As a seasoned researcher with extensive experience in cryptocurrency markets, I’ve closely monitored Dogwifhat (WIF) and its recent price behavior. The once-promising memecoin has unfortunately found itself in a precarious position, trapped within a descending channel since late May. This downward trend, characterized by lower highs and lower lows, is a clear sign of selling pressure and sustained weakness.

The Shiba Inu meme token, Dogwifhat (WIF), which gained popularity through its image of a fashionable Shiba Inu in a beanie, is currently facing tough times. Following an impressive surge earlier in the year, WIF has been experiencing a significant decline since late May. The digital currency is now confined to a descending channel and is moving closer to a crucial support level. The outcome for WIF depends on the ongoing struggle between bullish and bearish market trends.

Descending The Price Ladder: A Sign Of Weakness?

The technical analysis of WIF presents a concerning trend. The downward sloping channel formation, which is marked by decreasing peaks and troughs, signifies persistent selling activity. Over the past two months, WIF has experienced a significant drop in value, losing approximately 30% since late May. At present, its price hovers near the critical level of $2.44. In just the last week, WIF’s value has declined by around 15%, according to Coingecko’s statistics.

As a researcher studying the price movements of WIF, I’ve identified a critical level that could make or break the trend for this security. Should the bulls, who are banking on an upward price shift, fail to protect this support line, the price may take a downturn and potentially reach a new low of $1.93.

A Technical Tailspin

As an analyst, I’d like to point out that the bearish sentiment towards WIF is being reinforced by the Aroon Down indicator. This technical tool assesses the strength of a downtrend by measuring the difference between two moving averages. At the moment, WIF’s Aroon Down Line stands at a high of 100%, which indicates a powerful downtrend with the most recent low being recorded quite recently. This finding implies that selling pressure is dominating any potential buying activity among WIF investors.

Will The Bulls Rise To The Occasion?

For supporters of WIF, there’s still a flicker of optimism. If the market bears can keep the price above the current support, a rally back up to the resistance at $2.70 is plausible. This would provide a brief respite, allowing the memecoin an opportunity to gather strength and potentially break free from its downward trend.

As a researcher studying the potential impact of a breach in WIF‘s support system, I cannot stress enough the severity of such an event. It could trigger a chain reaction, with investors losing faith in the company and subsequently abandoning the market en masse. This exodus could send WIF into a downward spiral.

WIF Price Forecast

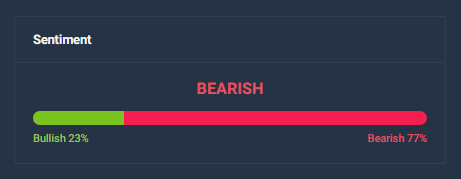

While examining the technical outlook for Dogwifhat, there’s a bearish attitude prevailing, in contrast to the bullish forecast predicting a surge of 225% up to $7.87 by July 15, 2024. However, the Fear & Greed Index displays a reading of 74, which indicates intense greed and could potentially signal overvaluation. Over the last month, Dogwifhat experienced 30% green days with a price volatility of 11.82%, indicating substantial price swings.

With the market’s present high volatility and prevalent greed sentiment, there are potential risks looming, even though an optimistic outlook has been projected. As a result, it might be prudent to hold off on purchasing Dogwifhat until the markets become more stable or if further positive signs make an appearance.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-06-15 12:22