If there’s one thing the denizens of cryptocurrency love more than magic beans, it’s watching large numbers waltz across charts like particularly glamorous ducks. 🦆 Lately, the entire crypto realm, led by the High Lords Bitcoin and Ethereum—and, yes, those annoying stablecoins that refuse to have any fun—have found themselves swaddled in almost $19 billion of fresh, sparkly capital. You could hear the sound of digital coins clinking all the way from Ankh-Morpork.

Markets That Go Up, Markets That Go Down, and Markets That Forget Which Way Is Which

This epic observation comes from wizard-analyst Ali Martinez, who gazed into the oracular device known as X (formerly known as Twitter, formerly known as ‘please stop posting those memes’). In true Discworld fashion, the capital flows in crypto are like any wizard’s hat: you look inside, you find all manner of things—rabbits, small cottages, and yes, lots of money. But mostly what flows in are three spell ingredients: Bitcoin, Ethereum, and stablecoins (think of them as the library books of finance—supposedly always valued, but who knows what’s written inside?).

The really clever part—the kind of thing only a wizard who’s lost their staff and found a spreadsheet could explain—is this: to figure out how much actual money people have laid on the table (apart from IOUs scribbled on a napkin), you use something called the “Realized Cap.” This is like weighing everyone’s pockets after a particularly exciting poker night, as opposed to just looking at what’s written on the chips. Very scientific. 🧐

If you’re dealing with stablecoins, however, don’t bother—their value only changes if reality breaks down completely, which, as we know, only happens on Tuesdays.

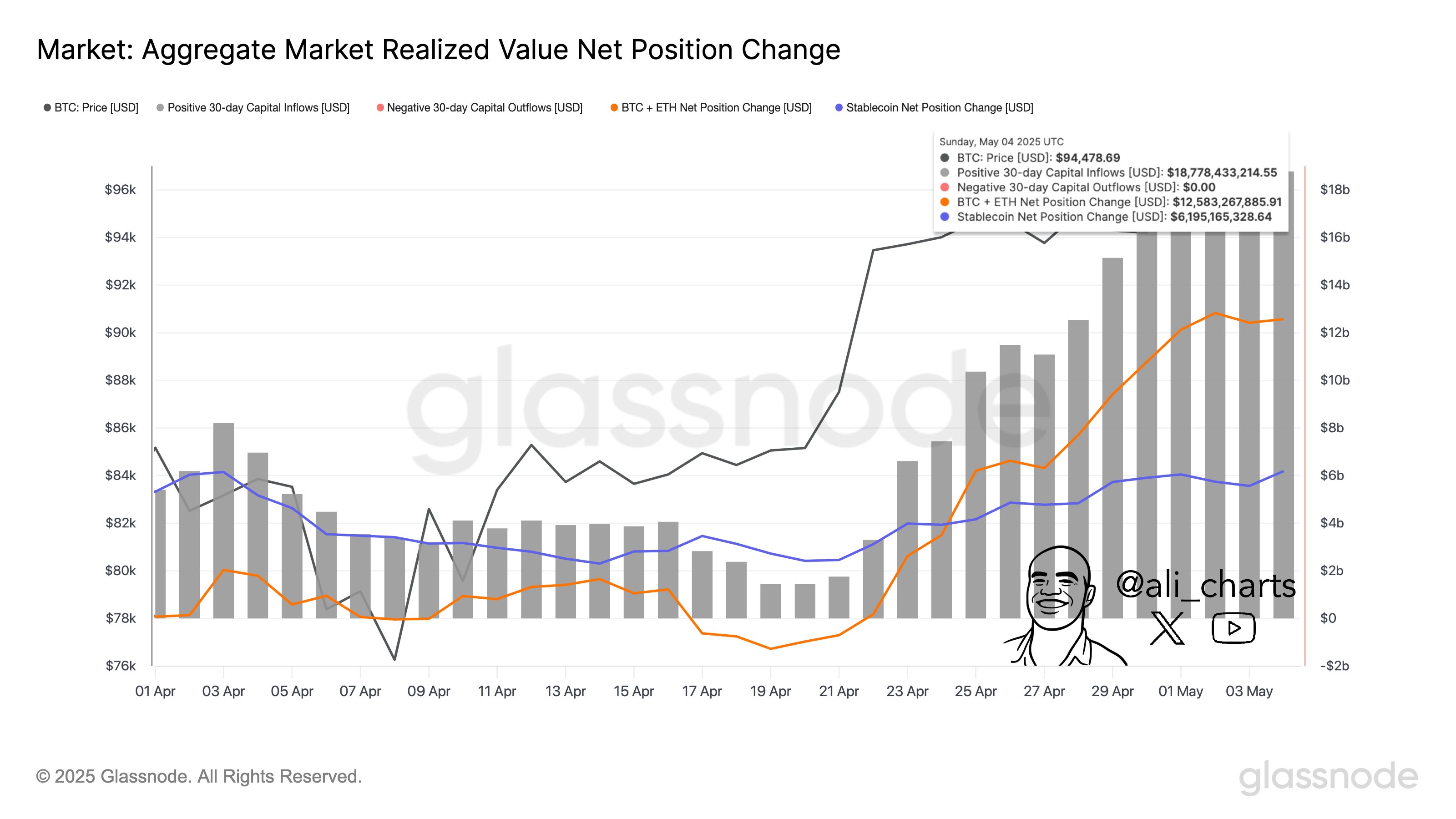

Behold! A chart, should you care to peer at it, that chronicles a month of net crypto flows. Really, it’s less a chart and more a polite reminder that fortunes are made, lost, and made again, all before breakfast:

Drink in those numbers: the accumulated net inflow for Bitcoin and Ethereum hit $12.58 billion (enough to buy a very small city, or one very fancy dragon). Stablecoins chipped in $6.19 billion, which is both impressive and, to those who remember last year’s chaos, slightly suspicious. That brings us to a grand total of $18.77 billion! (This is the point where even Moist von Lipwig would raise an eyebrow.)

All this happens while prices bounce back, aided and abetted by optimism, greed, or the ineffable mean streak of Lady Luck. As any seasoned Ankh-Morporkian gambler would say, “Let’s see how long that lasts before someone shouts ‘Bubble!’ and jumps out of a window.”

Naturally, nothing is certain in the world of cryptocurrency. Sentiment has the half-life of a goblin’s honesty, and fortunes change as quickly as the weather or the Patrician’s policies. We’ll just have to see what happens next—preferably with popcorn in hand. 🍿

Bitcoin Price: Now With Twice The Drama

At the time of writing, Bitcoin can be acquired for the low, low price of $94,200 per unit—down 1% on the week, up who-knows-what since the last time you checked, and just expensive enough to explain why your neighbor bought a new horse. (He claims it’s for “hedging”—but everyone knows it’ll end up in the Discworld Derby.)

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2025-05-06 03:43