As a seasoned researcher with over two decades of market analysis under my belt, I find Bobby A’s (@Bobby_1111888) analysis on XRP particularly intriguing. His ability to discern long-term trends from short-term market reactions is commendable, as it’s a skill that not many possess in this fast-paced crypto world.

In a recent analysis on X crypto platform, analyst Bobby A (@Bobby_1111888) expresses optimism about XRP‘s future price increase, even as the US Securities and Exchange Commission decides to challenge the court ruling in its lawsuit against Ripple Labs. Despite the ongoing regulatory uncertainty, Bobby’s examination of the broader market trends indicates a positive perspective for XRP, going against the possible negative influence that the SEC’s recent legal action might have on the sentiment of bearish investors.

Bobby compares the swift market responses often seen following high-profile legal announcements with the long-term patterns noticed in asset values. He reminds us that despite the SEC lawsuit in 2020, the value of the asset increased significantly from $0.11 to $1.95.

XRP Monthly Charts Still Look Bullish

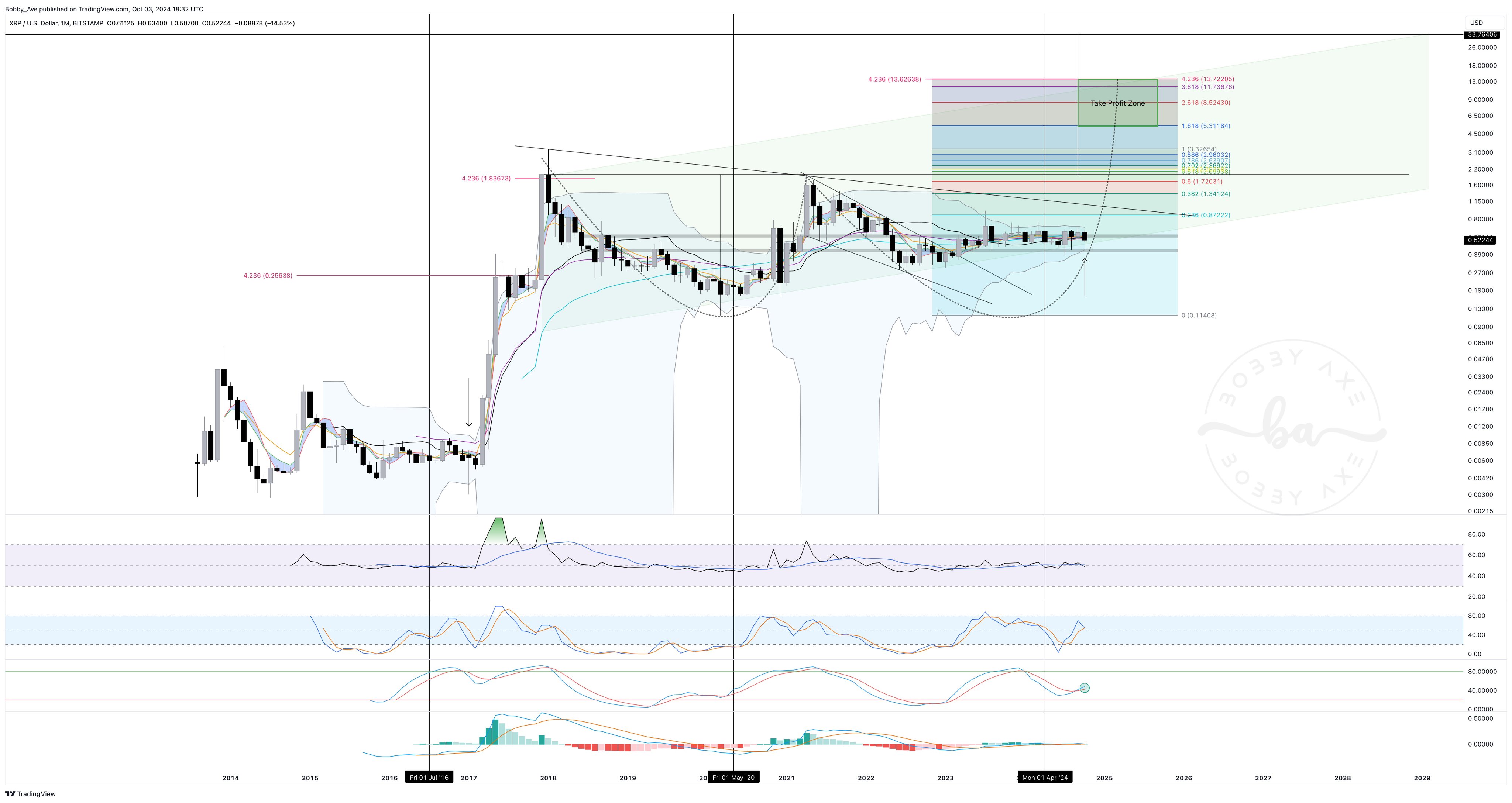

The expert points out that XRP‘s trading pattern over approximately the last seven years has been characterized by a steady, horizontal motion, or what he terms a “long-term base.” Bobby emphasizes that this prolonged phase of sideways movement is significant in predicting possible price increases.

Bobby points out that after each Bitcoin halving, he has observed a pattern where Ripple (XRP) tends to have significant price increases following the movement of momentum oscillators on a monthly basis. These price jumps can start at any time, similar to what was seen in 2017 and 2020.

As an analyst, I’m focusing my attention on the XRP/USD chart’s monthly Bollinger Bands – a useful tool for gauging market volatility and predicting potential price targets based on past market trends. Similar to what we saw in 2016, the current price appears to be closely aligned with all significant higher timeframe moving averages, even the median line of the monthly Bollinger Bands.

He adds, “While we are on the topic of the Bollinger Bands, they are the tightest they have ever been in the coin’s history,” he notes. This tightness suggests that XRP is at a pivotal point where any increase in volatility could lead to a substantial price movement.

Significantly, the potential profit range for Bobby’s investment lies somewhere in the span between the 1.618 Fibonacci extension level at $5.31 and the 4.236 Fibonacci extension level at $13.72. This suggests that Bobby could potentially earn returns ranging from approximately 950% to an impressive 2,600% during this bull run.

Bobby proposes that when volatility resumes, the initial price movements might be misleading, possibly intended to confuse market participants regarding the actual direction of the price trend. He likens this scenario to Bitcoin’s sudden surge in March 2020, implying that XRP could also undergo a similar, seemingly deceptive yet ultimately bullish price increase.

Bobby stated that the XRPETH and XRPBTC graphs don’t seem to indicate the beginning of a prolonged bear market, but rather, they might be showing signs of capitulation in deeply discounted regions. Keep in mind that disheartening news often surfaces at the bottom, while optimistic news tends to emerge at market peaks.

The upcoming U.S. presidential election may significantly influence the future regulations surrounding cryptocurrencies such as XRP. Bobby contemplates potential scenarios: If Donald Trump is re-elected for another term, it’s hard to imagine Gary Gensler continuing as SEC chair. He suggests that a shift in leadership at the SEC could lead to reduced regulatory oversight over Ripple and consequently XRP, creating a more advantageous market climate.

In his closing remarks, Bobby reiterates his strong conviction in the bullish thesis for XRP. “No one ever said this would be easy, and investing never is,” he reflects, encouraging his audience to adopt a strategic, long-term view of their investment in XRP.

At press time, XRP price stood at $0.52.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-04 21:40