As an experienced crypto investor with a keen eye for market trends and regulatory changes, I have observed the recent surge in XRP prices with great interest. The rally from $0.4957 to $0.7407 is impressive indeed, and I’ve learned over the years that such rapid increases often attract both excitement and caution.

For the past nine days, XRP has experienced a substantial increase, moving up from $0.4957 on November 4 to a high of $0.7407 on Binance today – that’s a jump of over 50% at one point. Around 30% of this rise happened in just the last 48 hours. However, after this swift climb, XRP underwent a sharp decline, dropping by -12% to $0.65 as we speak. Here are the main factors contributing to this rally:

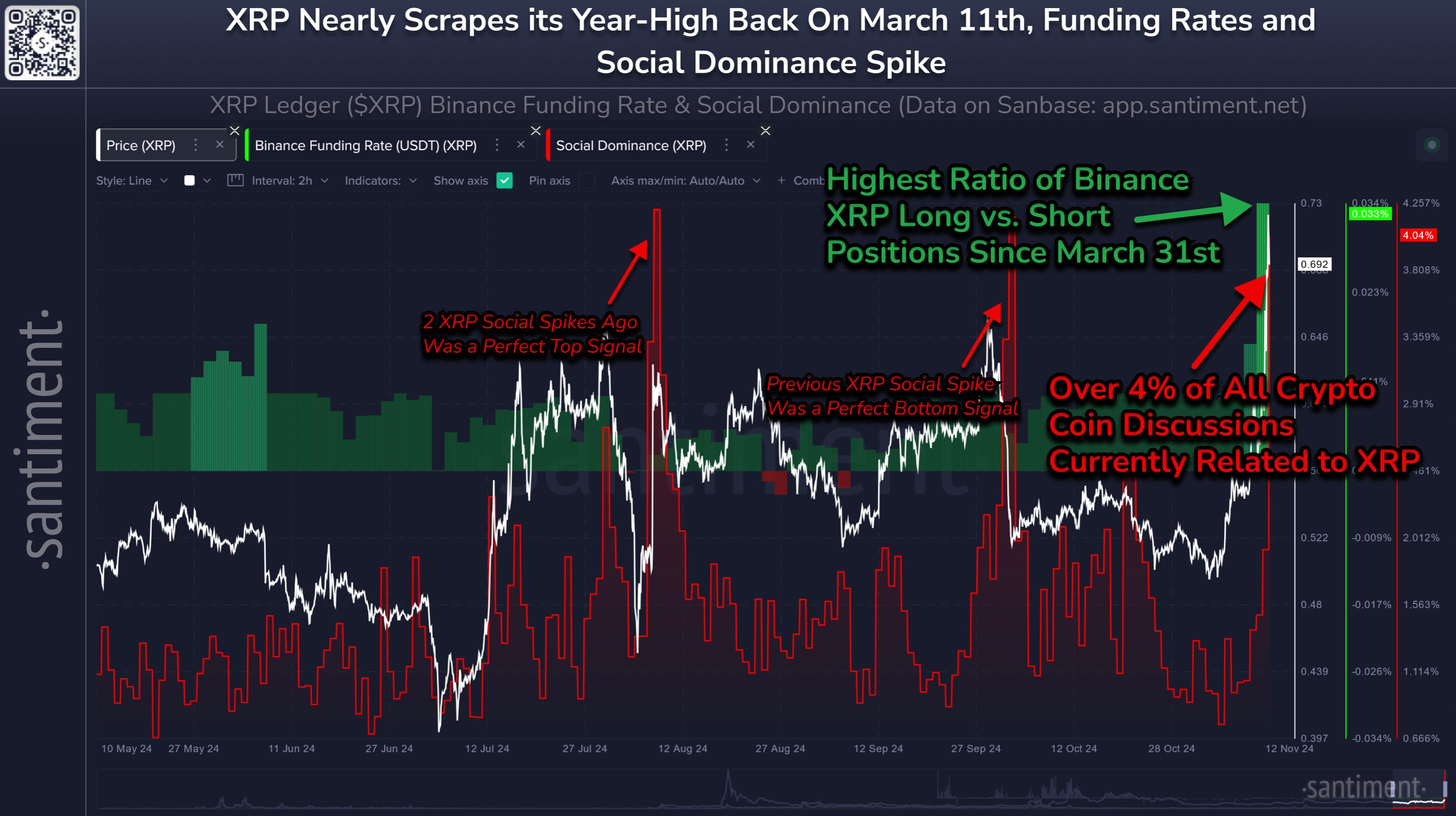

#1 XRP Funding Rates and Social Dominance Spike

It seems that one major factor fueling the increase in XRP’s price is a surge in social media chatter and changes in funding rates. According to on-chain analysis firm Santiment, there has been a significant increase in discussions about XRP within the crypto community, making it the focus of approximately 4% of all coin conversations following its impressive 45% rise over an eight-day period.

The company highlighted that for XRP to exceed its peak from March, which was $0.74, it’s crucial that the fear of missing out (FOMO) remains minimal, and the funding rates on major trading platforms such as Binance don’t become excessively burdened by long positions.

According to Santiment’s assessment, the number of long (buy) positions for XRP on Binance compared to short (sell) positions is at its peak level since March 31, suggesting a very optimistic outlook among traders about the token.

Additionally, they noted that similar peaks in social influence, like those in early August, functioned effectively as warning signs, implying that the present rise in social conversations might forecast an upcoming market adjustment. On the other hand, Santiment also highlighted that the previous social peak signaled a turning point for the market bottom.

#2 Gensler Resignation This Week?

