As a seasoned crypto investor with over a decade of experience in this volatile market, I’ve seen my fair share of bull runs and bear markets. The recent surge in XRP price was indeed exciting, but the current correction is not unexpected. With Bitcoin extending its market dominance, it’s only natural for altcoins like XRP to face selling pressure.

After reaching a high of $2.75 in a recent rally, the XRP price is currently experiencing some selling pressure and may potentially drop further if the dominance of the Bitcoin market increases. Since its peak on December 3rd, XRP has already declined by 18% and is currently trading at $2.28, with a market cap of approximately $130.42 billion. Additionally, the daily trading volume has decreased from $15.07 billion to around $13.75 billion.

Conversely, Bitcoin’s price, currently standing at $98,407 with a 24-hour volatility of 4.3%, has surged towards an estimated $104K this week, boosting its control over the crypto market. At present, Bitcoin holds approximately 55% dominance in the $3.5 trillion cryptocurrency market, and some market analysts forecast that this could potentially reach as high as 60-70%.

Following that point, the shift towards altcoins, often referred to as an ‘altseason’, would commence. This transition might prove tough for high-performing altcoins such as XRP, as pointed out by Pav Hundal, the chief analyst at crypto exchange Swyftx.

“Currently, a major risk for XRP investors who have borrowed heavily lies in the possibility that Bitcoin’s dominance rises once more. If there’s a shift from XRP to Bitcoin, it could trigger a wave of forced liquidations, leading to heavy losses. In recent times, we’ve noticed rapid retail buying activity, and the open interest is now almost twice as high as it was in 2021.

Over the past day, the price of XRP has experienced a significant decrease of approximately 5.32%, causing open interest to drop by around 6% to a level of $3.51 billion. Moreover, data from CoinGlass shows a substantial increase in long liquidations for XRP, amounting to about $32 million. According to Hundal’s statements:

“It’s starting to look like the market could be approaching euphoria territory.”

How Long Will XRP Price Correct before Bouncing Back?

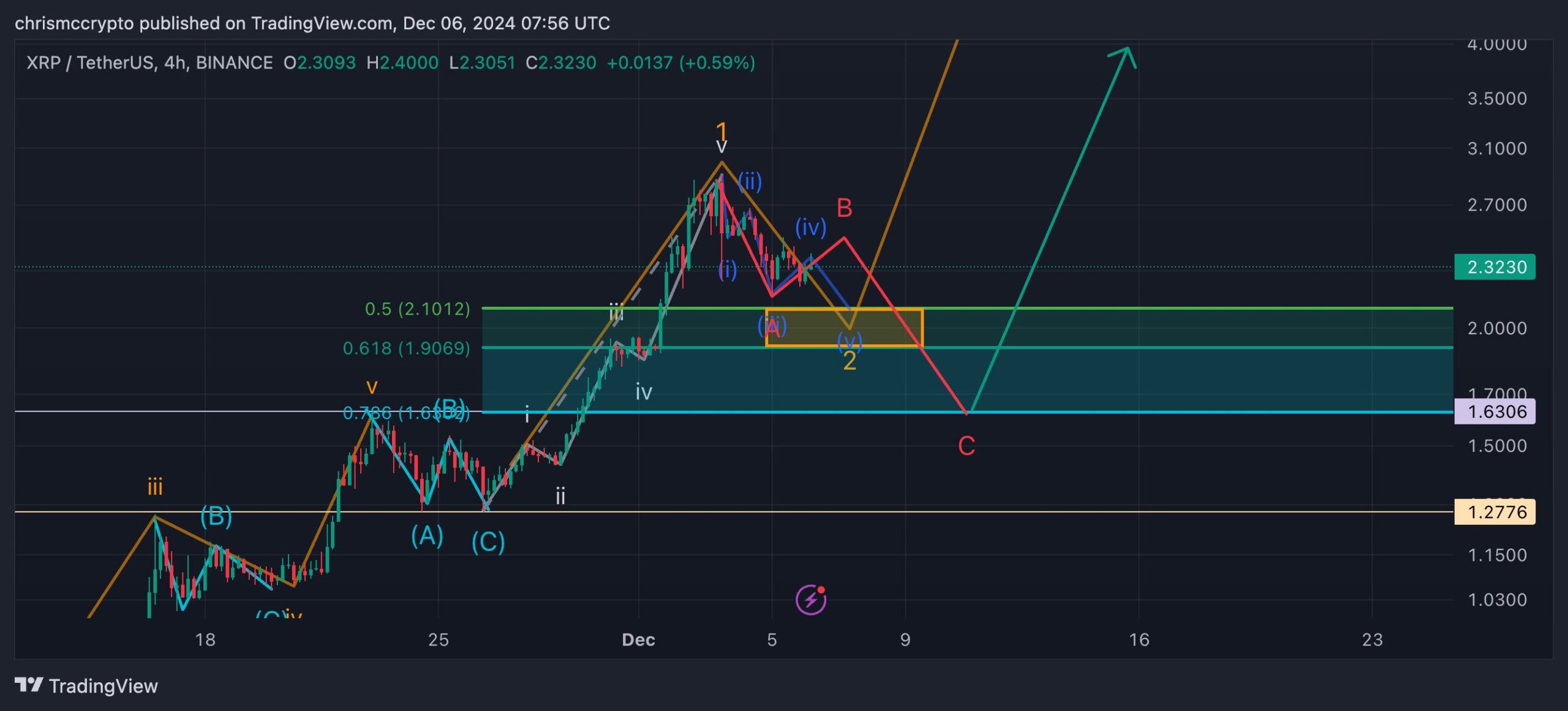

According to crypto experts, there are two potential correction wave patterns that could unfold for XRP. These theories stem from significant Fibonacci retracement levels and might determine the direction of its price fluctuations ahead. By keeping tabs on these scenarios, traders can identify crucial support zones that could be vital for their trading strategies, as suggested by Chris McCrypto.

- Shallow Correction: Analysts predict a potential bottom between $1.90 and $2.10, corresponding to the golden ratio of the Fibonacci retracement (0.5–0.618). Notably, the $1.90 mark aligns with significant support from subwaves 3 and 4 of Wave 1, reinforcing its potential as a key price floor.

- Deeper Correction: A more pronounced dip could see XRP reach $1.63, aligning with the 0.786 Fibonacci retracement level. This deeper correction aligns with a larger A-B-C wave pattern within subwave 2 of Wave 3. The $1.63 level also matches the previous high of subwave 5 from Wave 1, making it a critical support zone.

Courtesy: Chris McCrypto

In contrast, the potential adjustment for XRP might not be as significant if Bitcoin holds steady. Currently, Bitcoin’s price is experiencing a 4.7% decline, dropping below the $100K mark to $98,000. At present, Bitcoin is finding equilibrium after a dip to $93,000 earlier today.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-06 15:24