As a seasoned crypto investor with a few battle scars from the 2020 “Thanksgiving Day Massacre,” I can’t help but feel a sense of déjà vu as we approach this holiday season. The recent 8% correction in Bitcoin’s price has certainly raised some eyebrows, and it’s hard not to draw parallels with the events of four years ago.

Approximately four years ago, on a day remarkably close to today, Bitcoin suffered a significant drop of 17%. This took place in 2020 when its price fell from $19,500 to $16,200, an incident that became notorious as the “Thanksgiving Day Crash”. As the holiday season approaches once more, traders are speculating if this pattern might recur.

On Monday and Tuesday, I observed a significant 8% correction in Bitcoin’s price, which fell from approximately $98,871 to a low of $90,791. This sudden decline has ignited discussions among analysts, including myself, about whether history might be repeating itself with regards to the BTC price.

Bitcoin ‘Thanksgiving Day Massacre’ 2024?

Alex Thorn, the Head of Research at Galaxy Digital, utilized X as a platform to illustrate similarities between the present market and the occurrences in 2020. “Does anyone recall the Bitcoin crash on Thanksgiving 2020? Between Wednesday, Nov 25, and Friday, Nov 27, 2020, Bitcoin plummeted by 17%. However, BTCUSD later multiplied its value over the next 5 months. Could history repeat itself?

A potential catalyst for the crash could be the global M2 money supply. Currently, a chart illustrating the correlation between Bitcoin and global M2 is circulating on X.

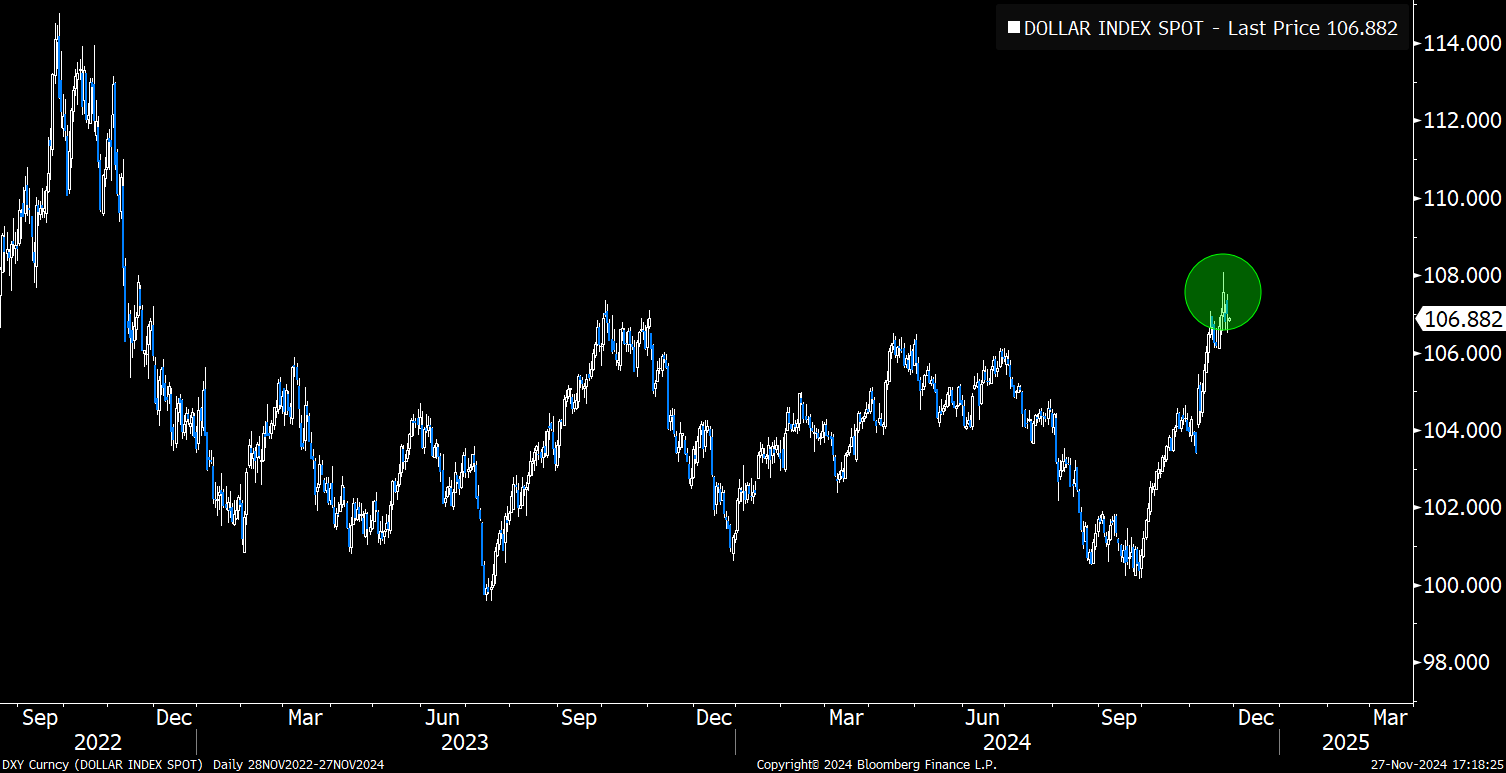

Joe Consorti, an analyst at Theya, noted that starting from September 2023, Bitcoin has generally followed the trend of global M2 money supply with a delay of around 70 days. Over the last two months, the global M2 has decreased from $108.3 trillion to $104.7 trillion, primarily due to factors like a strong US dollar causing foreign currency-denominated M2 to lose value when converted into dollars and slowing economies reducing borrowing and deposit growth.

Adviser Consorti warns, “If the ongoing contraction in M2 persists, there’s a possibility of a 20-25% adjustment taking place, which might push bitcoin towards around $73,000. This isn’t a forecast, but rather a stark illustration of Bitcoin’s connection to the global money supply. Yet, it’s important to note that Bitcoin could buck this trend, as it has in the past, especially during the period from 2022-2023 due to the FTX collapse and diminishing interest in the sector as a result.

He suggests that structural ETF inflows and corporate buying pressure could help Bitcoin resist the current M2 deflation. Consorti concludes, “Either way, a correction at this point seems about right. As mentioned before, these rapid run-ups in Bitcoin’s price always have pitstops along the way, […] it’s vital to understand the asset you hold, the macro environment it exists in, and the forces driving it higher long-term. If you truly understand bitcoin, you don’t panic sell.”

Although some analysts maintain a cautious stance, they also suggest that the current downturn might not last long. Jamie Coutts, Real Vision’s Chief Crypto Analyst, indicates via X that “Bitcoin’s demand has outweighed tightening liquidity over the past month.” He acknowledges that Bitcoin seems “extended in comparison to global M2” and that his liquidity model advises caution, particularly with leverage. However, he also points out possible policy changes that could benefit risk assets.

He references insights from economist Andreas Steno, indicating that the Federal Reserve is “in effect, discussing a put for USD liquidity—changes to support liquidity developments as early as December.” Coutts concludes: “DXY could have topped here. The lag effect that Fintwit is focused on atm is still real, but ultimately, the Fed is waving the bull flag for risk assets again. Bullish 2025. Bullish BTC.”

At press time, BTC traded at $93,250.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-27 14:46