As a seasoned analyst with over two decades of experience in the volatile and ever-evolving world of cryptocurrencies, I have seen my fair share of market fluctuations that would make even the most stalwart investor’s head spin. The recent XRP price action is no exception to this rule.

Over the past eight weeks or so, the fluctuations in XRP’s price have been quite significant, with trading activity reminiscent of levels not seen since more than six years ago. Following Donald Trump’s re-election as U.S. President on November 5, 2024, there was a substantial increase in XRP’s value, soaring over 400%. This peak was reached on crypto exchange Binance on December 3 at a price of $2.90.

Nevertheless, the value of XRP has seen a drop over the last seven days. It’s worth noting that this decline in XRP’s price appears to be following an ABC correction pattern, according to technical analysis, which predicts further declines before another upward trend ensues.

XRP Price Exhibiting ABC Correction

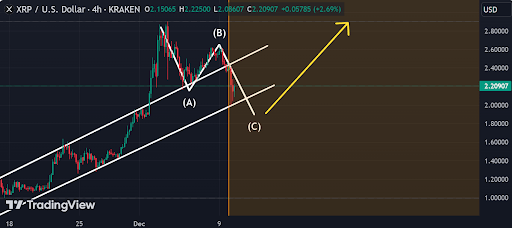

The drop in XRP’s price from the $2.9 peak appears to be following an ABC pattern, which seems close to wrapping up. This pattern is characterized by two decreasing trends (A and C) and a smaller increasing trend (B) in between them.

As I scrutinize the XRP/USD price chart on a 4-hour candlestick timeframe, it’s evident that a significant downtrend, labeled as wave A, started after the XRP price was repelled at the resistance around $2.9 on December 3 and plummeted until it hit a low of approximately $2.16 on December 5. This downward trend represents a substantial 25% drop over a span of two days. Following this decline, there was a brief uptrend, wave B, suggesting the bulls were still active. Wave B peaked at a lower high of $2.65 on December 9, translating to another 22% increase in just four days.

Over the past 24 hours, the XRP price has resumed its downward trend, hinting at the continuation of a corrective wave C. If this pattern repeats as it did with wave A, we might expect the XRP price to drop by around 25% from its current value of $2.65, potentially reaching a bottom just shy of $2. Before another surge, this could be reasonable given that the $2 price mark is psychologically significant and the bulls are likely trying to avoid a dip below it.

Bullish Impulse Suggests Next Move To $2.8 And Beyond

Currently, as I’m typing, the XRP price stands at approximately $2.19 and has decreased nearly 10% over the past day. The ongoing wave C, representing the final phase of the ABC corrective sequence, might keep falling until it encounters resistance around $2. Various technical indicators suggest this trend, with the Relative Strength Index (RSI) being a key one supporting this perspective.

For the first time since November 10, the Relative Strength Index (RSI) has dropped below its overbought zone. This indicates a slowdown in the bullish energy that drove XRP to its peak prices, allowing the anticipated corrective phase (wave C) to unfold.

Regardless of this dip, the market trends indicate that a surge from the $2 point could be quite plausible. Such an uptick might signal the start of a fresh bullish trend and potentially push the XRP price up to around $2.80 and possibly even further. This prediction aligns with the overall positive sentiment towards XRP, as investors remain hopeful about regulatory clarity following the change in the US presidential administration in January 2025.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-12-10 18:40