As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. The recent surge in Ethereum‘s price has caught my attention, especially considering its potential to breach significant resistance levels.

In the context of a broader crypto market rebound, Ethereum (ETH) has surged by 7%, reaching the significant resistance level of approximately $3,930. Over the past period, ETH has been moving within a range, fluctuating between $3,500 and $4,000, with investors anticipating a breakout that could potentially drive it towards a fresh record high.

Today’s drop in ETH price can be attributed to several factors. Initially, the U.S. CPI inflation figures matched expectations, which strengthened the bullish sentiment across the crypto market as a whole. Interestingly, Bitcoin experienced a 3.5% increase, reaching over $100K, but Ethereum and other altcoins have seen an even more pronounced surge.

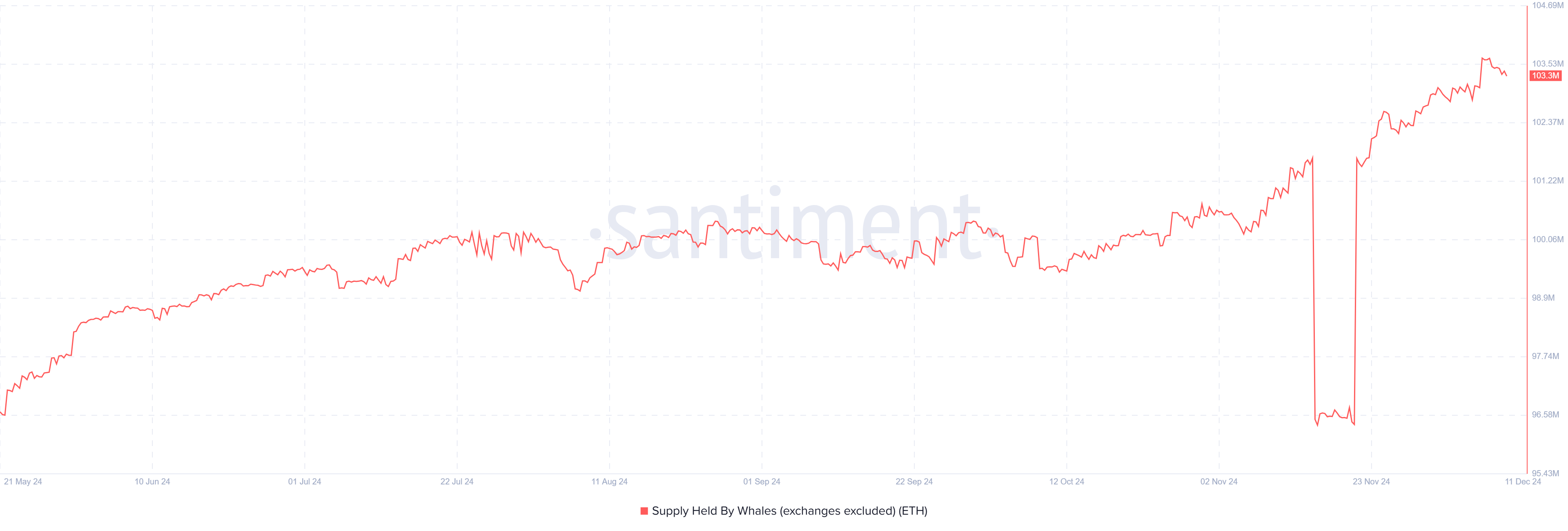

In my exploration of the Ethereum market this week, I’ve noticed a significant shift in buying behavior by institutional investors and whales. They seem to have seized the opportunity to purchase ETH at lower prices when it found support at around $3,550, as suggested by on-chain analytics. Interestingly, over the past seven days, there has been a substantial withdrawal of over 130,000 Ether from exchanges during this recent price decline, indicating a trend towards long-term holding rather than immediate trading.

Over the same timeframe, there was a significant rise of over 340,000 Ether held, implying that optimistic investors perceived the price drop as a chance to amass Ethereum at reduced prices.

Source: Santiment

Conversely, investments into spot Ethereum ETFs continue to be robust. Over the past nine trading days, these U.S. Ether ETFs have experienced consistent net inflows, amounting to approximately $2 billion in total since their launch.

As an analyst, I’ve observed a significant trend in the Ethereum Exchange Traded Fund (ETF) market. Specifically, the BlackRock Ethereum ETF (ETHA) has been leading the pack with a massive $2.9 billion influx of investments. Interestingly, Fidelity’s offering, FETH, is also experiencing a surge, with over $1.35 billion in inflows. This suggests that institutional interest in Ethereum investment products is regaining momentum at an accelerated pace.

Ethereum Price Eyes $5K amid Golden Cross Pattern

The cryptocurrency Ethereum (ETH) has developed a positive “golden cross” trend on its price graph, an indication from the technical side suggesting robust uptrend. Financial experts are hopeful, predicting a possible rise in value up to $5,000 for ETH.

$ETH Bullish Golden Cross

$5k ETH and AltSeason are coming 🚀

— Elja (@Eljaboom) December 12, 2024

Looking ahead, for Ethereum to affirm its upward trend, it needs to surpass the daily closing price of around $3,930, which currently serves as resistance. Historically, Ethereum has experienced several retreats after reaching this level.

In the future, Ethereum’s price must surmount the resistance at approximately $4,093, a level where it has previously encountered significant selling pressure. If it fails to do so, ETH may slide back towards the support of around $3,550 once more. Interestingly, market analysts suggest that sellers might be running out of steam at these price points.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-12 14:12