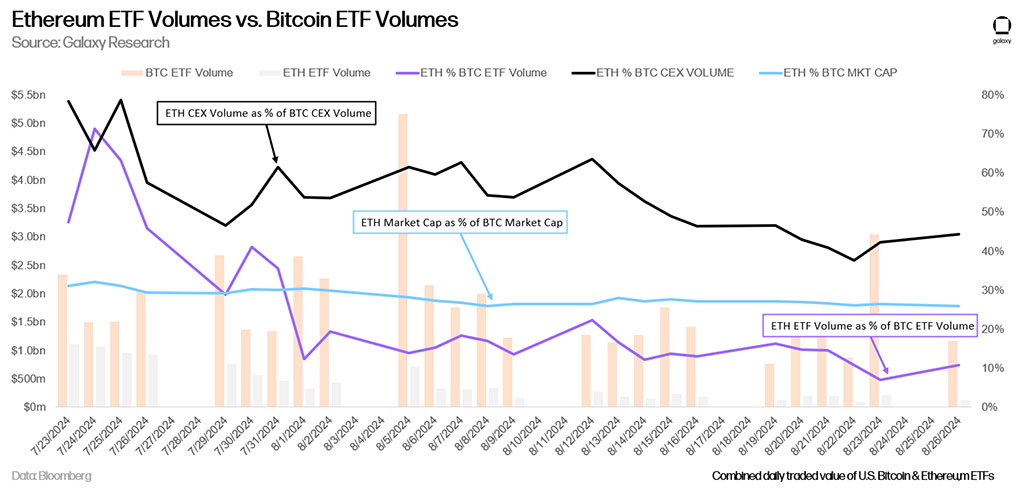

In response to the latest findings from Galaxy Digital suggesting decreased Ethereum (ETH) ETF trading volumes compared to Bitcoin (BTC) ETFs, I posit that the current market value of ETH may not be enticing enough for potential investors.

In simpler terms, “Today, we’re talking about Exchange Traded Funds (ETFs), and so far, the volume of Ethereum (ETH) versus Bitcoin (BTC) has been approximately 10-20%. At times, it can be even less. This is concerning because when compared to the market capitalization ratio of ETH/BTC, it’s only 26%.”

Photo: Galaxy Digital

From their initial launch, Bitcoin ETFs have attracted a staggering $17.5 billion in overall investments, whereas Ethereum ETFs have experienced a total of $477 million in withdrawals. This trend suggests a higher interest in Bitcoin among ETF investors compared to Ethereum.

Will ETH Affect Altcoins?

Thompson noted that savvy investors (ETFs) weren’t finding worth in Ethereum’s current valuation, but might appear later on. Given this prediction, he anticipated a prolonged drop in Ethereum’s price until the ETHBTC ratio reached its lowest point at 0.033 and the ETH/BTC market cap ratio touched 20%.

For context, the ETHBTC ratio tracks the ETH value relative to BTC and recently hit a yearly low of 0.040.

Photo: TradingView

The ETHBTC rate is often seen as a key indicator of the state of the cryptocurrency market’s altcoins sector. Just as Thompson predicted, a probable decrease in this rate might indicate an upcoming downturn for the industry, with Ethereum losing value while Bitcoin’s dominance increases.

“It’s not unexpected that within the coming weeks, the Bitcoin Dominance Chart might continue to leave investors holding altcoins feeling as though they would have been better off with Bitcoin.”

In addition to tracking Bitcoin’s dominance and the relationship between ETH and BTC (ETH’s performance), analysts also consider the expansion of stablecoins as an indicator for a potential surge in altcoins. Interestingly, the market capitalization of stablecoins has almost reached $170 billion, with Tether’s USDT taking the lead and the Ethereum network dominating the field.

To put it simply, Thompson argued that the growth in stablecoins was distributed across various assets, potentially favoring Solana over Ethereum (ETH). Essentially, if ETH underperformed, it might not be advantageous for the entire altcoin sector.

Additionally, Coinbase experts attributed Ethereum’s falling value to multiple aspects such as waning interest in U.S. ETFs and finding it challenging to grasp the storyline and future trajectory of Ethereum.

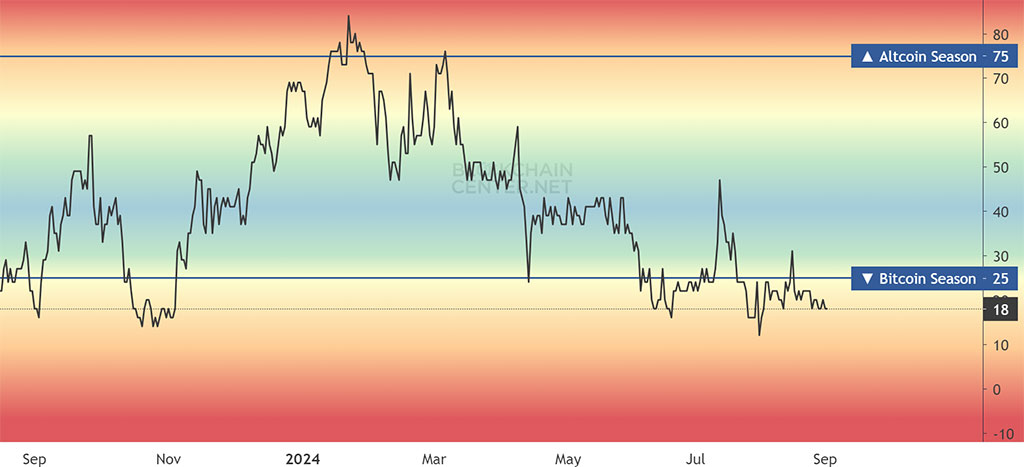

Photo: Blockchain Center

For now, the Altcoin Season Index stands at 18, suggesting that we’re still in a period favoring Bitcoin over most altcoins like Ethereum, as they have yet to outperform Bitcoin.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-09-02 15:32