As a researcher with a background in crypto markets and on-chain analysis, I find the recent behavior of XRP‘s open interest particularly intriguing. The data from CryptoQuant suggests an unusual trend that could be indicative of a potential price move for XRP.

According to recent data, XRP is displaying intriguing on-chain activity, which sets it apart amidst the broader market instability. This uncommon behavior was brought to light by CryptoQuant, a leading crypto analytics firm. The significance of this pattern lies in the increasing demand for XRP derivatives, as evidenced by a rising open interest, hinting at an imminent significant price shift for XRP.

XRP Open Interest Surges

As a crypto investor closely monitoring market trends, I’ve noticed that according to data from CryptoQuant, the open interest for XRP has started to increase once again following recent developments regarding the SEC and Ripple, XRP’s parent company.

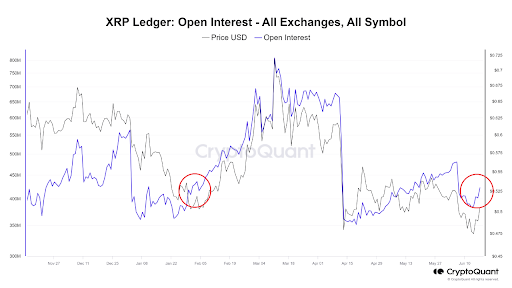

According to the CryptoQuant chart displayed below, the open interest, which had been steadily increasing since April 15, experienced a setback during the initial week of June. This decline in open interest coincided with a drop in XRP‘s price. Nevertheless, the open interest has since bounced back and is once again on an upward trajectory.

It’s worth noting that the recent surge in XRP‘s price is more pronounced than that of other cryptocurrencies. This observation holds weight given the general downturn experienced by many crypto assets in the last week. Moreover, the escalating open interest serves as a telling sign of investor sentiment towards XRP. The increasing number of open positions implies that investors are optimistic about a potential price hike for XRP in the near future.

How Will This Affect Price?

As a researcher examining financial markets, I would describe open interest as the current count of derivative contracts that remain unfilled. A rising trend in open interest typically indicates an influx of funds into the market. This is demonstrated in the chart before us, where notable upticks in open interest have predominantly coincided with price surges for XRP.

As a researcher studying market trends, I’ve discovered that open interest is a valuable indicator for astute investors. When open interest surges, it suggests that fresh capital is entering the market as traders establish new positions. This heightened activity and fluidity can serve as a precursor to where an asset’s price may be moving next. Regardless of whether the price trend ascends or descends, one certainty remains: enhanced volatility.

As a researcher observing the current market trends, I note that at the present moment, XRP is priced at around $0.486 with a 1.44% growth in value over the last seven days. Notably, among the top 20 cryptocurrencies by market capitalization, XRP stands alone as the only asset experiencing an increase during this timeframe. Furthermore, there has been a substantial trading volume observed in recent days, bolstering the optimistic perspective for XRP investors.

Based on Santiment’s findings, some traders remain pessimistic towards XRP‘s price trend, even though it has surpassed several other assets. Concurrently, traders have been shorting XRP to offset the buying pressure. However, Santiment points out that this shorting activity could function as a catalyst for further price increases when these positions are ultimately closed.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-06-21 20:20