As a researcher with extensive experience in the cryptocurrency market, I find the recent price volatility of Bitcoin intriguing. The asset’s retreat from its March all-time high is a clear indication of the market’s instability, influenced by various underlying factors. However, a significant development has emerged that may offer some optimism for investors: long-term holders have been reducing their selling pressure.

Bitcoin remains the center of attention in financial circles, as its volatile price swings capture public interest. Despite repeated efforts to surpass its record-breaking March high of over $73,000, the cryptocurrency’s price has retreated and currently hovers around $68,231.

As a researcher studying the cryptocurrency market, I’ve observed that the recent pullback represents a 7.3% decline from its March high, indicating a turbulent phase for this digital asset. Several underlying market influences have contributed to this volatility.

Long-Term Holders Lessen Selling, What This Spell For BTC

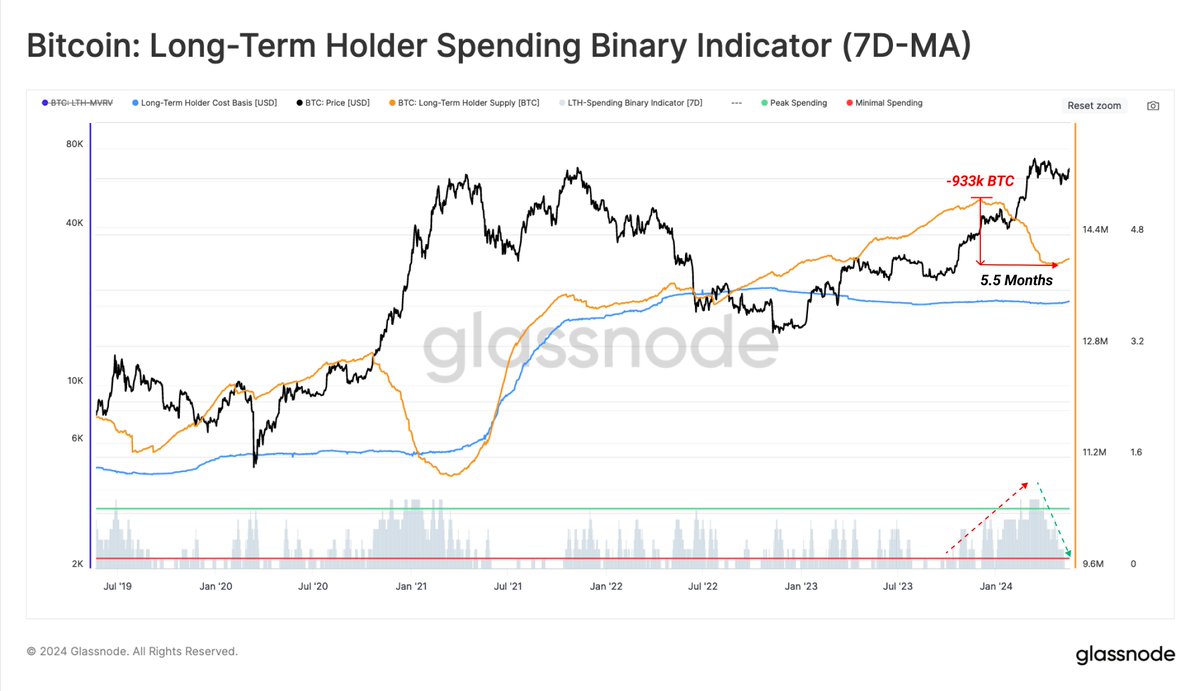

Noted market intelligence provider Glassnode reports an intriguing shift in Bitcoin’s market dynamics. Based on their latest findings, there is a discernible decrease in the selling pressure from long-term Bitcoin owners.

The “Long-Term Holder Selling Pressure Index” by Glassnode reflects the selling behavior of Bitcoin owners who have held their cryptocurrency for extended periods. According to the latest data, there has been a noticeable decrease in the number of long-term holders disposing of their Bitcoins.

In historical contexts, decreases in selling by long-term investors can lessen the impact of price declines. This reduction in selling may foster a more optimistic market environment.

Prominent cryptocurrency analyst RektCapital offers valuable perspectives on Bitcoin’s price pattern. He points out on social media platform X that following each Bitcoin halving event, Bitcoin often encounters resistance at the upper range limit. This could indicate a prolonged period of accumulation for Bitcoin before any significant price increase.

With Bitcoin currently trading at around $69,000, RektCapital reveals that a major breakout from its present consolidation phase may not occur until approximately 160 days following the last Halving event. This estimation suggests a potential significant price surge as late as September 2024. This insight is essential for investors seeking indicators of Bitcoin’s upcoming substantial price movement.

