As a researcher with experience in analyzing cryptocurrency market trends, I find the recent on-chain data for XRP quite intriguing. The significant increase in the “Age Consumed” metric, which indicates that old coins have been moved on the XRP network, is a sign that has proved to be bearish for the coin in the past. This large dormant coin movement may suggest that some HODLers are selling their coins, potentially leading to downward price pressure for XRP.

Recent activity on the XRP blockchain indicates that a large number of older XRP coins have been transferred. Historically, this trend has been associated with a downturn in the coin’s price.

XRP Age Consumed Metric Has Registered A Large Spike

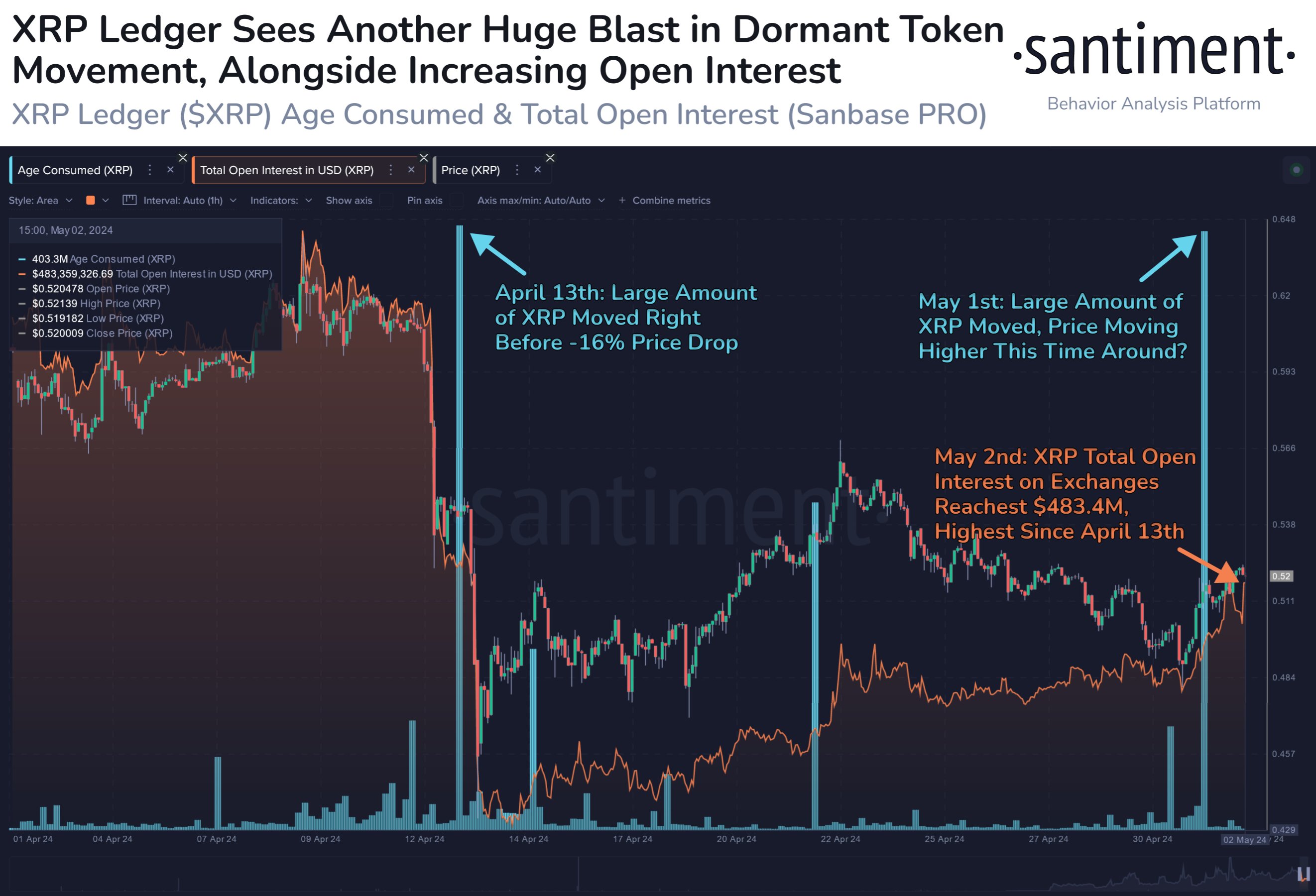

Based on information from the on-chain analysis company Santiment, there has been a significant shift in XRP coins that have been inactive, mirroring a trend seen with the asset earlier in the month.

The metric of focus in this context is referred to as “Age Consumed,” representing the number of tokens that have shifted addresses on a specific day, with each figure being multiplied by the elapsed time since their last transfer (according to Santiment’s explanation).

When the given metric is significantly elevated, it signifies that a substantial number of coins which were previously inactive have been transferred to the blockchain. These coins typically belong to more steadfast investors in the market. Consequently, any considerable shifts in their positions are worth taking notice of due to their infrequent occurrence.

The below chart shows the trend in this indicator for XRP over the past month or so:

As a seasoned crypto investor, I’ve noticed an intriguing development while analyzing the XRP chart. The Age Consumed metric experienced a significant surge at the beginning of this month. This could mean that some veteran investors in the XRP community have recently become active, choosing to make their moves after a period of relative quietness.

As a researcher studying market trends, I’ve noticed that the recent surge in price has been particularly noteworthy in size and resemblance to the spike we witnessed last month. It’s intriguing to recall that the preceding spike took place just prior to the cryptocurrency experiencing a significant decrease of approximately 16% in value.

I believe the earlier price surge may have been initiated by certain HODlers deciding to offload their XRP coins. Likewise, the recent significant shift in dormant XRP could signify similar selling actions, potentially leading to a downturn in XRP’s value.

Santiment points out that this may not be so after all, though, saying:

One perspective holds that the recent upward trend in the price of this vintage coin could be linked to anticipation among significant investors for buying opportunities, resulting in a gradual increase in value since the May surge.

As an analyst, I’ve noticed that the current dormant coin trend could potentially lead to a bullish outcome. However, it’s essential to pay attention to another emerging signal for this asset.

The chart brings attention to the fact that the Total Open Interest for XRP, representing the current number of active derivative contracts relating to this asset across all trading platforms, has experienced an uptick in recent times.

I’ve analyzed the data and found that the metric has reached a three-week peak of $483.4 million. This signifies a significant level of market speculation at present. Based on historical trends, we can expect price volatility as a result.

Theoretically, this volatility could cause the asset to move in either direction. It’s important to mention that the recent market downturn happened when Open Interest peaked excessively. However, the indicator has not quite attained those elevated levels again.

XRP Price

The price of XRP has not bounced back significantly since the market downturn, with it currently hovering around the $0.52 mark.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-04 02:10