Oh, gather ’round, dear readers, for we’re about to dive into the thrilling world of cryptocurrency, where the gods of finance and technology dance together in a ballet of numbers and screens. Today’s tale revolves around Ethereum (ETH), the second-born prince of the crypto kingdom, who’s currently eyeing a breakout from the $3,000 realm. But will the Federal Open Market Committee (FOMC) meeting be the wind beneath its wings, or will it leave our hero grounded? 🕵️♂️🔍

Now, let’s not forget that the crypto market is a fickle beast, always on the edge of its seat, waiting for the next big thing. And here comes the FOMC, strutting onto the stage, with most players betting their beans that interest rates will stay as they are. Amidst this tension, Ethereum stands tall, ready for a potential reversal rally that could send it soaring past the $4,000 barrier. 🚀🌈

Ethereum: The $3,000 Knight in Shining Armor

Our brave knight, Ethereum, has been through the ringer these past few months, falling from grace after reaching the lofty heights of $4,000 in early December 2024. But fear not! For even in its current state, hovering around $3,168, it still shows signs of strength, supported by the 50-week SMA line. 🛡️✨

The weekly candles tell a tale of resilience, with lower price rejections hinting at a possible comeback. The falling-wedge pattern forming on the chart suggests that a bullish reversal might just be around the corner. And wouldn’t you know it, the $4,000 mark looms large, ready to either welcome our hero or cast him back down to earth. 🌌🔥

The $4,000 Challenge: Can Ethereum Conquer?

Enter Ali Martinez, the wise sage of charts and patterns, who points out an inverted head and shoulders formation in Ethereum’s journey. This pattern, my friends, is a sign of things to come. If it holds, a dip to $2,900 could present a golden opportunity for the bold and the brave. But heed this warning: keep your stop-loss tight between $2,700 and $2,500. 📉🚫

“This head-and-shoulders pattern on #Ethereum $ETH is becoming overcrowded. I see everyone on X is sharing it.” – Ali (@ali_charts) January 28, 2025

At the moment, Ethereum is struggling to complete the right-shoulder part of this bullish pattern. But if it manages to hold above the $2,900 mark, the sky’s the limit. A successful breach of the $4,000 mark could very well lead to a new all-time high. 🚀💫

The FOMC: The Key to Ethereum’s Kingdom?

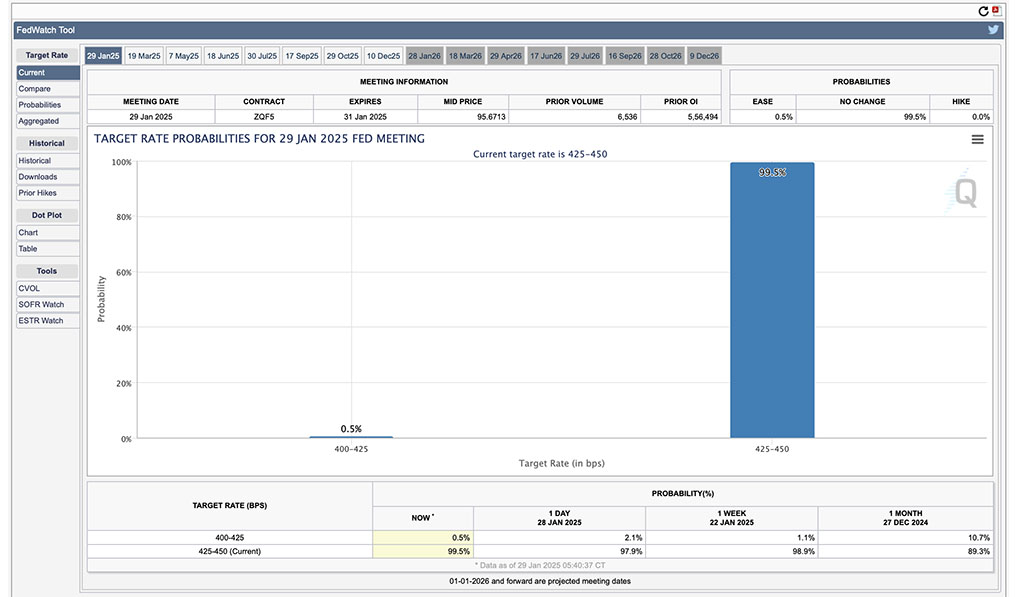

And now, dear readers, we come to the heart of the matter. The FOMC meeting could very well be the catalyst that propels Ethereum to new heights. According to the CME Group FedWatch, there’s a whopping 99.5% chance that the Fed will keep rates steady between 4.25% and 4.5%. 🤔📊

Back in April 2021, when the Fed held firm, Ethereum experienced a surge of epic proportions, jumping from $2,321 to $3,928 in just two weeks. Imagine what a repeat performance could do for our hero! A $4,750 price rally could be on the horizon. 🌄💰

A Rate Cut: The Wild Card

But wait, there’s more! There’s a slim 0.5% chance of a 25 basis point rate cut. Should this unlikely scenario unfold, it could inject a much-needed dose of optimism into the market. Institutions would be free to indulge in riskier assets like Bitcoin and other cryptocurrencies, potentially leading to a surge in Ethereum ETFs. 📈🚀

With the institutional pool growing, Ethereum could very well break through the $5,000 barrier, setting its sights on the $7,000 level. All it needs is a successful inverted head-and-shoulders breakout to make it happen. 🎯🌟

So, dear readers, as we stand on the precipice of the FOMC meeting, Ethereum’s fate hangs in the balance. Will it soar to new heights, or will it tumble back down to earth? Only time will tell. Until then, may the odds be ever in your favor! 🍀🔮

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2025-01-29 17:36