As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I find Egrag’s analysis particularly insightful and intriguing. His focus on historical data and technical indicators resonates deeply with my own approach to understanding market trends.

Cryptocurrency expert Egrag has delved into past trends of XRP‘s weekly price movements, implying that this digital currency may be venturing into areas never seen before, based on his analysis using historical data and key technical markers.

Egrag highlights significant shifts in XRP’s trading behavior, emphasizing the exhaustion felt by the XRP community during this prolonged cycle. “This cycle has been extremely exhausting and super manipulative, especially when it comes to XRP. But don’t lose hope!” he states.

Why XRP Is In Uncharted Territory

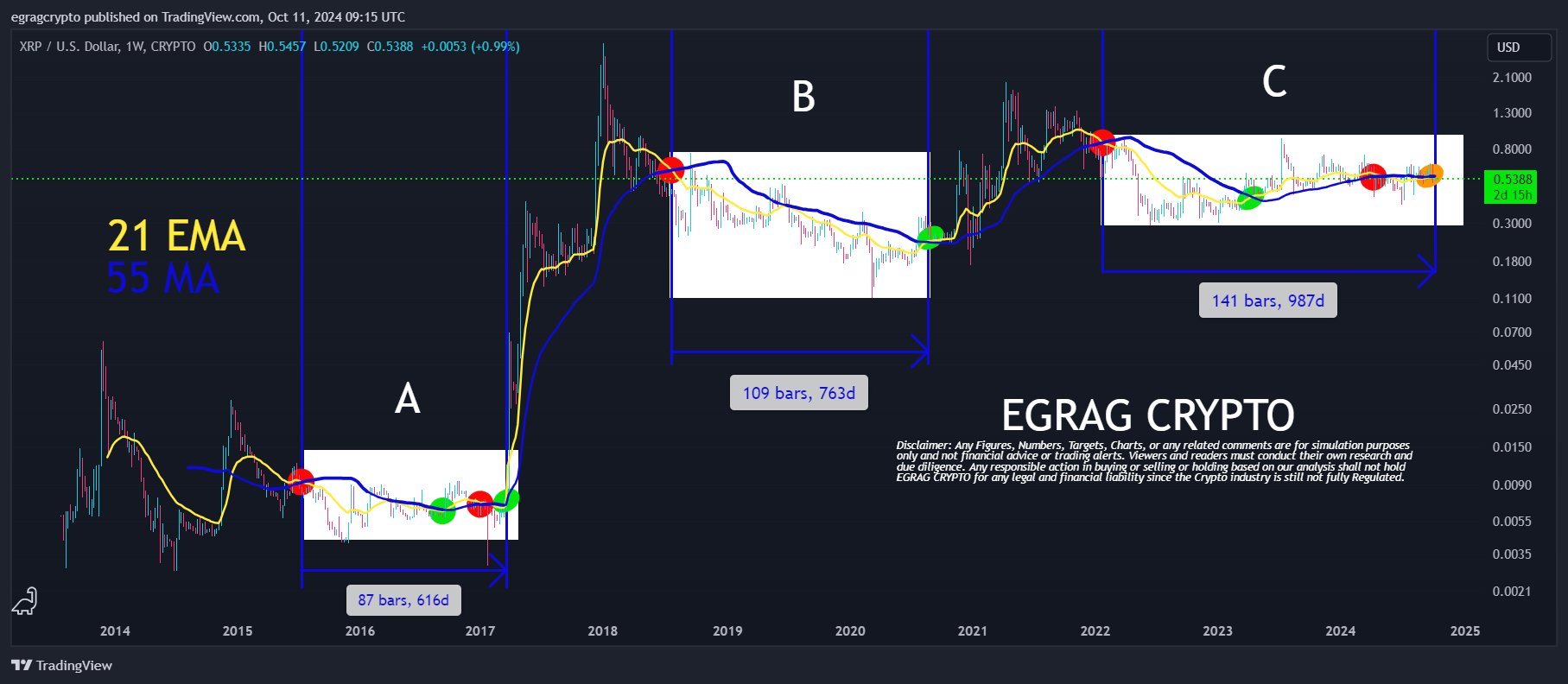

At the heart of Egrag’s study are two essential markers, each displayed on a weekly chart: the 21-week Exponential Moving Average (EMA) and the 55-week Simple Moving Average (MA). These indicators are well-known for their sensitivity to price fluctuations and have proven useful in the past for predicting shifts in XRP‘s market momentum. The way these moving averages interact, especially when they intersect, is crucial for predicting possible bullish or bearish tendencies.