Discussions regarding possible shifts in regulations are also impacting the market behavior of XRP, particularly under President Trump’s administration. Notably, pro-cryptocurrency attorney James “MetaLawMan” Murphy has presented a thought-provoking sequence of events via X, suggesting similarities between U.S. presidential elections and the departures of SEC chairs.

After the elections in 2016 and 2020, Mary Jo White and Jay Clayton, who were both SEC chairs at the time, stepped down shortly following the election results. Murphy speculates that if the 2024 election occurs, there might be anticipation for current SEC Chair Gary Gensler to do the same, as he posted on social media, “Gary Gensler, we’re on standby.

Time to say Goodbye Gary!

Nov. 8, 2016: Trump elected

Nov. 14, 2016: Mary Jo White (SEC Chair) announces her resignationNov. 3, 2020: Biden elected

Nov. 16, 2020: Jay Clayton announces resignationNov. 5, 2024: Trump elected

Nov. __, 2024: Hey @GaryGensler, we’re waiting— MetaLawMan (@MetaLawMan) November 12, 2024

As a researcher, I find it noteworthy that this speculation holds relevance for the XRP community due to the ongoing legal dispute between Ripple and the Securities and Exchange Commission (SEC). The incoming President, Donald Trump, has publicly expressed his intention to replace Gensler as SEC chairman on his inauguration day. He made this statement at the Bitcoin 2024 conference, emphasizing the need for a more pro-crypto leader to head the SEC.

Brad Garlinghouse, CEO of Ripple, has expressed robust backing for this possible shift, advocating for Trump to nominate candidates more favorable towards the crypto sector, such as Chris Giancarlo, Brian Brooks, or Dan Gallagher. He emphasized the importance of regulatory certainty, particularly in relation to digital assets like Ethereum and XRP.

Among some Ripple backers, there’s talk that Gensler’s departure might result in a more advantageous situation for Ripple, potentially by the SEC abandoning their appeal in the ongoing case. The market appears to be responding to this speculation, as investors may be attempting to get ahead of the news by buying up Ripple, hoping for a resolution or regulatory change.

At press time, XRP traded at $0.65.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-11-13 15:42