As a seasoned crypto investor with years of experience in this dynamic market, I’ve learned to keep a keen eye on significant developments and trends that may influence the prices of various cryptocurrencies. The recent approval of Ethereum ETFs by the SEC has undoubtedly sparked excitement within the community, but as an investor, I remain cautious.

The SEC’s approval of Ethereum ETF applications last Thursday has fueled anticipation about potential price changes for the second largest cryptocurrency, as the commencement of trading draws near.

Transactions involving substantial amounts of Ethereum being sent to cryptocurrency exchanges have sparked worries over investors looking to cash in on profits, readjusting their portfolios, or engaging in market manipulation.

Sell-Off Amidst Ethereum ETF Greenlight?

Based on the analysis of crypto specialist Ali Martinez, these events occur concurrently with Ethereum creator Jeffrey Wilcke moving a significant amount of 10,000 ETH, equivalent to around $37.38 million, to the digital currency exchange Kraken.

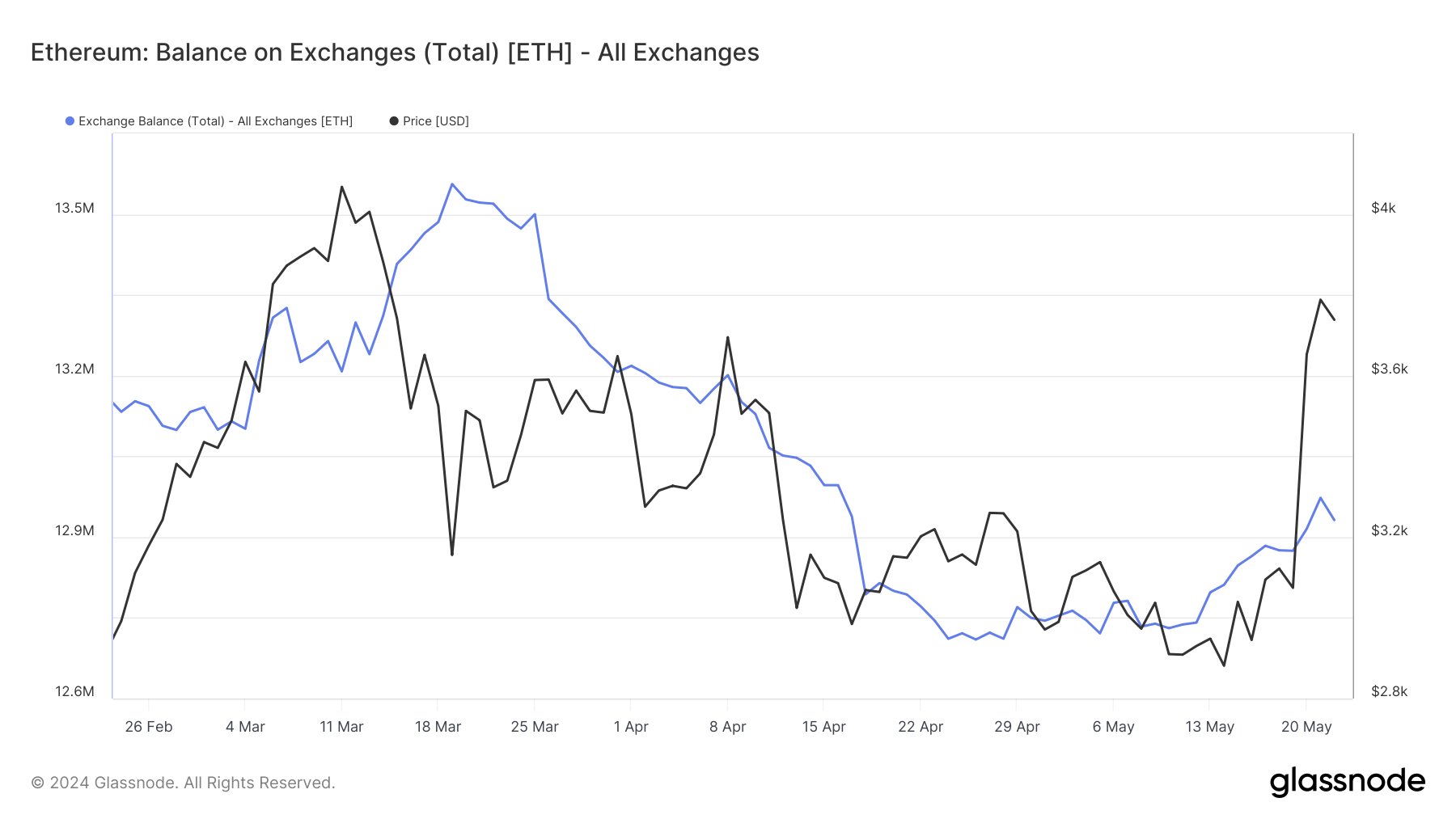

An uptick in Ethereum holdings on digital asset trading platforms implies a substantial boost in circulating tokens that can be traded.