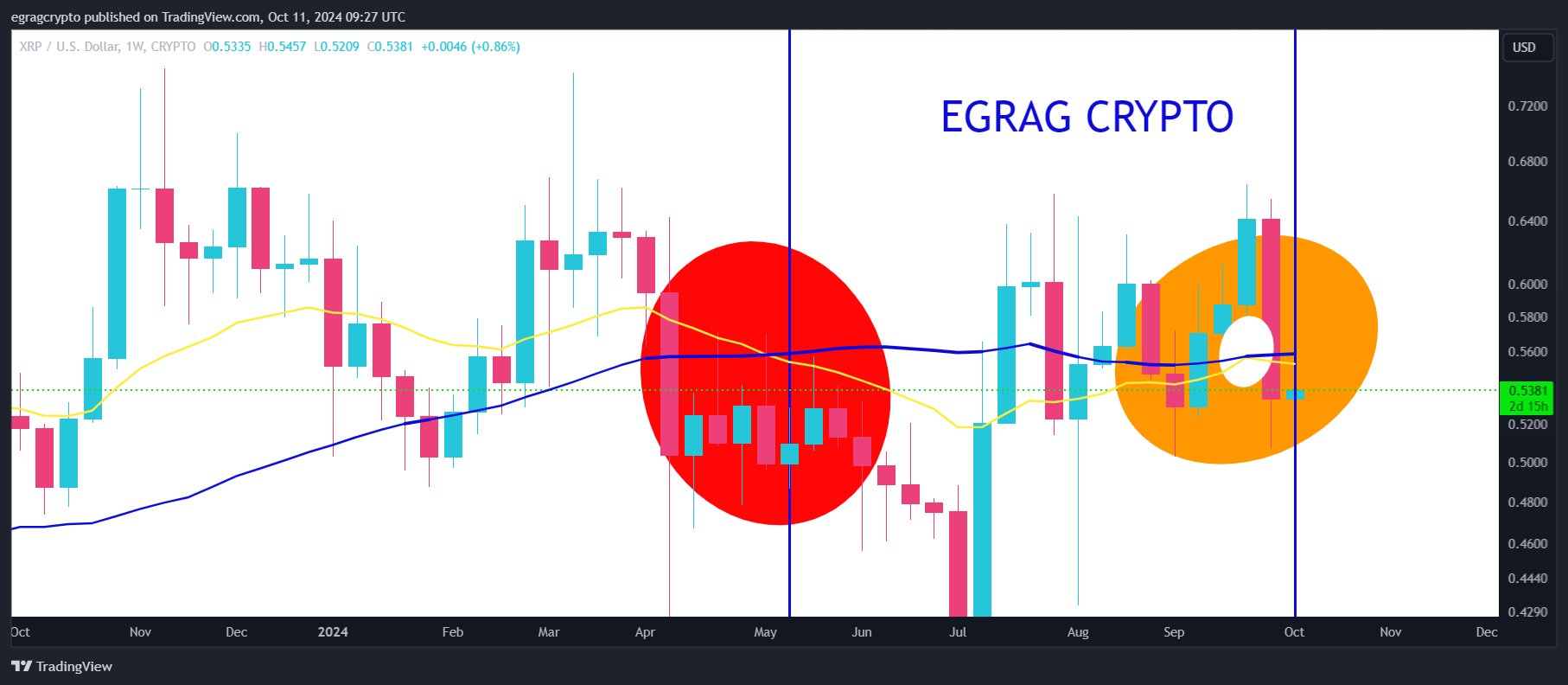

Egrag identifies three types of crosses in his analysis, each signaling different market sentiments. A bearish cross, marked by a red circle on his chart, occurs when the 21-week EMA crosses below the 55-week MA, indicating potential downward momentum. A bullish cross, denoted by a green circle, happens when the 21-week EMA crosses above the 55-week MA, signaling possible upward movement. An indecisive cross, represented by an orange circle, marks periods where the moving averages converge but do not decisively cross, reflecting uncertainty or possible market manipulation.

As I delved into my analysis during Cycle A, XRP displayed a bearish trend initially, then switched to a bullish one twice. These shifts in direction carried substantial weight on its price trend. The timeframe between the initial bearish cross and the first bullish cross stretched roughly over 616 days, within which the market’s mood gradually transformed. Around halfway through this cycle, another bearish cross emerged about 140 days following the first bullish crossover. This was followed by a second bullish cross that occurred 49 days later. This second bullish cross ignited an impressive price surge, as noted by Egrag, “We witnessed a bearish trend initially, followed by two bullish trends—one in the middle of the cycle and the second one proved to be quite explosive!

According to Egrag’s analysis, during cycle B, there was a close call for an early bullish trend in XRP. However, this was thwarted by a substantial price drop, which halted the moving averages from crossing as they would have normally. This happened midway through the cycle.

At present, during Cycle C, XRP‘s performance deviates significantly from its past cycles, particularly in terms of duration and intricacy. The timeframe between the initial bearish cross and the first bullish cross was around 441 days, longer than previous cycles. Following this, there was a phase lasting about 399 days that led to another bearish cross. As such, Cycle C has extended over approximately 987 days from the initial bearish cross, making it the longest cycle since XRP first began.

Currently, the 21-week Exponential Moving Average (EMA) and the 55-week Moving Average (MA) are getting closer to each other but haven’t definitively intersected yet. A circle marked in orange signifies an undecided intersection. Egrag seems upset about this situation, commenting, “At the moment, both indicators (21 EMA and 55 MA) are hovering around the orange dot—right on the brink of a potentially manipulated bullish cross that we barely missed. This is blatant manipulation in my opinion!

According to Egrag’s findings, the length and departure from standard patterns in Cycle C make XRP a unique situation. In other words, since the market has never seen anything like this before, it could lead to an unexpected outcome. To put it another way, after examining all the data, he believes that Cycle C is unlike Cycles A & B because of its duration and number of crosses. As we’re in unfamiliar waters, we might be in for a surprise with the results this time around.

Nevertheless, Egrag maintains a positive outlook towards the future. He foresees the emergence of a ‘utility phase’ for XRP, where the emphasis transitions from speculative trading to real-world uses of the cryptocurrency. “In my hopeful perspective, I anticipate this could be the time when the utility phase begins, enabling us to employ our XRP rather than selling it!” he asserts.

At press time, XRP traded at $0.53.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-10-11 18:04