As a seasoned researcher with years of experience navigating the tumultuous seas of the crypto market, I can’t help but feel a sense of deja vu as I witness Bitcoin and Ethereum taking a dive once again. This isn’t my first rodeo; I remember when BTC was just a few cents and ETH was barely a blip on the radar. But here we are now, watching these giants stumble and fall.

Amidst an increase in crypto market volatility, where Bitcoin (BTC) dipped slightly below $104,000, and Ethereum (ETH) experienced a significant drop approaching the $3800 level, both digital currencies have shown resilience with their underlying bullish sentiments managing to prevent a full-blown breakdown rally.

Over the past day, Ethereum has seen over $400 million in liquidations, indicating it may struggle to hold onto crucial support levels. With a current market capitalization of $466 billion and a 24.22% return over the previous 30 days, Ethereum is under pressure.

Could this temporary increase in supply lead to a significant drop in the price of Ethereum, or will it instead bounce back strongly to reach the $4,000 mark again soon?

Explosive Inflows in Ethereum ETFs

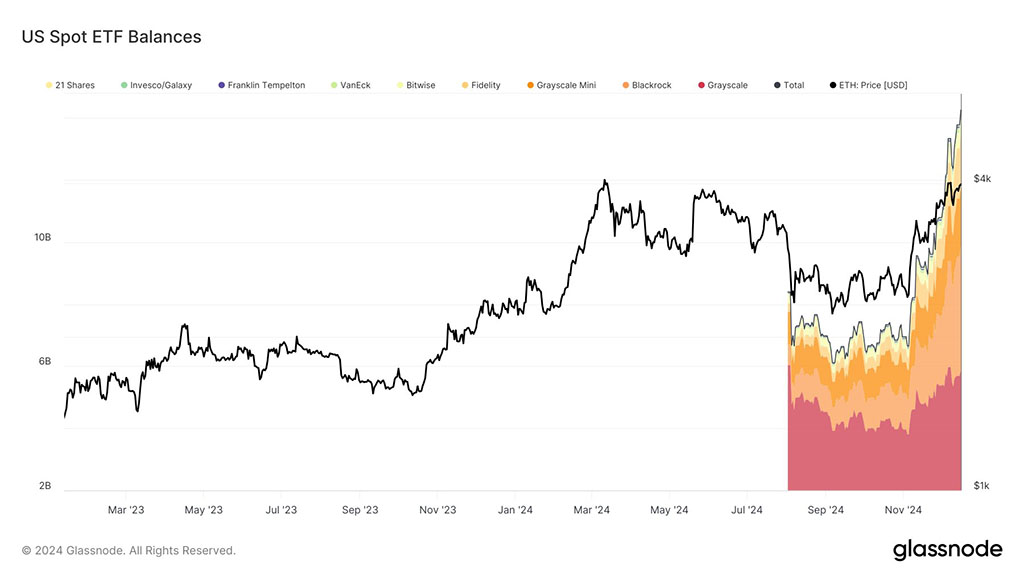

Institutional purchasing remains robust, with the Ethereum price temporarily dipping in a brief downward trend. Notably, U.S. spot Ethereum Exchange Traded Funds (ETFs) saw an impressive influx of approximately $144.7 million in a single day.

BlackRock took the front line in a significant move, investing $134.8 million in ETH, which was then followed by Fidelity’s purchase of $3.9 million. This underscores strong institutional belief. Moreover, the inflow of funds has skyrocketed since November 2024, amounting to over $6 billion, demonstrating an enormous surge in interest.

The surge in investment has brought the current value of all ETF assets to approximately $14 billion, representing 2.96% of Ethereum’s total market capitalization. Even amid market fluctuations, institutional interest in Ethereum continues to grow steadily. Before staking rewards become active, these ETFs could potentially pave the way for Ethereum’s significant future price increase.

Ethereum Price Analysis Targets $4,420

On the two-hour Ethereum price chart, we see an unsuccessful attempt by the price trend to maintain control above the $4,000 threshold, indicating a bullish weakness. Following a significant high in price at around $4,109 (a new 50-day mark), ETH’s price exhibited a bearish shift as Bitcoin’s price dipped below the $104,000 support level.

As a crypto investor, I’ve noticed that Ethereum has dropped below the crucial support of $3,900. Interestingly, the ETH price encountered a lower resistance at the 50% Fibonacci level around $3,795, indicating a strong sell-off. This suggests that Ethereum is finding it challenging to maintain its dominance above the $3,800 mark, given the persistent selling pressure in the market.

This situation shows a slight change occurring just above the 61.80% Fibonacci level at $3,861, suggesting a potential rebound for bulls following a significant decline. Following a brief adjustment, the MACD and Signal lines seem to be gearing up for an upward crossover. Additionally, the RSI line is undergoing a curving reversal, moving slightly above the oversold threshold line.

ETH Price Targets

If the upward trend persists and we surpass the 78.60% Fibonacci level, and if we manage to exceed the $4,000 psychological barrier, it’s expected that the uptrend could reach the 1.61% Fibonacci level at approximately $4,420. Conversely, a downward close below the 50% Fibonacci level might lead to a retest of the $3,647 support level.

In summary, although the current Ethereum price trend has briefly challenged its crucial support zones, the bullish sentiment remains robust. The influx of institutional investments into Ethereum ETFs suggests a possible resurgence in bullish momentum. Consequently, it’s likely that Ethereum will close 2024 on an optimistic note, given these indicators.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-18 15:27