As a seasoned crypto investor with a knack for recognizing hidden gems, I find myself drawn to Solana (SOL) in these tumultuous market conditions. Having weathered numerous bear and bull cycles, I’ve learned that the crypto market can be as unpredictable as a rollercoaster ride at an amusement park. However, SOL’s recent performance seems to suggest it’s not just another thrill ride but a sturdy roller coaster track amidst the chaos.

After the “Black Monday” crash, Solana (SOL) has regained approximately 30% of its value and is currently fluctuating between around $155 to $140. Notably, Solana-associated investment products experienced substantial losses last week, with outflows exceeding $30 million as per recent reports.

Despite a drop in memecoins’ trading activity and negative net flows during the week, the token persisted in maintaining a horizontal course. This steady trend has caught the attention of certain crypto analysts, who have commended SOL‘s recent performance due to its perceived stability, considering it a potentially reliable investment choice.

Solana ETPs See Record Outflows

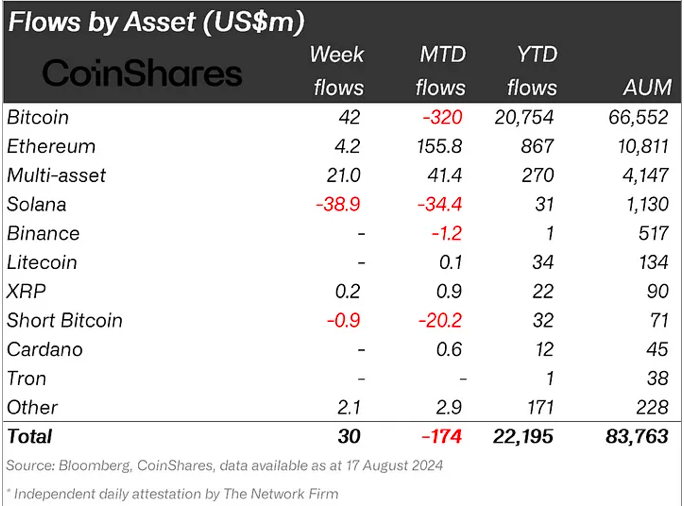

According to CoinShares’ latest report, there was a moderate intake of around $30 million into Exchange-Traded Products (ETPs) last week. This inflow indicates that crypto investment products experienced small increases over the past seven days, but the flow between providers varied.

According to the findings, traditional ETP issuers consistently saw a decrease in their market share as competitors offering newer financial products took over. Moreover, the trading volume of crypto funds plummeted to $7.6 billion last week, marking a nearly 50% drop from the $19 billion recorded the previous week.

For the past week, Bitcoin (BTC) experienced the highest accumulation among cryptocurrencies, with an inflow of approximately $42 million. Conversely, Short-Bitcoin ETFs recorded a withdrawal of $1 million, marking their second straight week of outflows.

As a researcher examining the flow of funds within the cryptocurrency market, I’ve observed that Ethereum-based products have accounted for just 10% of the inflows into the flagship cryptocurrency since August 12, totaling approximately $4.2 million. Despite the positive net inflows of $104 million from new providers, these were overshadowed by the significant outflows of $118 million from Grayscale Ethereum Trust (ETHE).

Despite a significant inflow, Solana-related investment products experienced the most substantial withdrawal among cryptocurrencies last week, with $39 million leaving Solana ETPs. The 21Shares Solana ETP saw a $37 million outflow, ranking third in the list of largest withdrawals by investment product for the week, trailing only behind ETHE and GBTC.

SOL Continue Sideways Trajectory

According to CoinShare’s findings, the poor performance of Solana ETPs was observed during a time when there was a significant drop in the trading volume of meme coins, which play a crucial role in its operations.

According to information from CoinGecko, Solana-based meme tokens decreased by 3.7% over the past 24 hours, resulting in a market capitalization of approximately $3.59 billion. Additionally, the coin’s trading activity has shown a comparable 3% drop since Sunday, reducing its daily trade volume to around $1.1 billion.

Over the weekend, the Solana ecosystem has remained relatively stable, fluctuating between a market capitalization of around $243 billion to $245 billion, which it has held since August 15. Similarly, the price of SOL coin has moved within the range of $140 to $155 over the weekend, a pattern it has maintained since August 12.

According to the crypto expert known as Altcoin Sherpa, the token’s value may experience more fluctuation and stabilization in the upcoming weeks. Despite this, he believes that the $125-$150 price range is an excellent opportunity for buying Solana (SOL), suggesting it could be a good long-term investment. In his opinion, SOL remains a token worth holding onto for some time.

Just like Crypto Jelle observed, Solana (SOL) has been moving sideways while other cryptocurrencies have hit lower lows. However, in the analyst’s view, SOL could experience a significant surge once Bitcoin stabilizes or begins to rise. Moreover, reaching a new all-time high for SOL is considered quite probable by this analyst.

As of this writing, SOL is trading at $144, a 1.4% drop in the last 24 hours.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Dakota Johnson Admits She ‘Tried & Failed’ in Madame Web Flop

- Sydney Sweeney’s 1/5000 Bathwater Soap Sold for $1,499

2024-08-20 11:10