As a seasoned researcher with over two decades of experience in the financial markets and a keen interest in the crypto space, I must admit that the recent surge in DYDX is quite intriguing. The rapid increase in its price and market cap, coupled with the significant inflow of whale investors, paints a picture of a promising altcoin on the rise.

Following the appointment of David Sacks as AI and crypto czar by President-elect Donald Trump, the price of DYDX saw a significant jump of approximately 35%, reaching beyond $2.40. This rapid increase was mirrored in the decentralized trading platform’s native cryptocurrency, dYdX, which experienced a massive surge in its market cap, reaching an impressive $1.59 billion. The daily trading volume also saw a dramatic rise of over 168%, exceeding $407 million.

After the investment by Sacks’ venture capital firm, Craft Ventures, into DYDX, the altcoin saw a surge in momentum that led to its price increase. This move extended its weekly gains to over 40% and monthly gains to 117%. The association between the newly appointed crypto leader and the token has fueled bullish sentiments among investors, contributing to recent growth for DYDX.

Currently, DYDX has moved up significantly, making its way into the top 90 most valuable digital currencies according to market capitalization. Additionally, the price of DYDX is approaching a potential breakthrough of a descending trendline.

Financial expert Captain Faibik has given a positive prediction for DYDX, suggesting that investors should monitor this token closely as it appears poised for a significant breakout of its trendline. Should the breakout occur, Captain Faibik anticipates a potential surge of up to 300% in the short term, which could propel the dYdX cryptocurrency to prices over $7 and possibly beyond.

- While appointing David Sacks for the role of crypto czar, Donald Trump said:

[Sacks] is going to develop a legal structure that provides the much-needed clarity for the Cryptocurrency sector, enabling it to flourish within the United States.

DYDX Price Surgs amid High Whale Activity

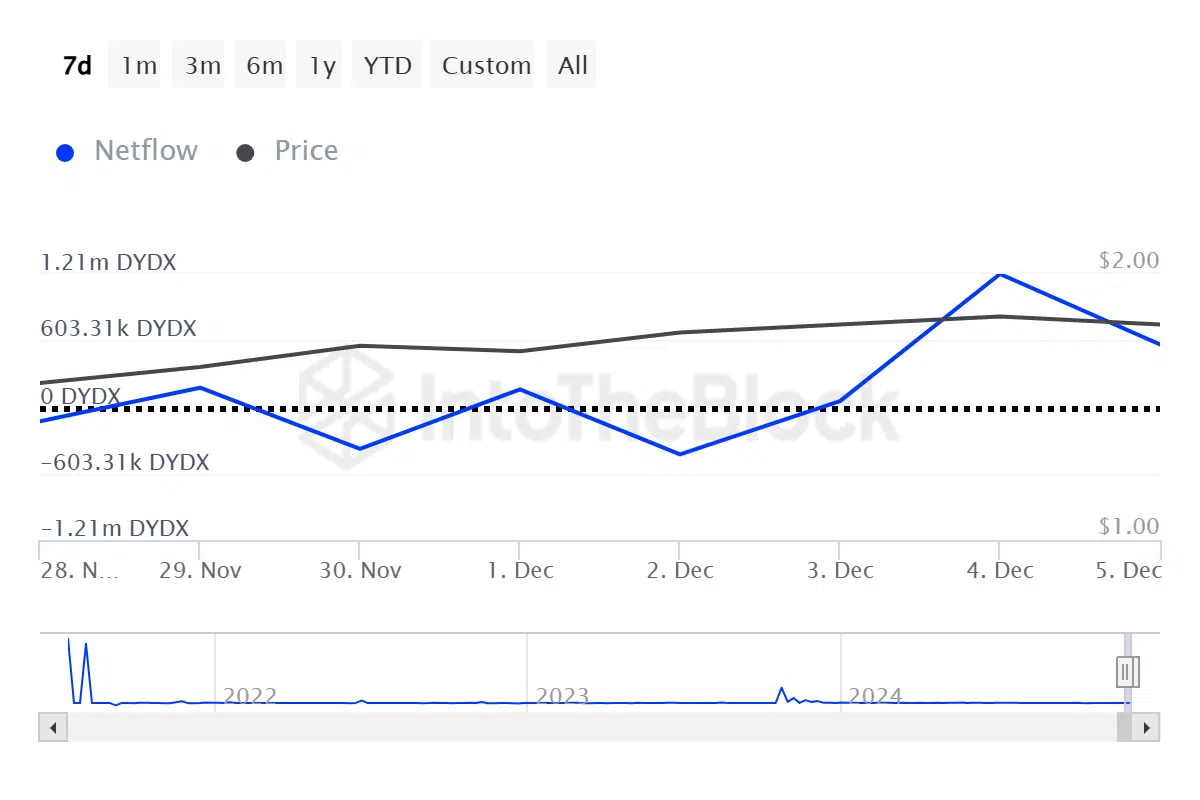

A significant reason for the increase in DYDX’s price is the rapid growth in demand from large-scale investors, often referred to as “whales.” Data from IntoTheBlock indicates that these whale investors have been accumulating DYDX tokens, with a net inflow of over $2.2 billion on December 4, contrasting the net outflow of $766K on December 2.

1) Whale investors usually amassing assets suggests a growing fear of missing out (FOMO) among regular investors, potentially triggering additional price surges. Meanwhile, DeFiLlama’s data indicates that the value locked in DeFi protocols has more than doubled, increasing from around $226 million in November to over $445 million as we speak.

It looks like crypto experts are anticipating a surge in alternative coins (alts), given that the price of Bitcoin has stabilized at approximately $96,000 over the past week. During this holiday season, it’s possible that investors might direct additional funds towards altcoins.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-06 16:49