As a seasoned researcher with extensive experience in the cryptocurrency market, I have witnessed numerous price surges and corrections throughout my career. The recent XRP rally, fueled by increased trading volume in South Korea and positive developments such as the launch of XRP indices and CEO Garlinghouse’s comments on the SEC lawsuit, is a familiar pattern I’ve seen play out multiple times.

As a seasoned cryptocurrency analyst with over a decade of experience in the industry, I’ve witnessed numerous market fluctuations and trends. Lately, I’ve been closely monitoring the digital asset scene, keeping an eye on key players and indicators. This week, I was intrigued by the surge in XRP trading volume on South Korean exchanges, which overshadowed Bitcoin (BTC) for the first time in a while.

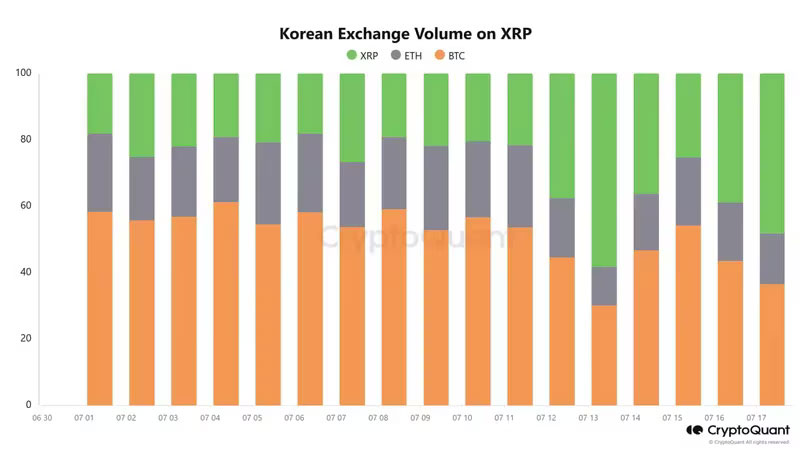

As a crypto investor closely monitoring market trends, I’ve noticed an intriguing development based on data from CoinGecko. South Korean trading activity has seen a significant shift, with XRP making up a substantial portion of the volume on leading exchanges UpBit, Bithumb, and Korbit. Specifically, XRP accounted for approximately 40% of trading volume on UpBit and over 35% on both Bithumb and Korbit earlier this week. This shift surpasses that of Bitcoin and Tether (USDT), suggesting a surge in short-term demand for XRP within the Korean market.

Beyond South Korea, the trend expanded, marked by heightened trading activity on international exchanges such as Binance and OKX. Nevertheless, XRP failed to overtake Bitcoin and Ethereum (ETH) in terms of global trading volume dominance. Prior in the week, open interest for XRP futures contracts more than doubled, indicative of optimistic positions among dealers.

XRP Rally Fizzles after SEC Lawsuit Hype

By the end of last week, the market had returned to its regular state. In South Korea, Bitcoin once again held the largest share of the cryptocurrency trading volume. However, Bitcoin experienced a 0.85% loss, while XRP saw a significant drop of 4.70%. Renowned for their impact on specific tokens, traders in South Korea are infamous for igniting frenzied buying sprees that can temporarily boost token prices and potentially affect global market trends.

Photo: CryptoQuant

According to Bradley Park, an analyst at CryptoQuant specializing in Web3, the continuous attention from local media and social media influencers seems to be fueling the surge in trading volume for XRP. This heightened interest can be linked to the latest developments regarding the Securities and Exchange Commission (SEC). In simpler terms, Bradley’s observation suggests that recent news about the SEC is sparking increased trading activity around XRP.

Last week, significant developments in the world of futures trading led to XRP‘s price surge. The announcements from CME and CF Benchmarks about launching new XRP indices and reference rates were key contributors. Additionally, Ripple Labs CEO Brad Garlinghouse’s optimistic outlook on Bloomberg TV regarding the ongoing SEC legal battle instilled confidence in investors, likely amplifying the market momentum for XRP.

As a researcher studying the cryptocurrency market, I’ve come across some comments that may have bolstered investors’ confidence in XRP. These remarks were penned by Ryan Lee, the chief analyst at Bitget crypto exchange. However, it is important to note his warning against a prolonged rally. He anticipates a possible technical correction around early August.

Lee pointed out that the increase in XRP‘s price may lead to a reversal, potentially resulting in a decrease around early August. Nevertheless, should the price remain above significant support points, approximately $0.70, it might continue ascending at a later stage.

A Wait-and-See Approach

The significant increase in XRP trading activity, notably in South Korea, underscores the token’s capacity for short-term price fluctuations. Positive news such as the introduction of XRP indices and upbeat statements from CEO Garlinghouse have ignited enthusiasm, but the market downturn serves as a reminder that more confirmation is required from the market.

Given that the SEC lawsuit continues to cast uncertainty over XRP and market conditions remain unpredictable, it would be wise for potential investors to exercise patience and observe how events unfold before making a decision. The token’s long-term success will hinge on the outcome of the legal dispute as well as its ability to secure widespread adoption and integration within the financial industry.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-07-19 18:55