Hannah Phung, an analyst leading at the cryptocurrency platform SpotOnChain, expressed her views on how the Bitcoin Halving might influence the price of this leading digital coin. This contributes to the ongoing discussion about whether or not this event could push Bitcoin‘s value up to $100,000.

Bitcoin’s Price Surge Might Not Come Immediately

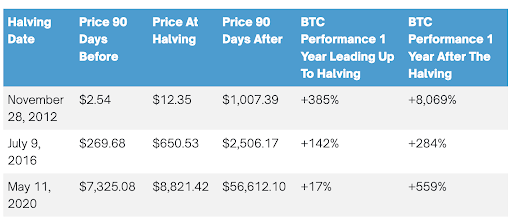

During an interview with BeInCrypto, Phung shared that Bitcoin’s value typically rises between 6 to 12 months following the Halving, not right away. This pattern is observable in previous Halving occurrences. For instance, Bitcoin experienced a price surge of more than 8,000% one year after the first Halving on November 28, 2021.

During this time, Bitcoin underwent significant price surges following the second and third halving events. These events occurred on July 9, 2016, and May 11, 2020, respectively. Notably, Bitcoin’s value rose by 284% one year after the first event and an impressive 559% after the second event. Phung explained that the increase in Bitcoin’s price can be attributed to the decrease in the number of new Bitcoins being mined. This reduction enhances scarcity, leading to a rise in demand and price when market conditions remain stable.

In February, NewsBTC shared an article stating that the need for Bitcoin was significantly greater than the amount being produced by miners. As a result, some cryptocurrency experts believed that Bitcoin’s price could skyrocket once miner rewards were reduced later in the month. One of these analysts, MacronautBTC, suggested that Bitcoin could reach as high as $237,000.

This Bitcoin Halving Could Be Different

Although the crypto market often adheres to historical trends, Phung warned that it can be unforeseeable as well. This means that the upcoming Halving could deviate from previous occurrences. Furthermore, this cycle has already set itself apart, as Bitcoin reached a new record high (ATH) before the Halving took place.

In addition, the analyst recognized that the Bitcoin market has grown significantly since previous halvings. Nevertheless, Phung anticipates a price rise following the halving, but cautioned that the precise moment is unclear and may occur before or after the typical timeframe.

In simpler terms, Rekt Capital, a well-known Bitcoin analyst, expressed his belief that the Re-accumulation phase of the current Bitcoin Halving might not persist for long due to the new All-Time High (ATH) price level. This is because this is the first time the Re-accumulation zone falls around the new ATH.

Market Sentiment Could Determine Bitcoin’s Price Post-Halving

Phung further discussed the potential impact of the market feeling following the Bitcoin halving on its future direction. She believes that many cryptocurrency investors will adopt a optimistic perspective once the halving occurs due to the importance of this event in shaping Bitcoin’s inventory.

After the initial buzz surrounding the halving event subsides, various indicators including price trends, trading activity, social media chatter, and on-chain statistics such as the number of active addresses or exchange balances must be examined to assess whether investors remain optimistic.

During the conversation, Phung proposed that the upward trend in Bitcoin’s price following its halving might last longer than usual. He explained that an increased number of institutional investors are now part of the market, making it more developed and stable.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-04-13 00:04