Approximately 242,000 units of Ethereum have moved to cryptocurrency exchange wallets within the past fortnight, indicative of heightened trading action potentially leading to market price fluctuations.

The combination of this ongoing trend and Wilke’s transfer indicates that some market players might be considering selling their assets or cashing in on their profits.

According to prominent figures in the industry such as Anthony Pompliano, the approval of an Ethereum ETF is seen as a promising development for the sector. However, investors and traders should remain cautious before making any moves. Based on the increasing number of Ethereum deposits into exchange wallets observed by Martinez, it’s possible that market participants may react through profit-taking or increased selling pressure.

The analyst points out an important observation from the TD Sequential indicator on Ethereum’s daily chart: a sell signal has emerged, potentially signaling a pullback or the start of a fresh downtrend prior to the continuation of the uptrend.

Ethereum’s Price Outlook In Focus

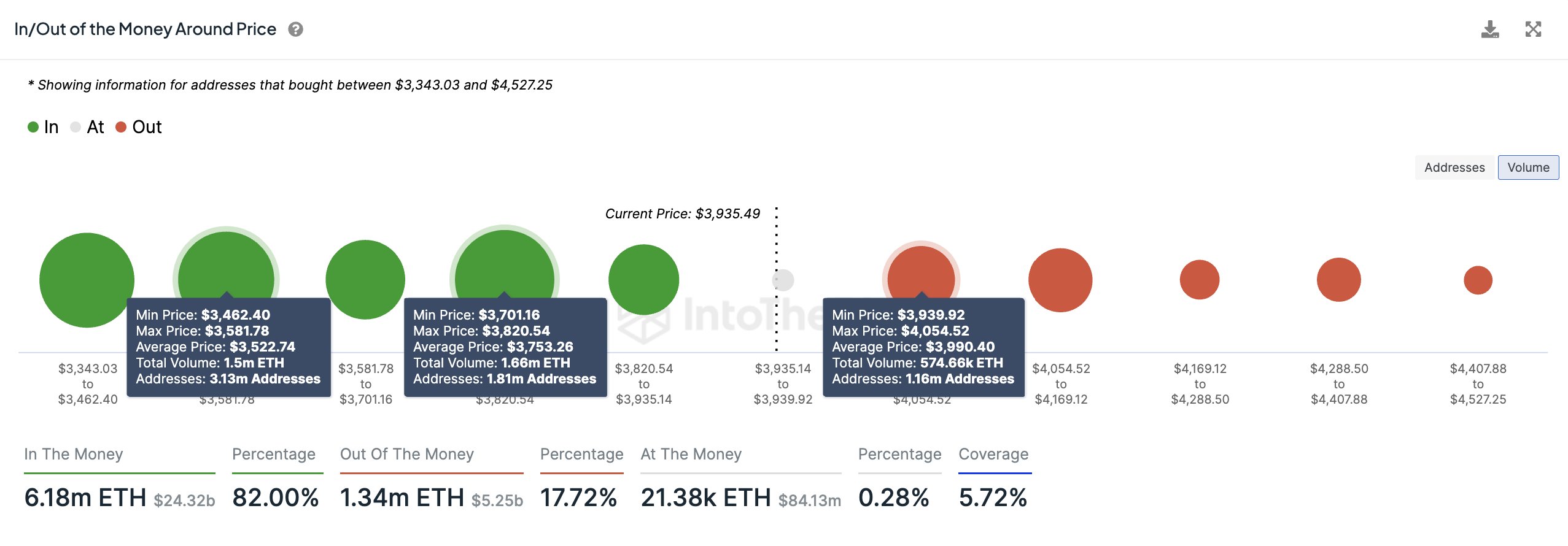

Exploring the price examination using IOMAP (Input-Output Model and Profitability) insights, Martinez reveals that Ethereum exhibits a robust purchasing area ranging from $3,820 to $3,700. Around this region, over 1.81 million wallets have acquired approximately 1.66 million Ether.

As an analyst, I would rephrase it as follows: I believe this price range could serve as a stronghold against the mounting selling pressure. However, if this level gives way, the next significant area of support can be found between $3,580 and $3,462, where approximately 3.13 million Ethereum addresses collectively hold around 1.50 million ETH.

“Looking on the positive side, Ethereum’s major resistance level lies between $3,940 and $4,054, where approximately 1.16 million wallets hold around 574,660 Ether.”

Martinez proposes that if the closing price of the daily candlestick exceeds $4,170, it could challenge the bearish perspective and possibly initiate a fresh uptrend, aiming for $5,000 as the potential next objective.

From my perspective as a researcher, at present, Ethereum’s price stands at $3,719, representing a 2.5% decrease over the last 24 hours. Nevertheless, based on the analyst’s evaluation, Ethereum continues to reside within a significant demand area.

As the eight Ethereum ETF applications from leading asset managers prepare to debut on the market and begin trading, it’s uncertain how their introduction will specifically affect Ethereum’s price trend.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-05-25 02:10