As a seasoned crypto investor with over a decade of experience navigating the tumultuous seas of digital assets, I have seen my fair share of market ebbs and flows. The recent surge in XRP‘s on-chain activity has piqued my interest, as it often signals potential growth opportunities.

Over the past period, there’s been a notable uptick in on-chain actions associated with XRP, leading to a recent spike in its public interest.

Various financial experts and stakeholders are showing growing curiosity towards Ripple‘s digital payment system, the XRP Ledger, because of its rising capacity for handling transactions.

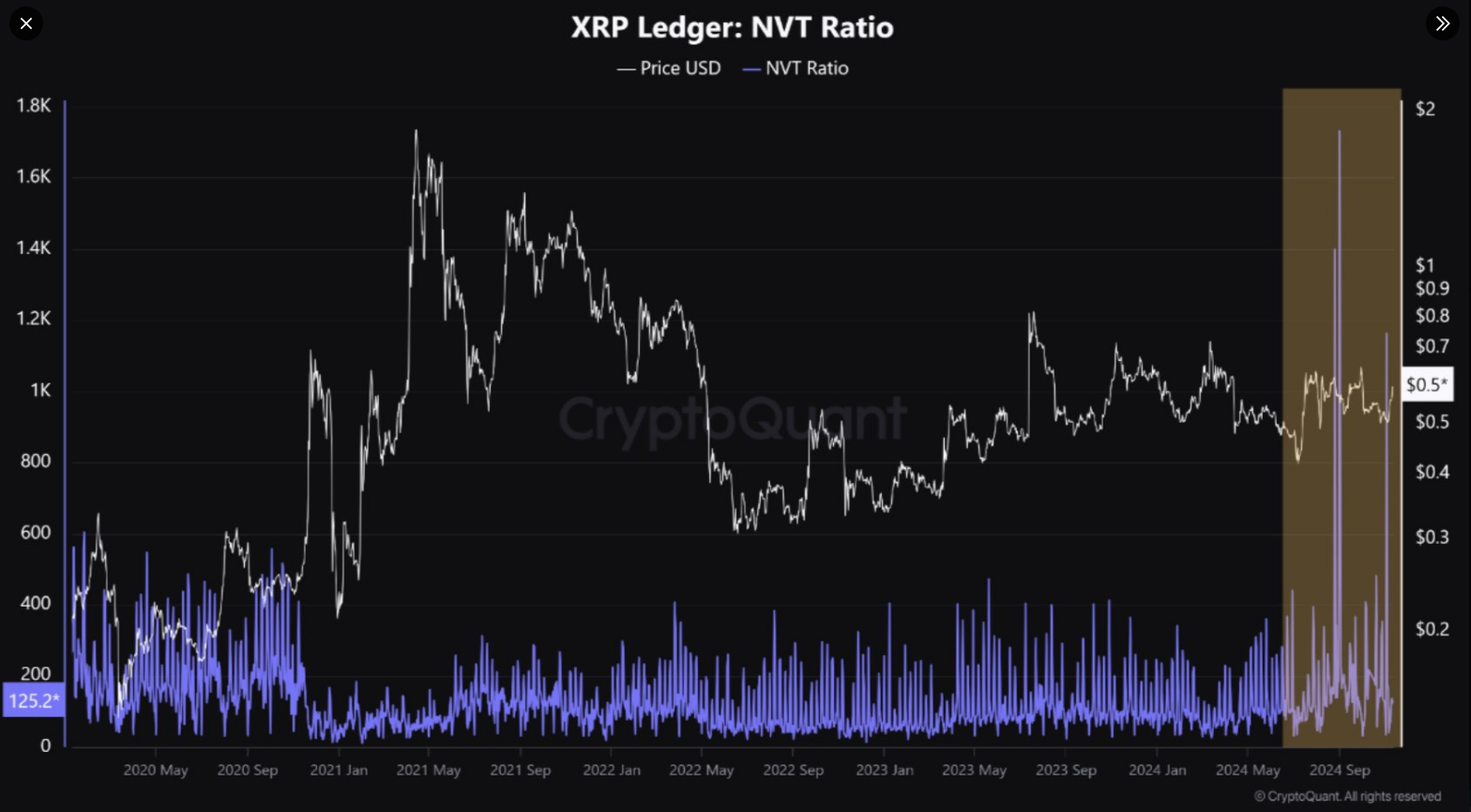

As an analyst, I’ve observed an uptick in the Network Value to Transactions (NVT) ratio of XRP, as highlighted by CryptoQuant on their X (previously Twitter) post. This surge in the NVT ratio suggests that on-chain activity related to XRP is picking up steam. This heightened activity could potentially mean that the level of network activity for XRP exceeds its current market evaluation.

Market analysts are closely monitoring the fluctuations in the altcoin’s worth and activity, as of late they’ve been displaying several indicators. Although there’s been a significant increase in network usage, the price of XRP is still facing hurdles, with major resistance levels fast approaching.

XRPL: Spike in NVT Ratio

Since the NVT Ratio compares Market Capitalization (currently hovering at approximately $51.1 billion) with On-chain Transaction Volume, this sudden increase indicates a rise in transaction activity.” – Paraphrased by AI Assistant

Read more

— CryptoQuant.com (@cryptoquant_com) November 13, 2024

What’s The Reason For The Increase In NVT Ratio?

A measure of the “value” of network activity is the NVT Ratio, which is calculated by dividing market capitalization by the volume of on-chain transactions. On November 2, XRP’s NVT Ratio saw a sharp rise, hitting 1,162 in a comparatively short amount of time.

The main reason for this rise can be traced back to a significant spike in on-blockchain actions, causing the system to handle approximately $44 million worth of daily transactions according to CryptoQuant’s data.

In simpler terms, a high NVT (Network Value to Transaction) ratio often indicates that the market value hasn’t grown as fast as the network’s activity level, even though it’s being used. For instance, when discussing XRP, this ratio suggests that there are more transactions taking place, which could be for remittances or other purposes, but its market value hasn’t increased at the same pace.

As a crypto investor, I’ve noticed an uptick in activity surrounding XRP, but unfortunately, this surge hasn’t seemed to impact the price of the token just yet. Intriguingly, despite the heightened activity, the market capitalization of XRP has remained fairly steady, hovering around $51 billion.

XRP: $0.75 Resistance In Focus

Concurrently, analysts specializing in XRP are closely monitoring its price fluctuations. Over the past year, the price of $0.75 has emerged as a significant barrier. Even renowned crypto expert Egrag Crypto identifies this level as a substantial hurdle for the token’s progression.

#XRP at 0.75c – The Key Level!

As a dedicated crypto investor, I understand that discussing the importance of $0.75 might seem repetitive. However, let’s step back and consider the broader context:

On the monthly graph, there are three long candles (wicks), indicating significant buying pressure has been met with strong selling pressure. This occurred around:

— EGRAG CRYPTO (@egragcrypto) November 13, 2024

Egrag proposes that if XRP manages to break through the $0.75 mark, it could aim for further milestones at $0.85 and potentially $1.12, possibly igniting a surge. However, achieving this hasn’t been easy—XRP’s attempts to surpass this level in November 2023, March 2024, and more recently have been confronted with strong selling activity.

Nevertheless, traders remain optimistic that the heightened network activity and support levels could provide XRP with the necessary boost, despite these setbacks.

December Rally

2024’s December could bring significant changes for XRP. Numerous experts suggest that if XRP manages to close above $0.60 per week, it might set an important threshold, often referred to as a “wake-up line.” This could potentially spark further price growth until the end of the year.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

2024-11-15 17:11