As a seasoned crypto investor with a knack for spotting trends and patterns, I find the analysis by EtherNasyonal particularly intriguing. Having navigated through multiple market cycles, I can attest that understanding these phases is crucial to making informed investment decisions.

It’s possible we’re gearing up for the eagerly awaited altcoin boom in the cryptocurrency market. With Bitcoin leading the charge, an expert has used the Wyckoff Cycle to analyze the current market phase. This analysis hints that altcoins are readying themselves for a significant surge, which could trigger the start of the altcoin season.

Wyckoff Cycle Reveals What Phase The Current Market Has Entered

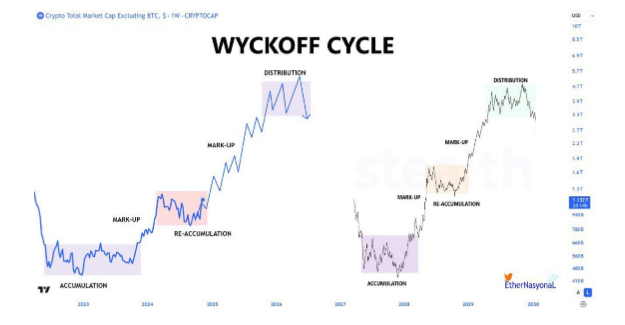

A well-known crypto expert known as EtherNasyonal has recently presented a graph depicting the total value of all cryptocurrencies excluding Bitcoin, using the Wyckoff cycle model to interpret market patterns and tendencies. This chart divides the market into four clear stages: Accumulation, where investors gather large amounts of the asset; Mark up, when prices rise due to increased demand; Distribution, where the price decreases as investors sell their holdings; and Mark down, where the market experiences a significant drop in value.

During the accumulation stage, savvy investors start purchasing assets at cheaper rates as the selling force weakens, causing prices to stabilize. When this phase ends, we move into the Markup phase, where prices break free from the stabilization zone and initiate an upward trend due to heightened demand.

In the Distribution phase, which is marked by increased selling activity, savvy investors start offloading their assets. This can result in price adjustments or equilibrium. Subsequently, the Markdown phase commences, where selling pressure significantly outweighs demand, causing a downward trend.

According to the crypto analyst’s analysis, we are currently experiencing a surge in cryptocurrency prices, which indicates that we are in the Mark up phase of the market. By the years 2025, 2026, and 2027, it is predicted that the overall market will transition through a re-accumulation phase, another Mark up phase, and a Distribution phase, respectively. In simpler terms, this means that over the next few years, we might see periods of increased buying (Mark up), followed by periods of consolidation or accumulation, and then periods of selling (Distribution).

On the right side of the diagram, you’ll find a sequence similar to those market phases continuing, with the period from 2027 to 2030 projected to encompass an accumulation phase, followed by a bullish trend (mark up), and finally a distribution phase.

Here’s When The Altcoin Season Could Begin

According to EtherNasyonal’s Wyckoff cycle diagram, it appears that the time for altcoins to flourish is approaching, as these digital currencies (other than Bitcoin) are gearing up for a potentially explosive growth spurt. The term “altcoin season” refers to a phase when various cryptocurrencies see substantial price surges and often surpass Bitcoin’s performance significantly. In previous market upturns, Ethereum, Cardano, Solana, and other altcoins have been among the leaders driving the altcoin rally.

According to the crypto expert’s analysis, we can anticipate the altcoin boom starting after a period of accumulation in the Wyckoff chart for the cryptocurrency market, which is expected to occur in 2025, following an upward trend (Mark up phase) in 2024.

During the accumulation period, it’s anticipated that alternative cryptocurrencies (altcoins) might undergo an impressive surge, potentially triggering a robust and optimistic altcoin market trend. The predicted altcoin season could be influenced by Bitcoin’s price movement, as previous altcoin seasons have followed periods of Bitcoin growth. Furthermore, if we observe a decline in Bitcoin’s influence over the market and growing interest in altcoins, this might indicate that an altcoin season could be just around the corner.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-16 22:34