As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull runs and market corrections. The recent price action of XRP has caught my attention, particularly due to its alignment with crucial Fibonacci levels. The current trading range between $2.13 and $2.92 is a battlefield for bulls and bears alike, and the next few days could be pivotal in determining the market’s direction.

Analysis shows that the XRP price has formed corrective phases following its recent downturn starting from December 3. At present, the digital currency is hovering around significant Fibonacci levels which might prolong the correction period. Notably, influential crypto analyst Dark Defender pointed out the $2.13 and $2.92 as critical price points for XRP on social media platform X.

XRP Tests Fibonacci Levels Amid Market Correction

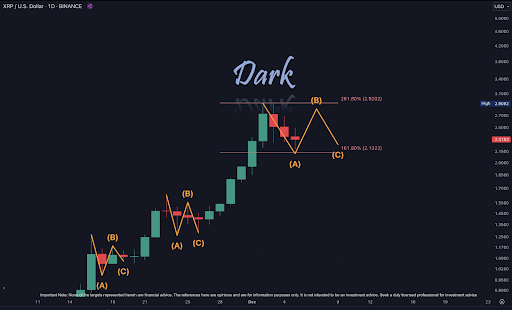

Based on a chart shared by crypto analyst Dark Defender on social media platform X, it’s clear that the surge in XRP’s value earlier this month reached approximately $2.92 on Binance, coinciding with the 261.80% Fibonacci extension level. Unfortunately, this significant peak didn’t last as the token experienced a correction, lowering its price to a support at around $2.17. Interestingly, this support level is also near the 161.80% Fibonacci extension level at $2.13, making it an important factor for XRP’s future pricing.

Keeping these figures in focus, Dark Defender highlights that $2.92 and $2.17 are currently crucial price points to keep an eye on. The bounce back from $2.17 implies that the downtrend could be nearing its end, possibly indicating a shift towards Wave B within the daily time frame according to his assessment.

What To Expect During Wave B

As an analyst, I’ve observed that the price movement of XRP during its rally follows a three-wave corrective pattern, specifically Wave B analysis. This pattern is divided into three key phases: Waves A, B, and C. In this structure, Waves A and C represent descending trends, while Wave B indicates an uptrend. If this pattern repeats, the XRP price might surge to approximately $2.92, which aligns with the 261.80% Fibonacci extension level. Subsequently, a potential downtrend could lead it back to retest support at $2.13, which coincides with the 161.80% Fibonacci extension level.

According to Dark Defender’s observation, it seems like we might need a couple of days to remove this structure. Consequently, the XRP price may persist in trading within these boundaries until a clear trend, whether upward or downward, becomes apparent.

Currently, market indicators point towards an uptrend, potentially pushing the value of XRP to reach new peak prices not seen for years. As we speak, the XRP price stands at $2.37, marking a 2.9% rise over the last day.

A significant factor behind this optimism is the appointment of Paul Atkins by President-elect Donald Trump as the head of the SEC. Known for his favorable views on cryptocurrencies, Atkins’ potential leadership could signal an end to the prolonged legal dispute between the SEC and Ripple. This resolution might attract substantial investments from institutions and retail investors into the XRP market.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-12-06 17:10