As a seasoned researcher with over a decade of experience in the crypto market, I must admit that the recent price action of XRP has caught my attention. While Bitcoin and Ethereum have been dipping, XRP has managed to buck the trend, showcasing a resilience that’s intriguing.

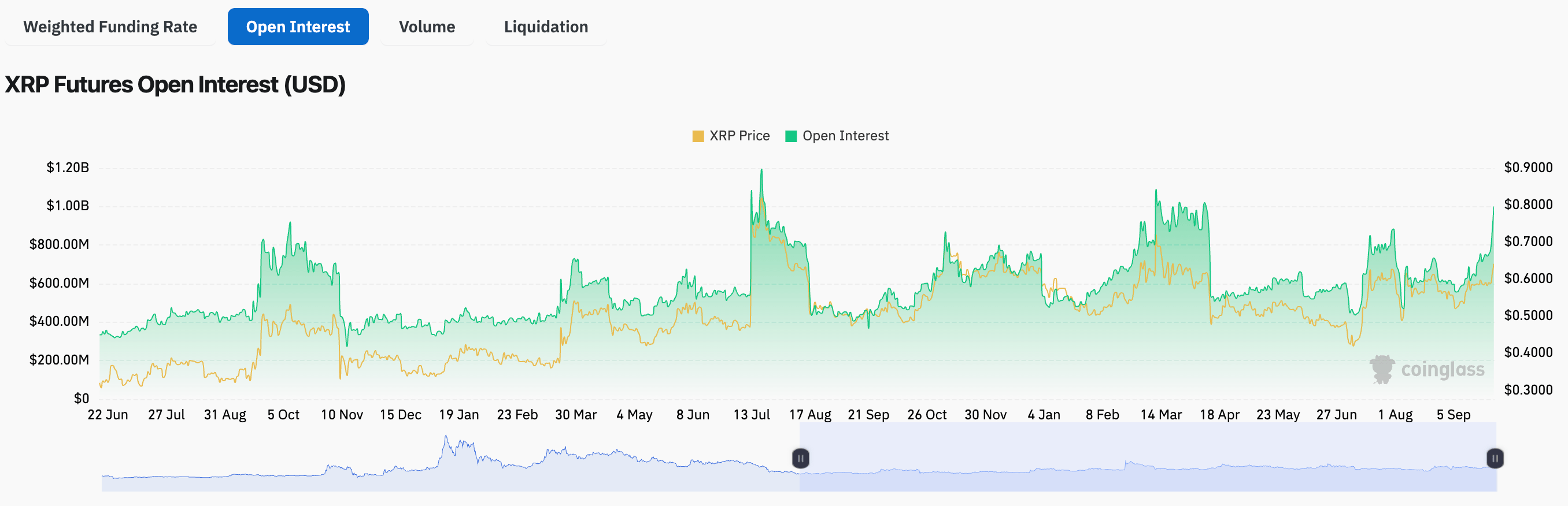

Over the weekend, the value of Ripple‘s XRP token accumulated almost a billion dollars in outstanding contracts (open interest), as its current price remains approximately $0.61, according to information from CoinGlass.

What’s Different About XRP Price Action?

Over the last seven days, Bitcoin (BTC) and Ethereum (ETH) have seen decreases of 1.5% and 2.3% respectively. On the other hand, Ripple’s XRP has bucked this trend, posting a gain of 4.1%. There are several potential reasons behind XRP’s price movement in the opposite direction.

Example: Not too long ago, Grayscale Investments, a company specializing in managing digital assets, introduced an XRP-focused investment trust in the United States. This move allows large financial institutions to invest in XRP, one of the top ten cryptocurrencies by market capitalization.

Grayscale’s Trust surged by more than 11% within a week, hinting at strong institutional demand for the seventh largest crypto-asset.

The launch of the Trust has also fuelled speculations about the potential approval of an XRP exchange-traded fund (ETF) shortly. If the US Securities and Exchange Commission (SEC) approves an XRP-based ETF, it would become only the third digital asset with its own ETF.

A significant advancement within the Ripple system is the upcoming release of a stablecoin tied to the US dollar, named RLUSD. At present, cryptocurrency experts from platform X are keeping a close eye on this stablecoin as it undergoes private testing on both the XRP and Ethereum blockchain networks.

As per the latest report, an amount of 480,000 units of RLUSD was created at the RLUSD Treasury, suggesting that the development of this stablecoin is actively progressing before it gets integrated into Ripple’s offerings, including its cross-border payment solutions. Additionally, this stablecoin can be utilized within various decentralized finance (DeFi) systems across different blockchain networks.

Implications Of Rising Open Interest

According to CoinGlass data, the open interest in XRP increased significantly over the weekend, reaching approximately $1.006 billion. However, as of the current reporting, it has dropped to around $945 million. Within the last day, the spot trading volume for XRP is slightly above $2 billion.

An increase in open interest often points to heightened market action, as it means more contracts are being initiated. This could imply that traders anticipate a price shift, either upward or downward, based on the current market atmosphere. Interestingly, the open interest for XRP recently reached approximately $1 billion in March 2024.

Regarding price predictions, there’s a split among crypto experts about XRP. The recent court win by Ripple Labs against the SEC has sparked optimism among investors, with one analyst suggesting that if the token manages to break through significant resistance points, it could potentially soar to a range of $16 to $20.

Simultaneously, another cryptocurrency expert, Carl Runfelt, pointed out a long-term bullish triangle formation in the token’s price graph. He mentioned that should XRP surpass this pattern and experience an exponential growth spike, it could potentially increase by over 200% within just a few weeks.

Contrary to expectations, if XRP fails to surpass the $0.60 resistance mark convincingly, there’s a possibility it may drop back towards the $0.55 support level instead. Presently, XRP is trading at $0.61, experiencing a 1.6% decrease over the past day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-02 08:46