#BTC

As a researcher studying Bitcoin’s price behavior historically, I have observed that following each halving event, Bitcoin has tended to pull back from reaching new highs in the price range on the initial attempt.

Moreover, history suggests this Re-Accumulation should last much longer

Bitcoin tends to breakout from these Re-Accumulation Ranges only up to 160 days after…

— Rekt Capital (@rektcapital) May 24, 2024

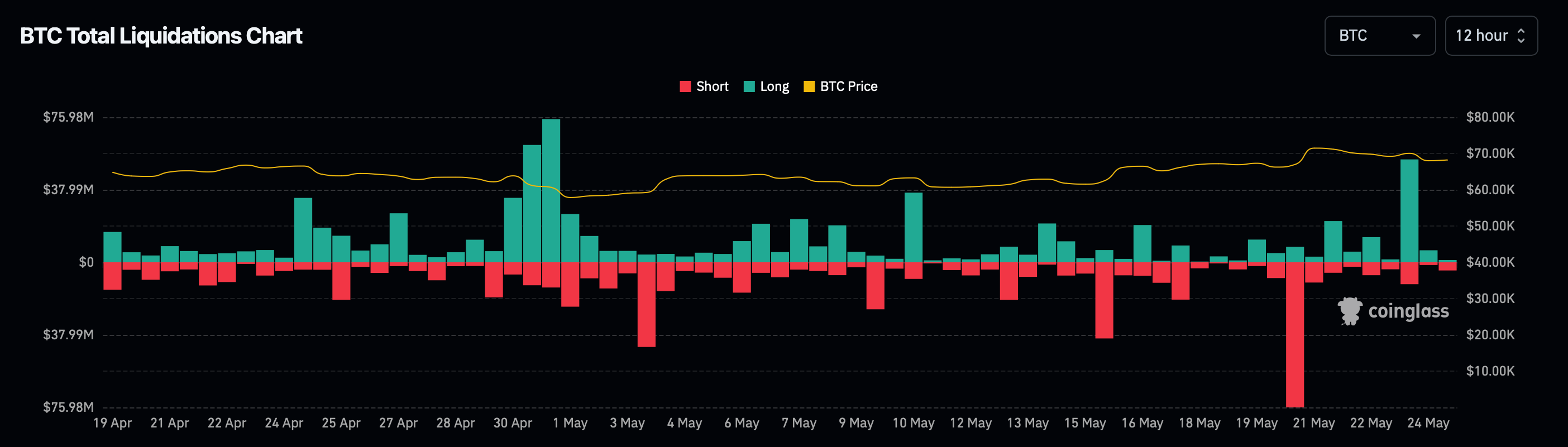

Over the last day, Bitcoin’s price fluctuations have resulted in significant losses for certain traders. According to Coinglass, long positions on Bitcoin saw approximately $41.68 million in liquidations, while short positions experienced about $14.34 million in liquidations.

During that timeframe, a total of $292.07 million worth of cryptocurrency positions were liquidated, impacting approximately 78,874 traders.

Upcoming Challenges For The Bitcoin Market

Based on Greeks.Live’s report, the upcoming expiration of a large number of Bitcoin and Ethereum options brings additional intricacy to the market’s near-term prospects. Approximately 21,000 BTC worth of options are approaching their expiration date, carrying a Put Call Ratio of 0.88 and a Maxpain point at $67,000, equating to a notional worth of $1.4 billion.

Approximately 350,000 Ethereum (ETH) options are approaching their expiration dates, which could impact the larger market given their substantial notional value of around $1.3 billion. Additionally, this significant quantity of options carries a Put Call Ratio of 0.58.

On May 24th, approximately 21,000 Bitcoin options will reach their expiration date. The put-call ratio for these options is 0.88, meaning there are more put (bearish) options than call (bullish) options. The maxpain point, which represents the price level that would cause the maximum number of options to be in-the-money, is at $67,000. The total notional value of these Bitcoin options amounts to $1.4 billion.

— Greeks.live (@GreeksLive) May 24, 2024

In the given situation, a put option grants its owner the ability to sell a particular asset for a fixed price during a defined period, acting as a safeguard against potential price drops.

In contrast, a call option grants the holder the ability to purchase an underlying asset at a specified price under certain terms, often used when expecting prices to rise. The Put Call Ratio serves as a valuable indicator of market sentiment: a larger ratio implies a pessimistic view, while a smaller ratio suggests optimism.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-05-25 03:05