As a researcher with over a decade of experience in the financial markets, I have witnessed many bull and bear runs in various asset classes. The recent surge in Bitcoin’s price action has caught my attention, especially after its persistent downtrend over the past few months.

After a pause, Bitcoin (BTC) appears to be regaining its strength, as recent price surges hint at the possible initiation of the much-anticipated market uptrend. As Bitcoin approaches the $57,000 mark once more, this fresh energy might trigger a bullish trend, possibly leading to further profits for Bitcoin investors.

Bitcoin Retests New Levels At $57,000

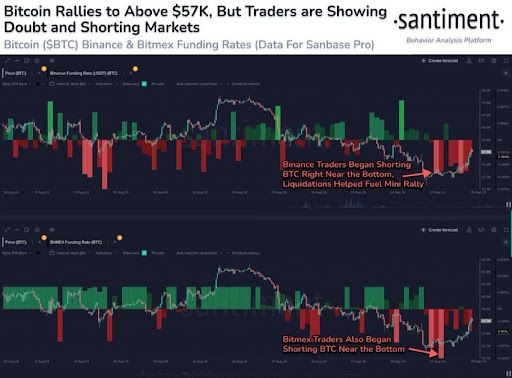

On Tuesday, September 10, the market intelligence platform Santiment announced an optimistic shift in Bitcoin’s price patterns. They shared on X (previously Twitter) that Bitcoin’s market worth has seen a significant surge, reaching approximately $57,600 over the past week.

On Monday, September 8, Bitcoin’s price saw a substantial increase of over 4.8%, reaching a notable achievement amidst a series of price drops it has experienced in recent months. In fact, just earlier in August, its value plummeted below the $50,000 mark, indicating a steep drop of approximately 20%.

The significant drop in price was caused by multiple elements, such as massive sell-offs from the German government and heightened concerns about selling off and market instability due to Mt.Gox’s Bitcoin distribution strategy. As the market absorbed this price plunge, Bitcoin managed to recover from its earlier lows, reaching its current price which is above $56,000.

At present, the cryptocurrency is being tested against new support areas approximately at $57,000. If it manages to break through this threshold, it might suggest the beginning of an even more significant upward trend. According to Santiment, Bitcoin’s recent price surge has coincided with short-selling activities on prominent crypto exchanges like Binance and Bitmex since September 7.

According to the latest insights from our market analysis tool, it seems that the widespread fear, uncertainty, and doubt (FUD) among cryptocurrency investors might lead to a further increase in the price of Bitcoin.

The optimistic view about Bitcoin’s price is echoed by Michael van de Poppe, a well-known crypto analyst. He has recently reported that Bitcoin is currently trading within a range of $58,000 to $56,000. Van de Poppe emphasized that the cryptocurrency exhibits robust underlying pricing structures, while several alternative coins are experiencing increased activity and momentum.

The analyst was taken aback to find Bitcoin overturning his earlier pessimistic outlook and soaring past $56,000. Consequently, Poppe anticipates increased optimism in the market if Bitcoin manages another climb above $55,000. He thinks that should it surmount this barrier, its value may rise to uncharted heights between $60,000 and $61,000 over the next few weeks.

Historical Patterns Suggests Imminent BTC Break Out

A cryptocurrency expert known as ‘Rekt Capital’ predicts a positive future for Bitcoin, expecting a significant increase in its value within the coming fortnight. Past trends indicate that the digital coin might surge, breaking free from its current bearish phases.

According to Rekt Capital, historically, Bitcoin’s performance in September tends to be weak, offering minimal gains. Yet, there’s a strong possibility that the value of Bitcoin will significantly increase by October, carrying this upward trend through November and even December.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-09-12 01:16