As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself constantly intrigued by the rollercoaster ride that is the SUI price. The latest dip, while concerning, is not entirely unexpected given the highly volatile nature of this Layer-1 blockchain.

After reaching an unprecedented peak of $2.35 just a week ago, SUI’s price has experienced a significant drop, falling below the critical support level of $2.0. This decline suggests a decrease in investor enthusiasm towards the Layer-1 blockchain, possibly due to waning interest.

In recent weeks, the value of SUI has been fluctuating greatly, causing more investors to feel pessimistic about the altcoin. However, last month’s introduction of MLS Quest, a soccer-themed NFT platform created in collaboration with Sweet, a gaming blockchain startup, has sparked optimism among supporters of SUI.

The surge in SUI’s price was largely driven by the debut of the US dollar coin on the Sui mainnet. However, as the broader cryptocurrency market experienced a downturn and pullback, the optimism surrounding the altcoin started to wane. At the time of publishing, SUI is being traded at $1.89, with a total market capitalization of $5.37 billion.

As the optimistic outlook for SUI in the short term weakens, it’s under mounting stress to maintain its value above the $2 mark. The price trend of SUI appears to mirror Bitcoin‘s market mood frequently, suggesting that SUI’s price movements are influenced by Bitcoin’s sentiment.

Courtesy: TradingView

Despite the current upward trend looking hopeful, reinforced by the 20-day Exponential Moving Average serving as a base, doubts persist about its longevity. Keep reading to determine whether buyers will assert control or if the value of SUI could experience more drops.

SUI Price Sentiment on a Decline

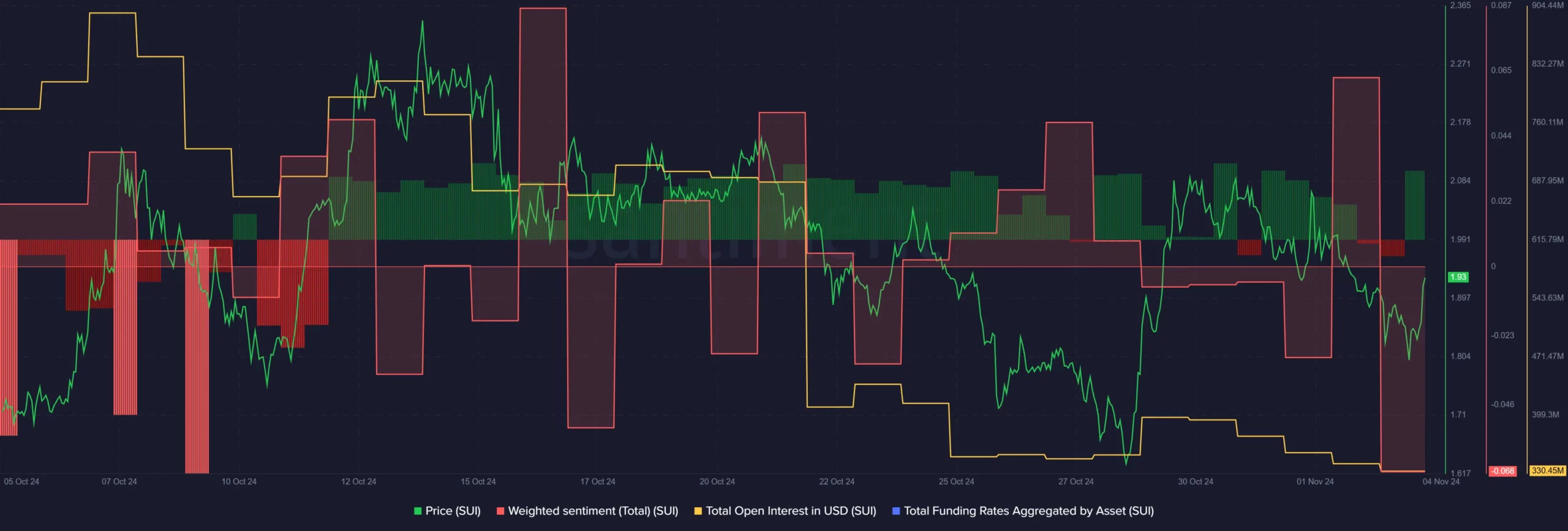

According to data provider Santiment, the sentiment towards Sui on social media has shifted from slightly positive (0.06) to slightly negative (-0.06) over the past two days. This negative sentiment often leads to feelings of fear, uncertainty, and doubt (FUD) among investors, which can cause a quick drop in price.

It seems that the overall commitment or promise to trade SUI’s perpetual contracts has significantly decreased, dropping from a peak of $895 million during the recent widespread market surge on October 7, to $440 million as of the latest update.

Courtesy: Santiment

Despite mounting bearish sentiment, SUI’s funding rate turned positive, moving from -0.002% to 0.01% as its price briefly crossed the $1.95 mark earlier today.

At the moment, SUI is valued at $1.88 per unit. Over the last day, it has increased by 0.3%. It continues to hold the position as the 18th largest cryptocurrency, with a market capitalization of approximately $5.3 billion. Notably, its daily trading volume has seen a significant boost, rising by 30%, now standing at around $630 million.

We’ll find it intriguing to observe how the price trend of SUI might change moving forward, considering that the general altcoin rally could potentially stretch into January 2025.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-04 15:09