Well, well, well! The US Securities and Exchange Commission (SEC) has finally decided to play nice with the crypto world by giving a thumbs up to the first-ever interest-bearing stablecoin. Yes, you heard that right! Figure Markets, a digital asset firm that sounds like it was plucked straight from a tech startup pitch, has launched YLDS. This little gem is pegged to the US dollar and promises daily yield payments to its lucky holders. 🎉

Stable Coin News: Long time guest on The Office Space @FigureMarkets receives #SEC approval for their $YLDS interest bearing Stable Coin – the first of its kind.

The stablecoin, called YLDS and developed by the digital assets firm Figure Markets, will be pegged to the U.S.…

— MartyParty (@martypartymusic) February 20, 2025

Now, what makes YLDS the cool kid on the block? Unlike its more popular cousins like USDT and USDC, YLDS is officially registered with the SEC as a security. That’s right, folks! It’s like getting a VIP pass to the finance party, while the others are still waiting in line. 🕺

Figure’s CEO, Mike Cagney, is strutting around like he just won the lottery, claiming this approval is a game-changer. He’s asking the big question: why do we even need banks anymore? If you can hold your assets, self-custody your funds, earn interest, and transact like a boss, who needs a bank? 🤔

“If I can hold this, if I can self-custody this, if it pays me interest, and I can actually use it to transact, what do I need a bank for?” Cagney told Fortune.

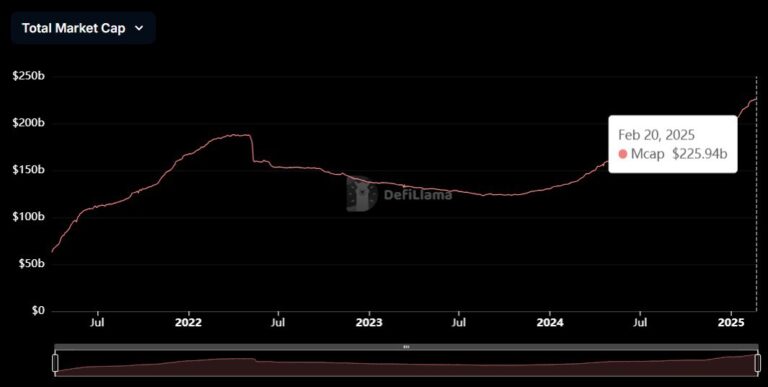

And guess what? The SEC’s year-long approval process coincides with a surge in demand for stablecoins. According to DeFiLlama, the stablecoin market cap has nearly doubled from its bear market lows, hitting around $225 billion. These digital currencies are basically the dollar’s cooler, younger sibling in the crypto trading and DeFi world. Meanwhile, traditional banks are starting to hop on the bandwagon for global transactions. Talk about a plot twist! 📈

Stablecoins market capitalization reached over $225 billion. Source: DeFiLlama

YLDS Offers 0.5% Daily Yield, Unlike Tether’s Zero

Now, let’s talk about the juicy part: YLDS is offering a daily yield of 0.5%. That’s right, folks! While Tether (USDT) is sitting there with its zero, YLDS is ready to outshine the competition. Tether made a jaw-dropping $13 billion in profits last year—basically the same as Mastercard’s net income. Can you say “money moves”? 💰

CEO Mike Cagney believes this interest-sharing model is YLDS’s secret weapon. Sure, there are yield-bearing stablecoins out there, but many are playing in the legal gray area. The SEC has had its eye on these tokens before, including Binance’s now-defunct stablecoin, but that case was dropped faster than a hot potato. 🥔

The competition is heating up! Ripple and PayPal are rolling out their own stablecoins, but YLDS is strutting in with a regulatory edge. This could make it the belle of the ball for investors and institutions alike. 💃

YLDS Goes Public — KYC Now a Must for Buyers

Now, here’s the catch: because YLDS is a publicly registered security, buyers must complete a Know-Your-Customer (KYC) process. It’s like a bouncer checking IDs at the club—no KYC, no interest. If you don’t pass the KYC, you can still hold the asset, but you won’t be earning that sweet daily interest. Sorry, not sorry! 😅

Figure plans to make YLDS available for users starting Thursday, marking a major milestone in the evolution of stablecoins. The global stablecoin market has crossed $200 billion, and these digital assets are being recognized as a bridge between

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2025-02-21 03:12