In the tumultuous theater of the modern financial arena, we find ourselves spectators gazing upon Bitcoin, that capricious trickster. Just last week, it danced upon the precipice of a celestial summit, eclipsing the terrestrial bounds with an ostentatious peak of $118,667. Yet, like the capricious fates themselves, it now lingers—trading at a modest $117,953—seemingly gathering its strength before yet another tumultuous pirouette. With the echoes of jubilant optimism resonating through the crypto halls, a sudden pause ensues, as if even Bitcoin itself contemplates the meaning of existence.

Our soothsayer, RLinda, armed with her mystical charts and elusive predictions, foresees a duality of possible futures hinged precariously upon the faint lines of resistance and support. Oh, such is the nature of hope: it flares brightly yet often flickers in uncertainty!

Support Zones: Guardians of Bitcoin’s Fate

The sacred numbers dictate our cryptocurrency’s destiny, as RLinda illumines the path ahead. Despite its ventures into this purgatorial phase of consolidation, one must recognize that a definitive apex remains yet unconfirmed. The cosmos of market structures continues to whisper promises of bullish fortune, for Bitcoin, newly emerged from a languorous two-month slumber, treads upon the threshold of realization.

Upon the hourglass of fate—represented by the 1-hour candlestick—Bitcoin finds itself precariously perched above a support zone beneath $117,500. If it falters, we may witness a torrential cascade lead it to levels of despair at $115,500, then perhaps further down, echoing woe to the fateful heights of $111,800. Ah, the Fibonacci levels, those enigmatic integers, may serve as tender comforts, while the last bastion of bullish hope lingers near $110,400, beckoning the resilient bulls, who carry both optimism and a hefty wallet, to leap forth and rally.

Image From TradingView: RLinda

Bitcoin’s Temptation: The Elusive $125K

And yet, amidst all this turmoil, a glimmer of ambition persists. Bitcoin may still ascend the lofty heights towards $125,000, but such a conquest hinges on the precarious balance of market forces. For the expedition to commence, it must triumphantly breach the formidable barriers at $118,400 and $118,900—only then may it signal a triumphant “breakout of structure.” A daily close above these heights would herald a transcendence from this dreary consolidation into an exhilarating upward thrust.

In essence, dear reader, the dual prophecies—the bearish gloom and the bullish light—rest upon Bitcoin’s reactions at the critical junctures of support and resistance. But alas, the consolatory phase may linger far longer than one’s enthusiasm permits, perhaps echoing the melancholy behavior of previous exuberant cycles.

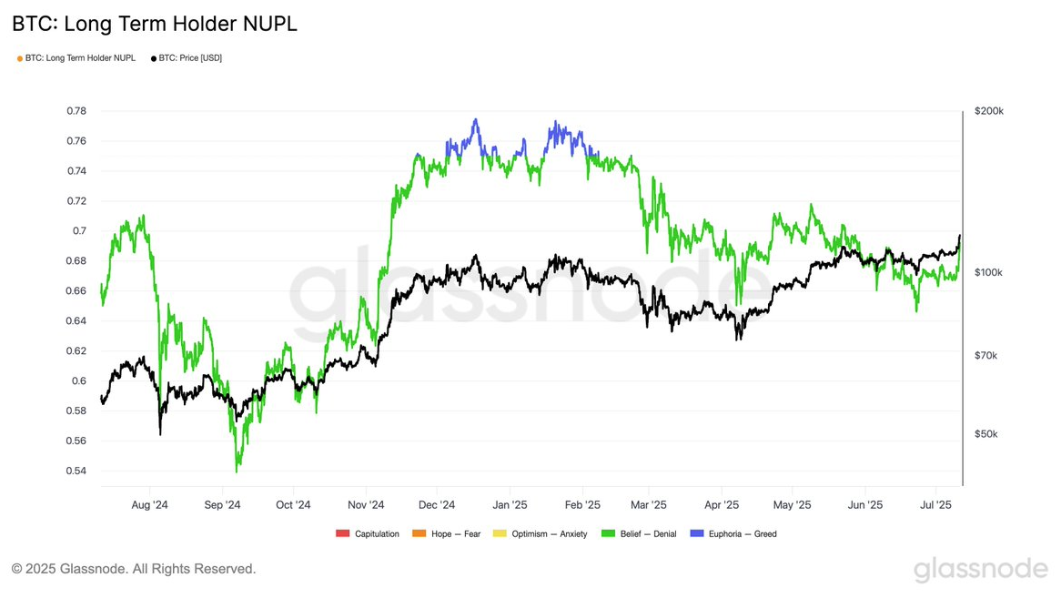

Moreover, as the Long-Term Holder Net Unrealized Profit and Loss (NUPL) metric reveals, the collective sentiment resides at 0.69, a stark distance from the euphoria dictated by the 0.75 threshold. While Bitcoin has donned the robes of a new all-time high, long-term holders remain like the weary travelers, yet to fully bask in the sun of profit. The present era has witnessed a mere 30 days above euphoria, reminiscent of a fleeting dream, compared to the 228 days of the past. Such is the paradoxical richness of human emotion interwoven with the fabric of finance.

Image From X: Glassnode

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Capcom Spotlight livestream announced for next week

- Justin Bieber ‘Anger Issues’ Confession Explained

2025-07-13 22:51