As a seasoned analyst with over two decades of market observation under my belt, I have learned to read between the lines and decipher patterns that may not be immediately apparent to the untrained eye. In the case of Cardano (ADA), the recent price surge has raised some red flags for me.

As a proud holder of Cardano (ADA), I’ve noticed that the recent price surge of nearly 15% in the last week has sparked quite an interest among fellow investors. The on-chain data suggests that we might see some interesting reactions from the community as a result of this bullish trend.

Cardano Could Face Significant Selling Pressure

Investors who have recently bought Cardano may feel compelled to sell due to potential profit-taking, as approximately 12% more of the Cardano supply is now sitting on profits. This could lead these investors to cash out their gains, especially given Cardano’s volatile price behavior throughout this market cycle.

Although Cardano has experienced some price increases lately, it has underperformed significantly compared to other coins since the start of the year, resulting in a loss of over 35% for its year-to-date (YTD) performance. Consequently, holders of Cardano may feel more inclined to cash out their gains rather than holding on to hope that this recent price rise represents a sustained bullish trend instead of just a temporary relief bounce.

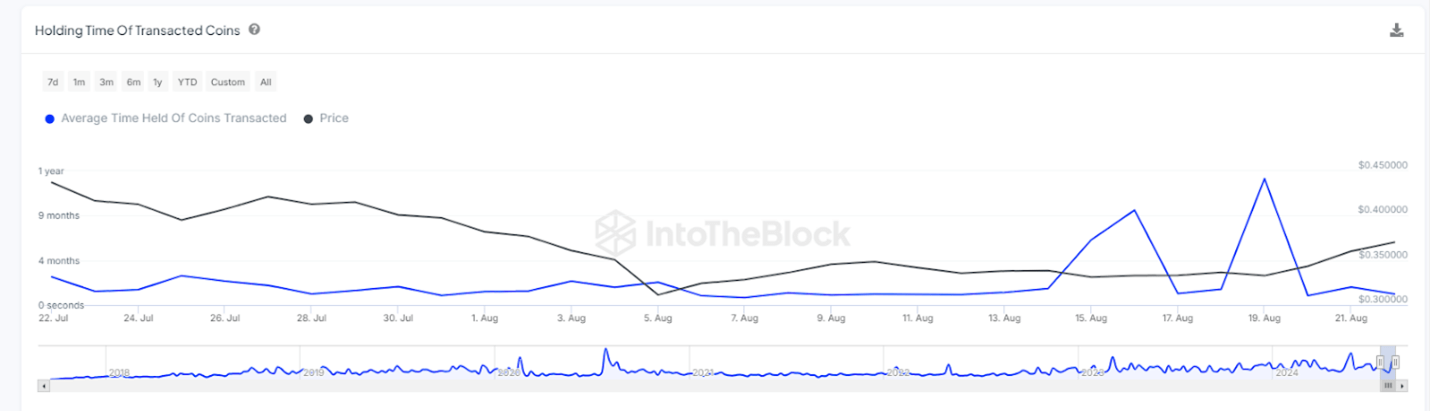

Based on recent transaction patterns among these Cardano holders, it seems they may be growing less confident about the crypto token and could soon cash out to secure their gains. Data from market intelligence platform IntoTheBlock indicates that the typical holding period for coins traded over the past month is approximately 5 months, which suggests that Cardano investors might be selling their tokens prematurely.

Additional information from IntoTheBlock indicates the potential number of addresses that might sell their ADA tokens should current holders decide to cash in on their gains. Approximately 481,370 addresses purchased ADA within the price range of $0.3 to $0.35, making them prime candidates for realizing profits. Given the recent surge in Cardano’s price could be a temporary relief rally, these early investors risk losing money if they fail to sell and the price drops.

A Guide For ADA Investors

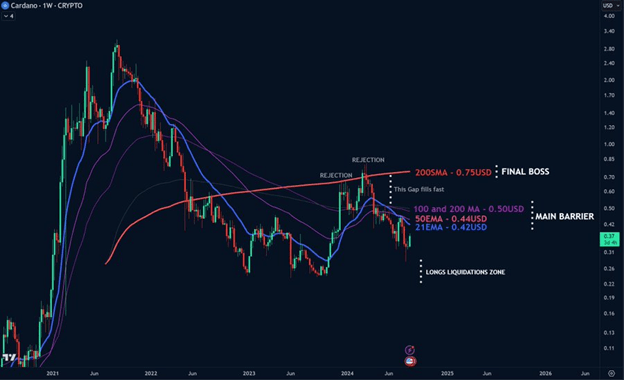

Crypto expert Trend Rider recently shared an advisory for Cardano investors, describing it as a “comprehensive strategy to remain composed amidst market turbulence.” This guidance was presented visually through a chart, highlighting significant points that investors should keep an eye on and consider when making informed investment choices.

The analyst pointed out that the price range of $0.22 to $0.31 offers a significant buying opportunity for investors looking to increase their holdings, as it represents a high liquidity zone. He also highlighted that the optimal region for selling or cashing in on Cardano is between $0.42 and $0.55, marking a key profit-taking area.

The analyst predicts that if Cardano surpasses its current resistance level, it could experience a swift increase to around $0.75. He considers this point as the “toughest resistance” or a key place to cash out profits. Those who are strongly confident in Cardano might decide to keep holding the cryptocurrency if it reaches $0.75, as breaking above that level could signal an entry into bull market territory, according to Trend Rider.

Currently, as I’m typing this, ADA is being traded approximately at $0.379, marking an almost 4% increase over the past 24 hours, based on information from CoinMarketCap.

Cover image from Dall-E, chart from Tradingview

Read More

- Odin Valhalla Rising Codes (April 2025)

- King God Castle Unit Tier List (November 2024)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Cape Fear Cast: Patrick Wilson Eyed to Star in Apple TV+ Show

- Vesper’s Host guide – Destiny 2

- POPCAT PREDICTION. POPCAT cryptocurrency

- Rare Porsche 911 Carrera RS 2.7 Lightweight Heads to Auction

- Incarnon weapon tier list – Warframe

- Thunderbolts* Post-Credits Scene Sets an MCU Record

2024-08-23 21:04